The Taxpayer's Tab - Volume 8 Issue 20

Trump Gets Specific on Defense but His Offsets Fall Short of the Costs

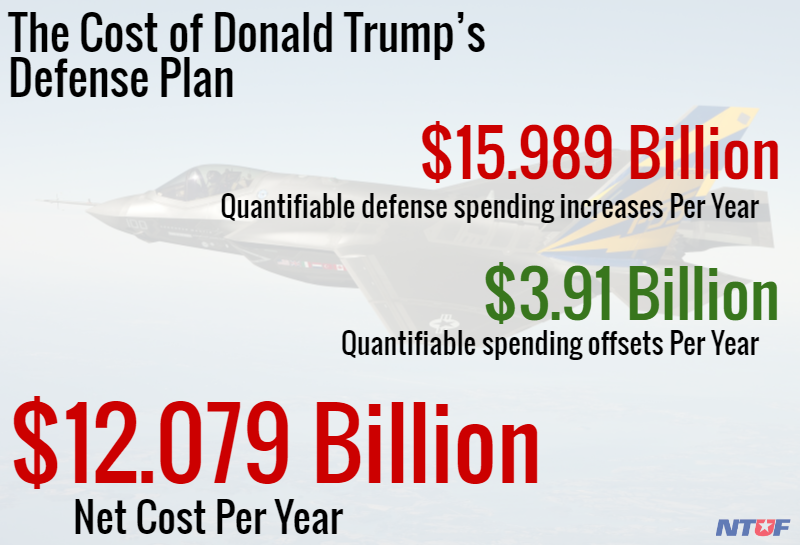

Going back to last year’s primary debates, Donald Trump had called for large yet unspecified increases in the military. Just recently we noted there were no mentions of either “defense” or “military” on his campaign website. Given his repeated statements, NTUF assumed Trump would (at a minimum) support repeal of the defense sequestration scheduled to cut spending by $54 billion from 2018 through 2021 ($13.5 billion per year). Trump’s new defense plan lines up with the assumptions NTUF made last week.

Trump specified increases in the Armed Forces that go above and beyond the sequester levels at $16 billion per year, leaving a lot of additional questions on the actual cost of unspecified programs.

In a related speech, Trump said he will “ask Congress to fully offset the costs of increased military spending.” He outlined six proposals to offset the cost of the defense build-up, but the savings that could be quantified would only offset $3.9 billion of the spending hikes. His proposals to reduce improper payments and recover unpaid taxes could generate additional savings and tax receipts over the long-term, but would require additional spending in the short-term.

NTUF’s complete line-by-line analysis is available at CandidateCost.org. Highlights of the findings include:

Boost Army End Strength: Trump’s plan to raise the Army’s end strength to 540,000 could cost $38.3 billion over six years.

Add Marine Infantry Battalions: Trump wants the Corps to have 36 battalions, meaning he would have to add four active over the next five years at a cost of $10 billion.

Build Navy to 350 Ships: This would increase the shipbuilding budget by $7.5 billion per year - plus additional indeterminate personnel and training costs.

Develop a “State of the Art” Missile Defense System: The Missile Defense Agency’s FY 2016 budget is $8.3 billion. It is unclear what funding level Trump would support.

“Unleash American Energy”: Using figures from a 2012 Congressional Budget Office (CBO) report, NTUF estimates that expanding leasing for oil and gas on federal lands would increase net offsetting receipts by $1.7 billion over ten years.

Reduce the Federal Workforce through Attrition: CBO estimates that a plan to hire only one federal employee for every three that retire would save $18.7 billion over five years.

Stop Funding Unauthorized Programs: CBO reports that $310 billion was spent on programs whose budget authorizations have expired. Savings could be significant to the extent that Congress does not reauthorize them. Trump should list the programs he would recommend for termination.

NTUF’s complete analysis of Trump’s defense platform and the complete agendas of candidates Hillary Clinton and Gary Johnson are available at CandidateCost.org.