Polls consistently show that inflation and the high cost of living remain a top concern for Americans. One of the biggest threats facing families is the “tarifflation” that would result from new import taxes.

For example, former President Donald Trump and his running mate, Sen. J.D. Vance (R-OH), have proposed a 20 percent tariff on imported food, clothing, toys, fertilizer needed by American farmers, parts needed by U.S. autoworkers, and more.

Bananas are the most popular fresh fruit in the United States, and nearly all bananas sold in the United States are grown abroad. Based on 2023 imports, imposing a 20 percent tax on imported bananas would increase their cost by roughly $400 million.

Similarly, most of the beans used to make the coffee that Americans drink are imported. Last year, the United States imported $8 billion worth of coffee. As with bananas, most imports were duty-free. Everything else being equal, tariffs would increase the cost of coffee by $1.6 billion.

It would be silly to suggest that Americans would be better off if we decided to start growing our own bananas and coffee. But that seems to be just the direction that some politicians want to take us through tariffs and misguided “Buy American” mandates.

American drivers would feel the impact of tarifflation at the pump. BCA Research calculates that a 10 percent tariff would increase average gas prices by 5 percent. This implies that a 20 percent tariff could increase the price of gas by 10 percent. Someone paying $3.13 a gallon for gas could pay an extra $3.13 for every 10-gallon fill-up.

Tarifflation would be particularly costly for Americans who buy goods made in China. For example, Trump and Vance have proposed a 60 percent tax on products, including Bibles and toys, made in China.

According to the Southern Baptist Convention’s Ethics and Religious Liberty Commission, 75 percent of Bibles are printed in China. China also produces nearly 80 percent of the toys sold in the United States. A big tariff hike could lead to shortages and higher prices for these products.

Similarly, a report prepared by the Trade Partnership Worldwide for the Consumer Technology Association estimates that these proposed tariffs would increase the price of laptops by $357, video game consoles by $246, and smartphones by $213.

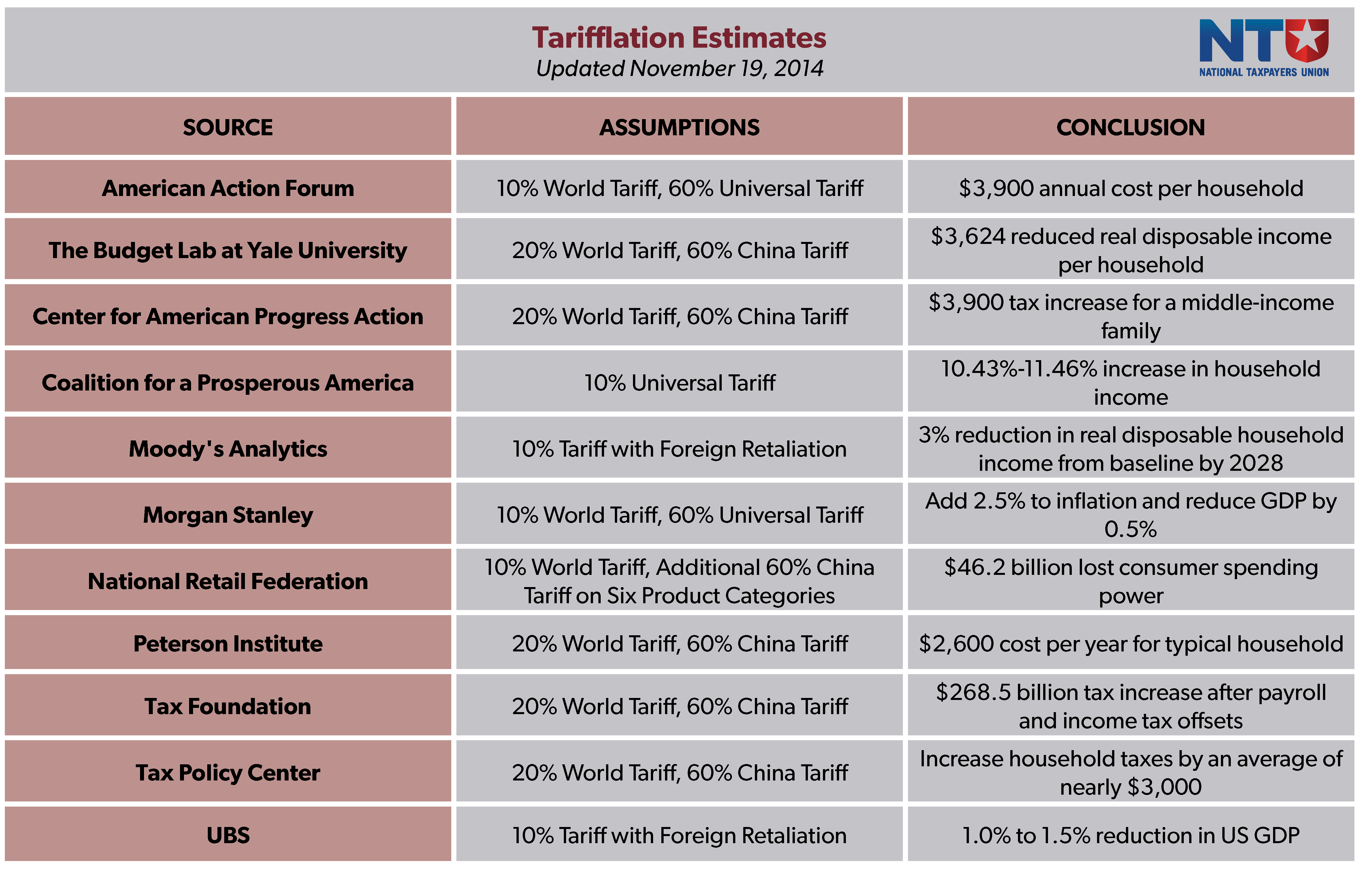

Several studies have attempted to account for the overall impact of tariffs. For the most part, the results have been similar, with the main difference being just how much damage new tariffs would inflict on Americans.

Figure 1: Tarifflation Estimates

[Note: The Coalition for a Prosperous America’s results are an outlier. They are included, even though they are based on assumptions that are empirically unsupported, because the unusual conclusions have been cited by the Trump campaign.]

At the end of the day, broad-based inflation is primarily driven by U.S. monetary policy. However, the evidence is overwhelming that massive tariff increases would inflict higher prices on Americans. At a time when Americans remain concerned about the high cost of living, the federal government should not hit them with higher prices via tarifflation.

Sources:

The Budget Lab at Yale University

Center for American Progress Action

Coalition for a Prosperous America