(pdf)

Introduction

It is a common refrain from some politicians that the rich are not paying their fair share of income taxes. This sentiment is echoed by findings from a Pew Research poll conducted last April, which indicated that a significant portion of respondents feel that wealthy individuals do not pay their fair share of income taxes, with 60 percent expressing that this issue bothers them a lot. This sense of unfairness has fueled calls for increased enforcement funding for the Internal Revenue Service (IRS) to crack down on evasion by “tax cheats.”

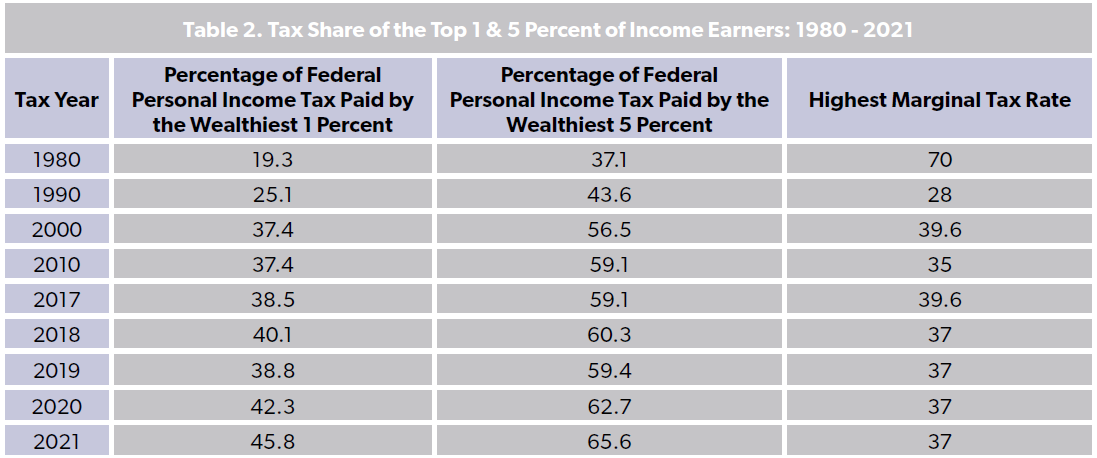

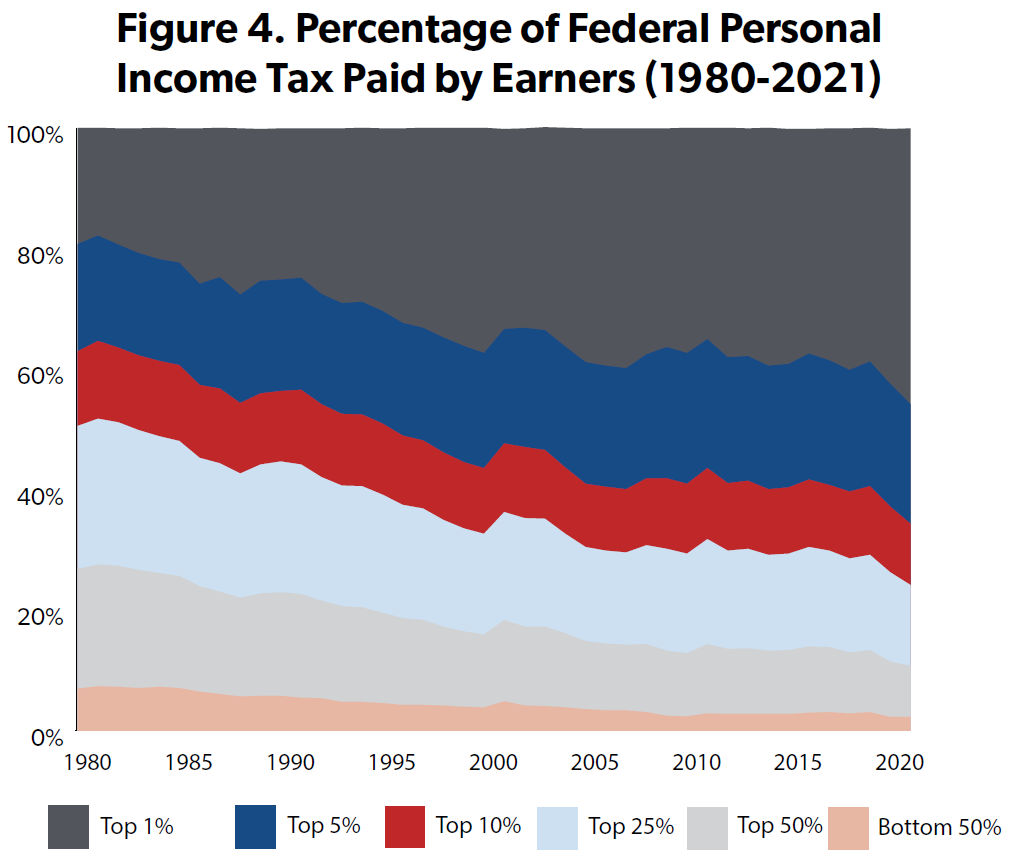

This sense among many Americans conflicts with just how progressive the tax code actually is. In fact, even as tax reforms over the years, including the Tax Reform Act of 1986 and the Tax Cuts and Jobs Act of 2017, have lowered the top marginal income tax rates, the tax code has grown increasingly progressive. The latest data from the IRS shows that the top one percent of earners paid a record high percentage of income taxes in the data NTUF has collected since 1980.

Tax Shares in Tax Year 2021

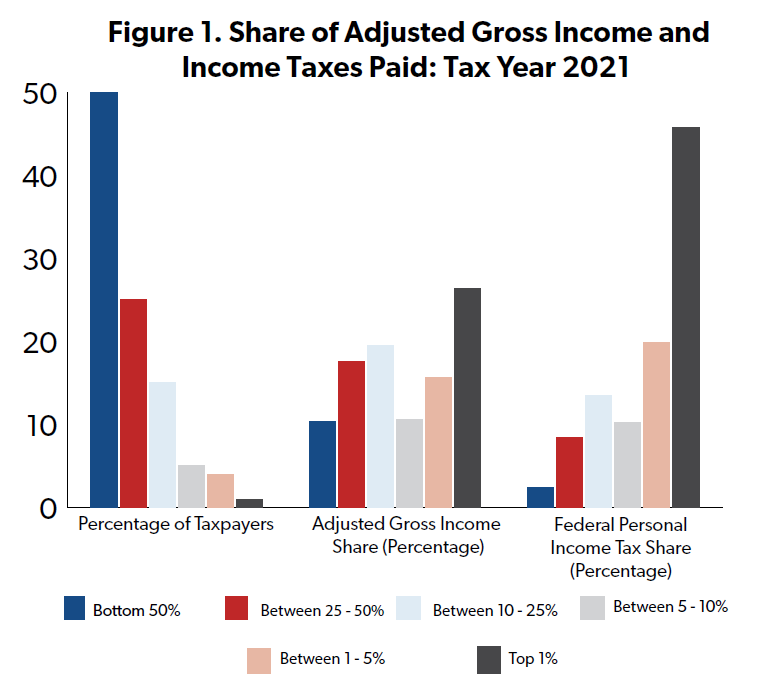

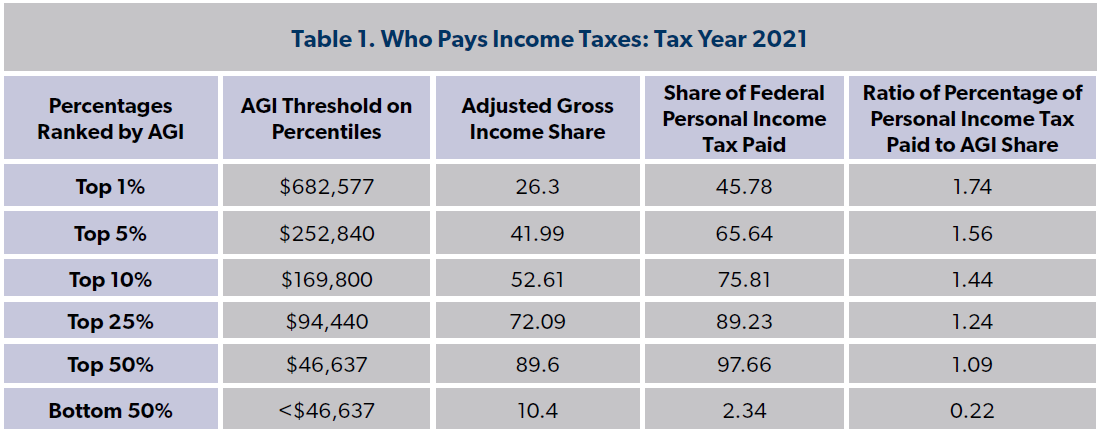

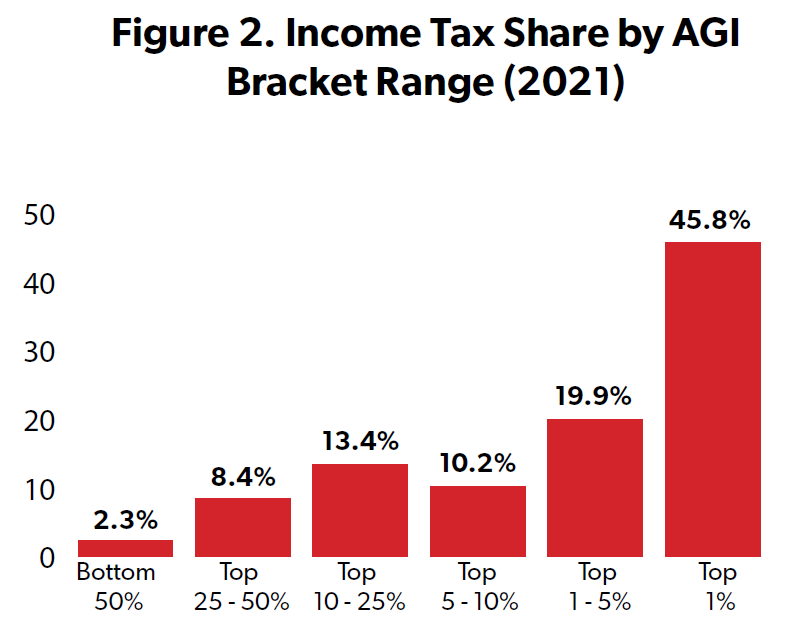

The IRS's Statistics of Income division publishes annual data showing the share of taxes paid by taxpayers across ranges of Adjusted Gross Income (AGI). The newly released report covers Tax Year 2021 (for tax forms filed in 2022). The newest data reveals that the top 1 percent of earners, defined as those with incomes over $682,577, paid nearly 46 percent of all income taxes – marking the highest level in the available data. Notably, the amount of taxes paid by this percentile is nearly twice as much as their share of Adjusted Gross Income (AGI), underscoring the progressive nature of the tax system.

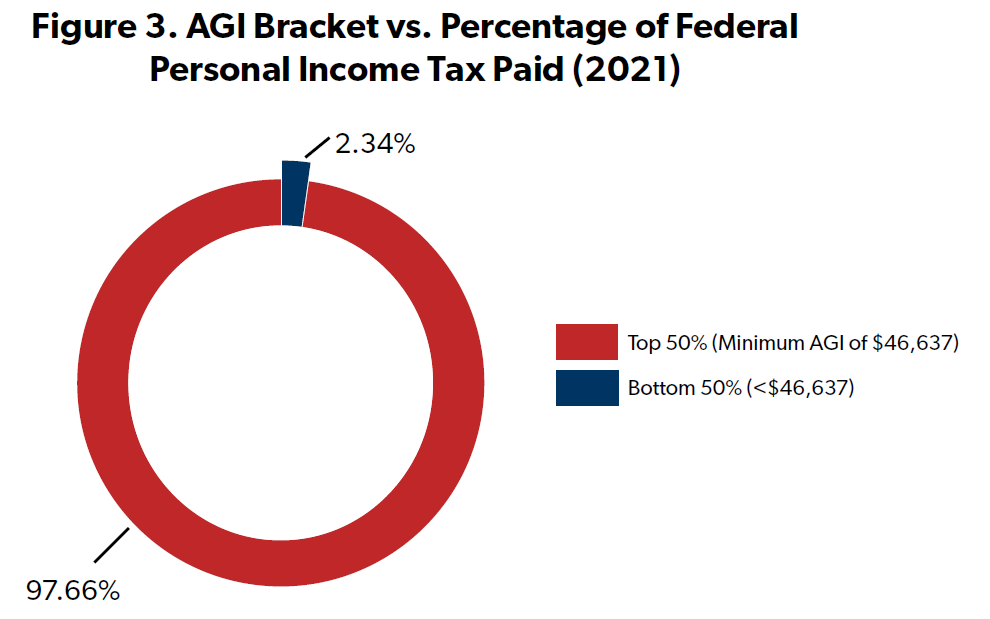

The top 10 percent of earners bore responsibility for 76 percent of all income taxes paid, and the top 25 percent paid 89 percent of all income taxes. Altogether, the top 50 percent of filers earned 90 percent of all income and were responsible for 98 percent of all income taxes paid in 2021.

The other half of earners, those with incomes below $46,637, collectively paid 2.3 percent of all income taxes in 2021. This group includes many filers with no income tax liability either because their earnings fell below the taxable threshold or due to eligibility for tax credits that effectively reduce or eliminate income tax liability. Separate IRS data highlights that over 56 million tax returns in 2021 reported no income tax liability, with 93 percent of these returns filed by individuals with incomes less than $50,000. This underscores the complexity of the tax system and the various factors influencing tax liability across income levels.

Historical Tax Share Data

In 2021, the economy was starting to recover from the effects of the coronavirus pandemic and the shutdown of large parts of the economy, and GDP and employment levels increased as people returned to work. This economic recovery coincided with a continued trend observed in historical IRS data compiled by NTUF, tracking the distribution of the federal income tax burden since 1980.

Back in 1980, the top marginal income tax rate stood at 70 percent and the wealthiest one percent of earners’ share of income taxes was 19 percent. Over the following decades, their share of income taxes increased even as the top marginal tax rates were reduced. Since 1980, the income tax share of the bottom half of earners has fallen from 7 percent to 2.34 percent in 2021 (compared to 2.32 percent last year).

Conclusion

Over the past several decades, lower income earners' share of income taxes has steadily grown smaller as the burden was shifted more and more to the wealthier. These trends stand in stark contrast with the rhetoric about whether people are paying their “fair share.”

The data should inform policymakers that when people are allowed to keep more of their own money, they prosper, move up the economic ladder, and contribute a larger share of the nation’s income tax bill. On the other end of the spectrum, our highly progressive tax code ensures that low-income earners are afforded protection from income taxes through exemptions, deductions, and credits.

Policymakers should strive for a tax system that imposes minimal burdens on wealth creation through the private sector, fostering an environment that opens up opportunities for all individuals to succeed and contribute to the nation's prosperity.