In today’s political climate, the sentiment that “the rich are not paying their fair share of income taxes” has become ubiquitous. According to data released from a Pew Research poll last April, approximately 60 percent of American adults are “bothered by…the feeling that some corporations and wealthy people do not pay their fair share in taxes.” The sentiment is likely one reason for recent calls to increase the IRS’s enforcement budget in a bid to rake in more revenues.

This perspective regarding the rich’s supposed failure to pay their fair share of taxes conflicts with reality. The National Taxpayers Union Foundation’s (NTUF) annual “Who Pays Income Taxes?” study shows that the income tax code is very progressive: the top income earners pay the vast majority of income taxes, while the lowest 50 percent of earners pay little (if any) income tax. Even for all federal taxes, as Brian Riedl calculated, the top-earning 1% paid 25% of all federal taxes while the bottom-earning 60% paid only 13% of federal taxes.

A recent report published by Congress’s Joint Committee on Taxation (JCT) adds to the evidence of the progressivity of the tax code. NTUF’s analysis is based on the most recently available data from the IRS, which is subject to a lag of two or three years. For instance, the most recent “Who Pays Income Taxes” paper published in February of 2024 analyzed newly released IRS data for tax year 2021. By comparison, JCT’s new analysis estimates incomes generated, income taxes paid, and other important metrics for tax year 2024.

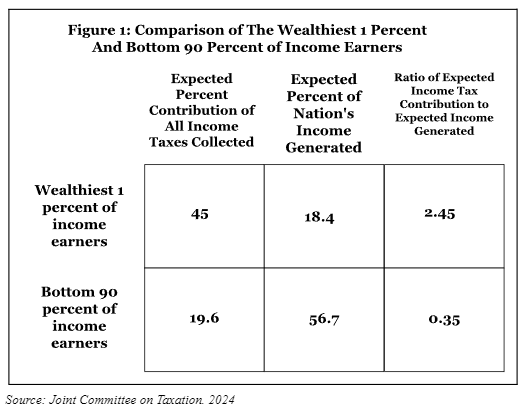

According to the report, the wealthiest 1 percent of income earners are projected to contribute 45 percent of all income taxes collected despite only being expected to generate 18.4 percent of the nation’s total income. By contrast, the JCT estimates that the bottom 90 percent of income earners will only contribute 19.6 percent of all income taxes collected despite generating 56.7 percent of the nation’s total income. When the ratios of income tax contributions to incomes generated are tabulated and compared, we find that the wealthiest 1 percent of income earners are projected to pay approximately 7 times more in income taxes for every dollar of income generated than the bottom 90 percent of income earners. These findings are presented in Figure 1.

This discrepancy between taxation of the wealthiest 1 percent and the bottom 90 percent highlights just how progressive our tax code really is. By contrast, in 1980 the top marginal income tax rate stood at 70 percent and the wealthiest 1 percent of earners contributed just 19 percent of total income taxes collected.

It is also worth noting that recent tax reform efforts like the 1986 Tax Reform Act and the 2017 Tax Cuts and Jobs Act – which lowered marginal income tax rates across the board – have resulted in the tax code becoming more progressive, not less. While advocates of higher taxes paint a picture of a tax code that lets the rich off easy while pushing tax obligations onto the middle class, the reality is very different.

Moreover, it should be noted that our tax code has countless provisions that help to significantly reduce – or in many cases completely eliminate – the income tax obligations of lower income filers. According to NTUF’s most recent ‘Who Pays Income Taxes’ paper, “our highly progressive tax code ensures that low-income earners are afforded protection from income taxes through exemptions, deductions, and credits.” Rather than foisting even more of the burden of our unaffordable spending programs on the wealthy, policymakers should permit taxpayers to keep more of their own money.The claim that the top 1 percent of income earners are not paying their “fair share” of income taxes is unfounded. Even a cursory review of the data produced by the JCT suggests that the wealthiest 1 percent of income earners cover more than twice as much of our nation’s income tax bill than the bottom 90 percent of income earners despite generating less than a third of the bottom 90 percent 's income. If policy makers truly prioritize the establishment of a more progressive tax system, it would be essential for them to look into policies which minimize the tax system’s obstruction of wealth creation through the private sector.