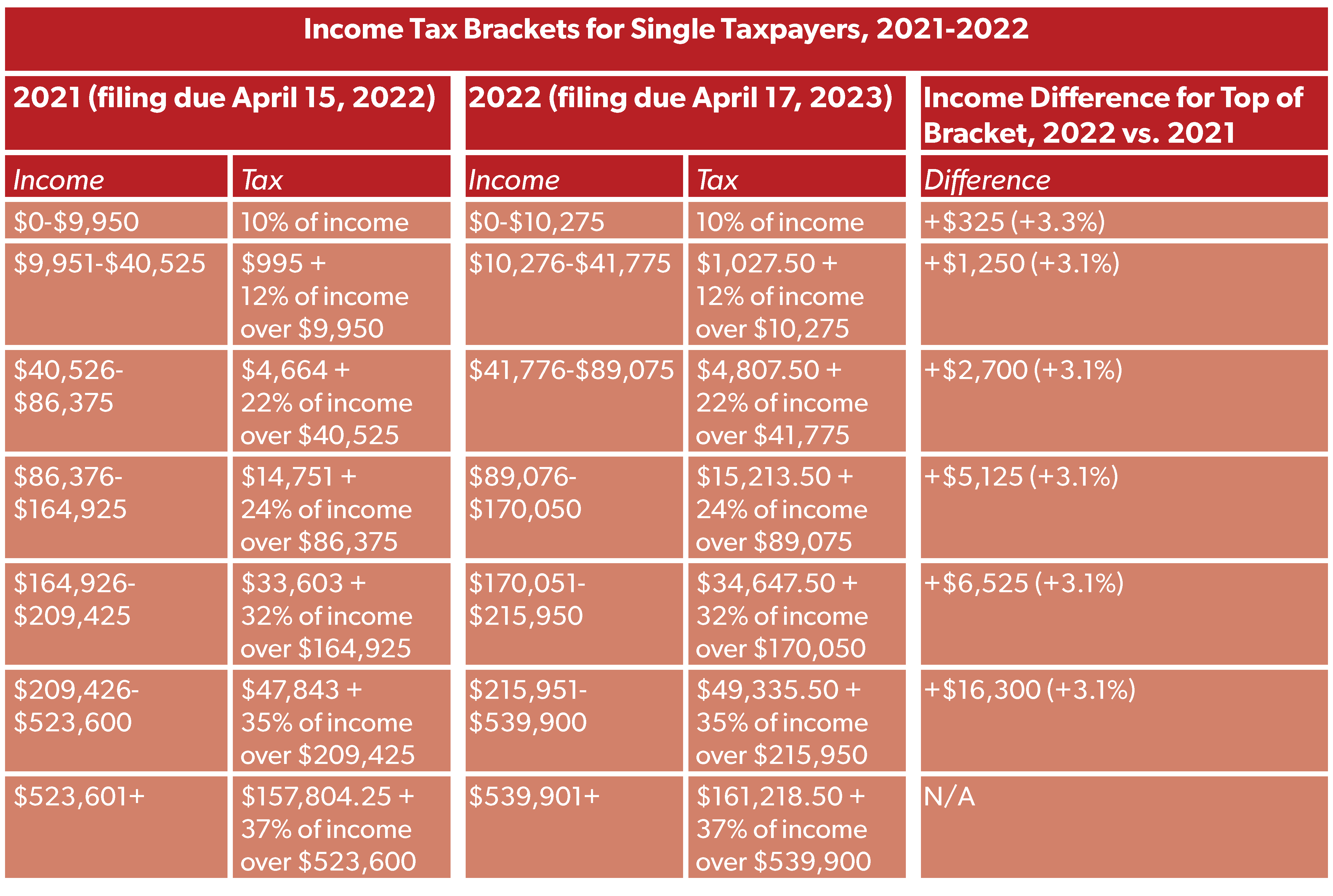

The Internal Revenue Service has released 2022 inflation adjustments for federal income tax brackets, the standard deduction, and other parts of the tax code. See below for how these 2022 brackets compare to 2021 brackets. Importantly, the 2021 brackets are for income earned in 2021, which most people will file taxes on before April 15, 2022. The 2022 brackets are for income earned in 2022, which most people will file taxes on before April 15, 2023.

Single Tax Brackets and Standard Deduction

Married Tax Brackets and Standard Deduction

How to Calculate Federal Tax Liability

A common misconception about federal tax liability and tax “brackets” is that once you enter a certain tax bracket, you pay the rate listed on all your income from dollar zero. This is not the case. Individual income tax rates are marginal. This means that, if you’re an individual earning income in 2022, you will pay a 10-percent rate on the first $10,275 you earn. On your $10,276th dollar, you will start paying a 12-percent rate on each dollar, until you reach the next bracket at $41,775.

Here’s how a sample tax calculation might work for a single adult making $60,000 per year in 2022 and taking the standard deduction:

- Subtract the standard deduction of $12,950 from $60,000 in income, which equals $47,050;

- Identify the tax bracket the taxpayer falls in, the 22-percent bracket;

- Take $4,807.50 (the amount of taxes the taxpayer owes on their first $41,775 in income);

- And add 22 percent of their remaining income between $41,775 and $47,050 ($5,275 * 0.22, or $1,160.50);

- For a total tax owed of $5,968.

The taxpayer would then reconcile the total tax owed with the amount in taxes they had withheld by their employer. If they had more taxes withheld than what they owe, they would receive a refund. If they owe more taxes than they had withheld, the taxpayer would owe the IRS a payment by April 17, 2023.

Again, for a full review of the 2022 inflation adjustments in the tax code see here. For a review of 2021 tax brackets, the 2021 standard deduction, and more, see here.