American families are suffering from the impact of inflation—the rising cost of basic necessities and discretionary spending alike forces tough choices. Many families are experiencing these difficulties in their back-to-school shopping. A new study from National Taxpayers Union (NTU) warns that this problem will only increase if increased tariffs are imposed.

Many of the low-cost goods (pens, pencils, etc.) and high-priced items (clothing, electronics, laptops, etc.) that parents purchase for their children are manufactured overseas where labor costs are cheaper, which helps to keep back-to-school prices more affordable.

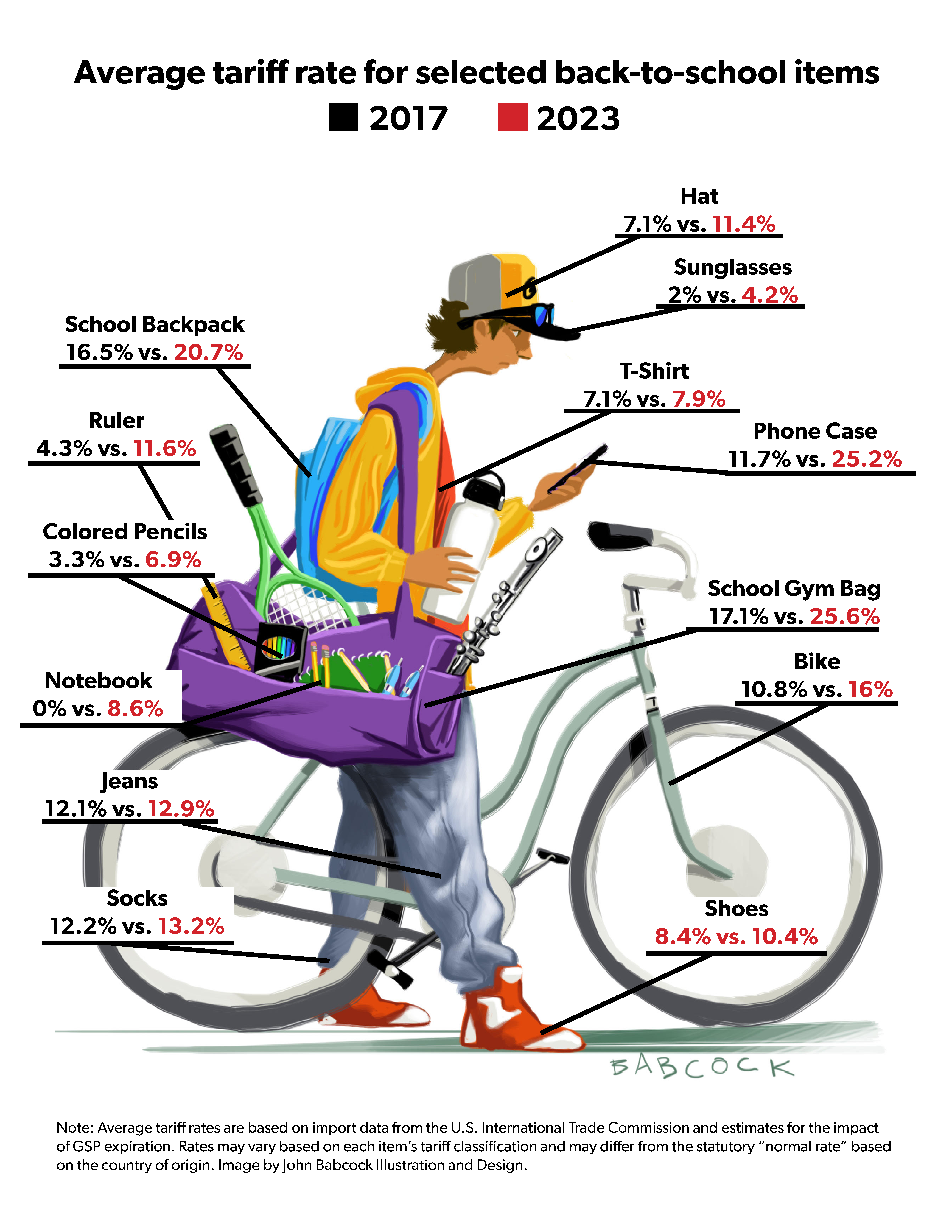

Since 2017, U.S. tariff rates have increased for the first time in decades. As a result, many products that students need or want have seen prices rise because of the new import tariff rate and inflation-related increases.

NTU’s new study, “Import Taxes Inflate Back-to-School Prices,” argues that tariffs will have an inescapable impact on American consumers:

American Apparel and Footwear Association statistics show that the overwhelming majority of shoes and clothing sold in the United States is imported. Tariffs do not directly affect the price of made-in-the-USA products, but they indirectly inflate prices by driving up the cost of imported inputs used to produce goods in the United States.

Unfortunately, many recent trade policy recommendations include increased tariffs. Proposals to revoke “normal” trade status for China or to impose a 60 percent tariff on imports from China would significantly increase the overall average tariff rate.

If you would like to speak with the Director of NTU’s Free Trade Initiative, Bryan Riley, about tariffs and their impacts on American consumers, please contact NTU Communications Manager Courtney Manley at courtney.manley@ntu.org.