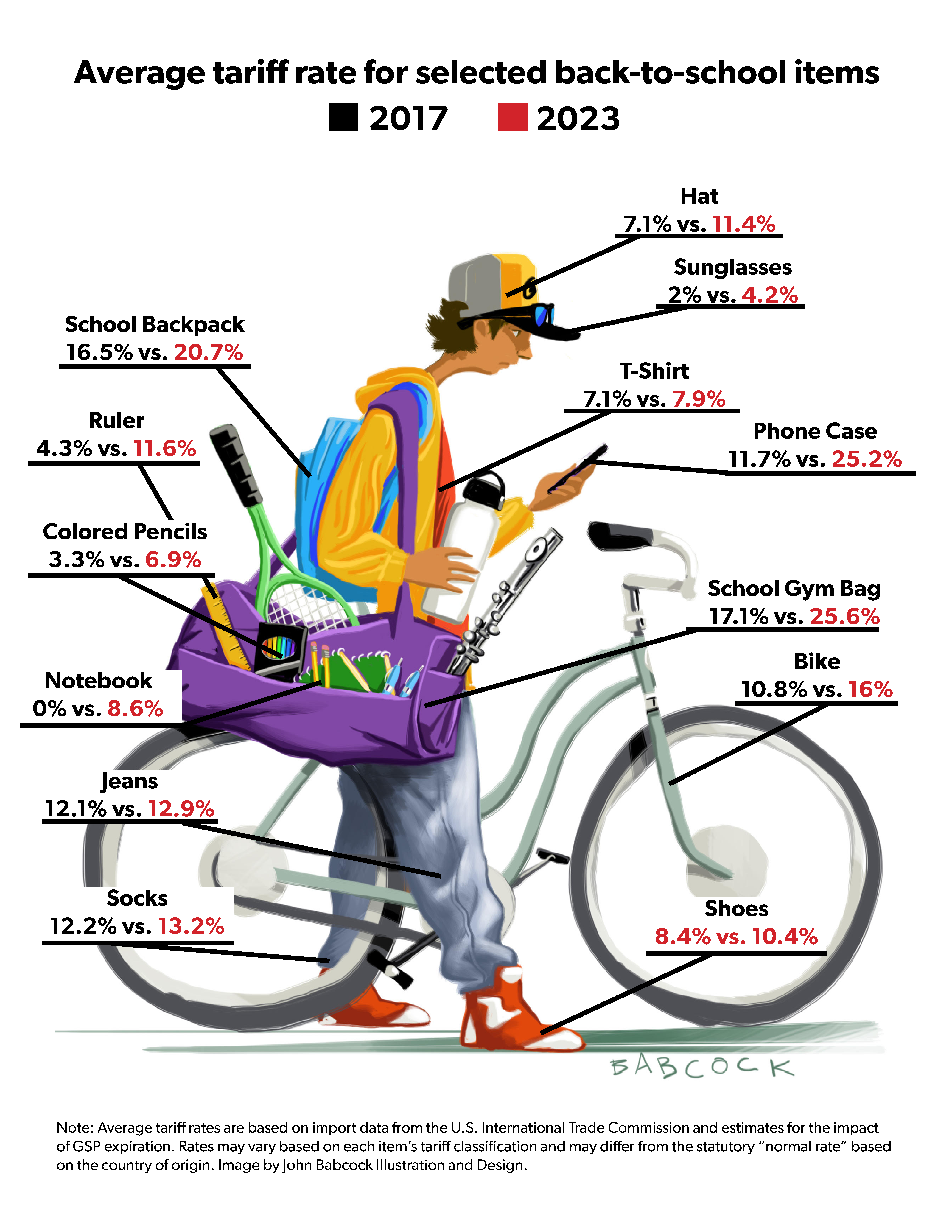

High prices are a big concern for many American families. Taxes on imports, also known as tariffs or duties, inflate the price that families pay for many back-to-school goods. After 2017, U.S. tariff rates increased for the first time in decades as a result of policies like Section 301 tariffs on imports from China and the expiration of the Generalized System of Preferences (GSP) program. GSP lowered tariffs on imports from many developing countries.

American Apparel and Footwear Association statistics show that the overwhelming majority of shoes and clothing sold in the United States is imported. Tariffs do not directly affect the price of made-in-the-USA products, but they indirectly inflate prices by driving up the cost of imported inputs used to produce goods in the United States.