(pdf)

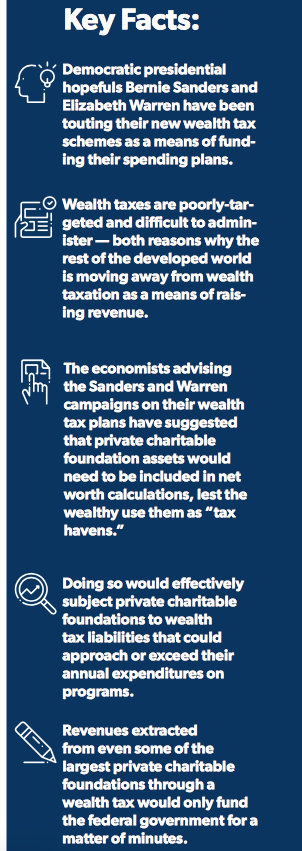

Wealth taxes are all the rage in this year’s Democratic presidential primary, with Senator Bernie Sanders and Senator Elizabeth Warren releasing grandiose plans to tax the wealth, not income, of the rich. While any wealth tax plan would be harmful in its own right, one underreported element of such schemes is that their architects suggest lumping the assets of charitable foundations in with those of their wealthy benefactors. Ostensibly aimed at preventing tax avoidance, this would have a profound negative effect on large charitable institutions. By more directly tying their finances to those of the wealthy Americans that donate to them, the assets of large charitable institutions would be subject to punitive taxes, meaning more money for the federal government and less for charitable giving.

Wealth taxes are all the rage in this year’s Democratic presidential primary, with Senator Bernie Sanders and Senator Elizabeth Warren releasing grandiose plans to tax the wealth, not income, of the rich. While any wealth tax plan would be harmful in its own right, one underreported element of such schemes is that their architects suggest lumping the assets of charitable foundations in with those of their wealthy benefactors. Ostensibly aimed at preventing tax avoidance, this would have a profound negative effect on large charitable institutions. By more directly tying their finances to those of the wealthy Americans that donate to them, the assets of large charitable institutions would be subject to punitive taxes, meaning more money for the federal government and less for charitable giving.

Background: Wealth Taxes

A wealth tax differs from most other kinds of taxes in that it does not target a specific stream of earnings or expenditures. Where an income tax only applies to the dollars a taxpayer earns in a given year, and a sales tax applies only to their consumption, a wealth tax applies to a taxpayer’s entire net worth. As a result, even very low rates can have profound impacts as the effect of the tax compounds year after year.

This effect can make wealth tax rates seem misleadingly low. For example, the top marginal income tax rate following the passage of tax reform is 37 percent. Sanders’s wealth tax proposal, on the other hand, has a top bracket of “just” 8 percent, which at first glance seems far lower. But when converted to what approximates an income tax rate, Sanders’s wealth tax can approach or even exceed 100 percent. Because it applies to all assets (including cash, stock holdings, real estate, and other property like cars or art), a wealth tax must be weighed against the appreciation of the asset. In other words, an 8 percent wealth tax applied to a share of stock that appreciates at an 8 percent rate is equivalent to a 100 percent income tax rate. When applied to any asset that appreciates less than 8 percent (or even depreciates) in a given year, the equivalent income tax rate can soar well over 100 percent.

Such high tax rates would be enormously harmful to economic growth. Faced with the prospect of tax liabilities that go beyond what even productive investments can be expected to yield, wealthy investors may simply forgo those investments. It would also encourage investors to make riskier investments to try and capture any after-tax return, or it could encourage the wealthy to consume a much larger share of their wealth than they would have previously.

To Sanders and Warren, curbing the wealth of the rich may be the goal, but the core driver of economic growth is investments that increase productivity. Cutting investment will have long-term impacts that reduce economic growth.

Wealth taxes suffer from another issue: they are poorly targeted. Broadly speaking, investment income falls into two categories: what are called normal returns and supernormal returns. Normal returns are the compensation an individual expects for their investment — the reason people invest in the first place. Generally speaking, normal returns should be exempted or lightly taxed to encourage investment and saving.

Supernormal returns, on the other hand, are compensation above and beyond what is expected from an investment. These are generally less sensitive to tax policy because they are often just lucky. Early investors in Apple had an extremely high return for their investment, but since most likely did not expect that venture to pay off so spectacularly, paying taxes on that successful investment would likely not discourage them from future investments. High taxes on a more average investment would be a different story.

Though their political goal is to take a bite out of the richest Americans, wealth taxes target normal returns and lightly tax supernormal returns, when optimal tax policy would do exactly the opposite.

Since few investors would be affected by a rate above 1 to 3 percent,[3] a wealth tax would generally fall upon normal returns.

Consider a case where a taxpayer with a net worth of $300 million invests in an asset, in essence subjecting that asset to a 3 percent wealth tax under Sanders’s plan. Whether that asset grows at a 3 percent rate or a 30 percent rate, it will still face a tax rate of 3 percent of its value. In essence, the investor earning 3 percent pays a 100 percent income tax rate, while the investor earning 30 percent pays 10 percent. Effectively, the normal returns are taxed, while the supernormal returns are exempted.

Wealth taxes are also extraordinarily difficult to administer. Simply put, it can be very complicated to assign a taxpayer’s non-liquid assets a value each tax year. Not only would a wealth tax require a means of establishing (and auditing) roughly 180,000 taxpayers’net worth each year, it would create administrative headaches for the Internal Revenue Service (IRS) in determining how to treat certain assets. One of the largest headaches would be associated with treatment of private charitable foundations.

The Administrative Nightmare of Attributing Foundation Assets

Wealth tax advocates have argued that such a policy would have to assess tax not just based on personal holdings, but on the assets of private charitable foundations associated with a taxpayer as well. While this would be done in the name of heading off tax avoidance, it would have profound impacts on some of the largest and most effective charitable institutions in the world, by tying their financial fortunes to the tax bills of their wealthy donors. It would also introduce yet another layer of complication to a tax scheme that is already arguably impossible to enforce effectively.

The complication arises from the incredible difficulty in attributing foundation assets for tax purposes. Presumably assets would only be commingled for a taxpayer and foundations in which they have some sort of control, like a role as a trustee. But determining how to attribute assets held by such foundations gets complicated very quickly.

For example, perhaps the most famous wealthy American that would be impacted by a Sanders or Warren wealth tax that also targets closely-held foundations is Microsoft founder Bill Gates. His net worth is somewhere north of $100 billion, and the foundation he started with his wife, the Bill and Melinda Gates Foundation, has $47.9 billion in assets. It spends approximately $5 billion each year on disease eradication, education, and innovation projects. But figuring out how to attribute the foundation’s assets for wealth tax purposes is an incredibly difficult question.

The foundation has a relatively straightforward leadership structure, with trustees being limited to Bill and Melinda Gates as well as Warren Buffett, another of America’s wealthiest individuals. Would the foundation’s wealth be attributed equally to the three trustees, despite the fact that the Gateses and Buffett have not donated the exact same amount to the foundation? The designers of Warren’s wealth tax, the economists Emmanuel Saez and Gabriel Zucman, argue that Buffett’s contributions should be considered part of Gates’s wealth, but that isn’t the only possible solution. Likely, there would need to be some effort to establish each trustee’s “basis” in the foundation by calculating their total contributions to its total assets.

On top of this, many other donors give to the foundation’s causes through a closely-held 501(c)3 called Gates Philanthropy Partners. Would these assets also be added to the wealth tax bill of the Gates Foundation’s directors (or the Gateses alone), given that the foundation exercises control over its operations? If so, this could create a perverse incentive for charitable foundations to avoid outside donations in order to minimize the negative impacts of a wealth tax on its benefactors.

Regardless of the method chosen to attribute foundation assets, would the same apply for foundations where the main benefactor is no longer living? For example, the Walton Family Foundation has nearly $5 billion in assets and gives almost $600 million in grants to educational and environmental causes each year, but its founders, Sam and Helen Walton (of Walmart fame) are no longer living. Would the assets associated with the foundation’s endowment in 1987 be attributed to all of its five directors, all of whom are members of the Walton family? This only becomes more complicated in cases where current trustees are generations removed from the original founder, such as in the case of the Russell Sage Foundation, which was founded in 1907.

Economists Saez and Zucman offer no definitive answers to these questions, saying “To the extent that the foundation is controlled primary [sic] by one person or family (as opposed to a board that rotates), such wealth constitutes concentrated individual power and it makes sense to make such wealth taxable. At the same time, because such wealth is pledged to charitable giving, it could arguably receive preferential treatment.” The administrative details of what is taxable in their world, and what receives preferential treatment, is left to the imagination.

One other option would be to simply apply wealth taxes on a forward-looking basis. This would ostensibly eliminate many of the complexities of attributing assets donated to charity in the pre-wealth tax era, but it would entail its own set of difficulties. For example, while some charitable donations made by wealthy individuals come in the form of cash or easily-valued assets like shares in publicly-traded companies, others are much more challenging to assign an accurate value to. This could include shares in private companies, real estate, or in-kind contributions like free services. For the same reason that so-called “mark-to-market” taxation is challenging to administer, these types of contributions would create significant work for the Internal Revenue Service.

Impact on Charitable Giving

No matter what policy choices are made to address these questions (and the dozens this paper overlooks for the sake of brevity), a wealth tax would have massive implications for American altruism. Private foundations donated $75.9 billion in 2018, funding important initiatives throughout the country and overseas. A wealth tax, especially one as expansive as those contemplated by Warren and Sanders, would have profound impacts on charitable institutions.

Such tax schemes would present a choice to foundations and their wealthy benefactors: either “divorce” so that the individual no longer has any direct connection to the foundation, or effectively subject the foundation’s assets to a wealth tax as a result of maintaining a direct connection. In either case, the result would be hugely disruptive for some of the largest and most effective charitable institutions in the country.

If the choice is to disconnect so as to avoid wealth tax implications, there would be significant governance concerns for many foundations. Many of the largest institutions pursue charitable goals laid out by their founders and are subject to oversight and direction to ensure they execute on their mission in accordance with the donor’s intent. In fact, the emphasis on adhering closely to donor intent has led to a growing trend of planned “sunsets,” whereby foundations spend down assets over a set period of time in order to ensure that future directors do not steer it in a fashion at odds with the will of its founder. A wealth tax would throw a wrench into the works of any foundation or donor seeking to maximize charitable impact, as it would introduce a layer of tax planning that would significantly distort their incentives.

If donors and foundations do not “divorce,” however, the negative effects could be even more severe, since the assets of many large foundations would effectively be subjected to wealth tax. Foundations would have to either reduce annual giving or draw down their endowments to satisfy their newfound tax liabilities, or some combination of the two. Either way, long-term giving would decrease. While it is difficult to assess the total economy-wide impacts of such a scheme, we can look to some illustrative examples to help understand what the effects would be for select institutions. Using public tax forms and foundation-provided financial information, we can calculate rough estimates of tax liabilities to help understand what impact it might have on charitable enterprises.

The Bill and Melinda Gates Foundation is a great example. If we assume the foundation is taxed as part of Bill Gates’s wealth, per the proposal drafted by economists Saez and Zucman, the foundation’s tax burden would be $3.8 billion per year under Senator Sanders’s plan. That is almost as much as the foundation gave away in 2018, when it donated $4.5 billion to a variety of causes. Had the wealth tax been in place, the foundation would have had to make a difficult choice between cutting its charitable expenditures to less than one-fifth of what it had planned, or drawing down its endowment and thus harming their ability to fund future giving.

Additionally, even if the wealthy divorce themselves of control of their foundations, a wealth tax would obviously have an impact on propensity to give to charity in the first place. If donating to charity becomes less attractive relative to consumption due to the impact of a wealth tax, the likely result is fewer charitable expenditures and more consumption. This is particularly true in cases where an individual’s wealth tax bill would be substantially larger than their contribution to their charitable foundation.

One example of an institution that could face severe impacts from a wealth tax is the Dell Foundation. Michael and Susan Dell, of Dell computer fame, have an estimated net worth of $32.3 billion, which would subject them to a tax of at least $2.45 billion were Sanders’s wealth tax in effect.[4]A tax of that level would presumably put in some jeopardy the $180 million in contributions the Michael and Susan Dell Foundation received from its benefactors, and the $130 million the foundation spent on health and education programming in 2017.

Warren’s proposed wealth tax has lower rates, but would still represent a punitively large tax burden for the Dells. They could expect to face a tax burden of $1.9 billion — less than they would pay under Sanders’s proposal, but still an amount that could conceivably threaten their willingness to continue their generous funding of their foundation.

Taxing The Wealthy Isn’t A Cure-All

Sanders and Warren may counter that this data shows that their wealth taxes could extract more tax revenue from the wealthy than they are currently giving through their charitable enterprises. However, it is important to keep in perspective foundation wealth compared to the vast amounts of taxpayer dollars the federal government churns through daily.

Sanders and Warren have repeatedly suggested that the solution to all revenue shortfalls is to simply levy higher taxes on America’s billionaires. And America’s billionaires do hold a significant amount of wealth - $3.1 trillion in total. Yet even if the federal government were to confiscate all of this wealth (a decidedly non-renewable revenue source) for 2020, it would only fund the federal government from January through the beginning of September. That’s not even considering the vast increases to spending that Sanders and Warren are proposing.

Given this, the effective taxes on the selected foundations discussed earlier would represent little more than a drop in the bucket. Using the Congressional Budget Office’s projected FY 2020 baseline, Table F shows just how meager these potential revenues would be relative to the federal government’s spending habits.

Conclusion

The concept of a wealth tax is simple enough, but the administrative realities could have severe unintended consequences for some of America’s largest and most successful charities. If legislators force wealthy Americans to pay tax on both their personal assets and those of their charitable foundations, the result could prove chaotic for the world of philanthropy as donors and institutions work to minimize tax bills.

This is just one of many problems that the implementation of a wealth tax faces, and a large part of why the rest of the developed world is moving away from wealth taxes, not towards them. Politicians such as Senator Sanders and Senator Warren should follow the evidence of these past failures and shelve their wealth tax ideas as well.

[1]Brackets are halved for single filers.

[2]Originally, Warren’s wealth tax had a top rate of 3 percent. However, she proposed to increase the top rate to 6 percent when she released her plan to fund Medicare for All.

[3]According to Sanders’s plan, married filers would have to have a net worth exceeding $500 million to exceed these rates.

[4]Net worth estimates are using Forbes 400 data, and subject to estimation errors on the part of Forbes. Tax bill estimates do not attempt to include charitable foundation assets in wealth tax liability.