Introduction

H.R. 82, the Social Security Fairness Act (SSFA), passed in the House on November 12. On December 11, Senate Majority Leader Chuck Schumer (D-NY) announced that he intends to bring this bill up for a vote before the current session ends on January 3.

The SSFA would eliminate the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) from Title II of the Social Security Act. These two provisions currently prevent overly generous and unintended “windfall” Social Security benefits to individuals who worked in jobs that were not subject to Social Security taxes, such as many state and local government positions.

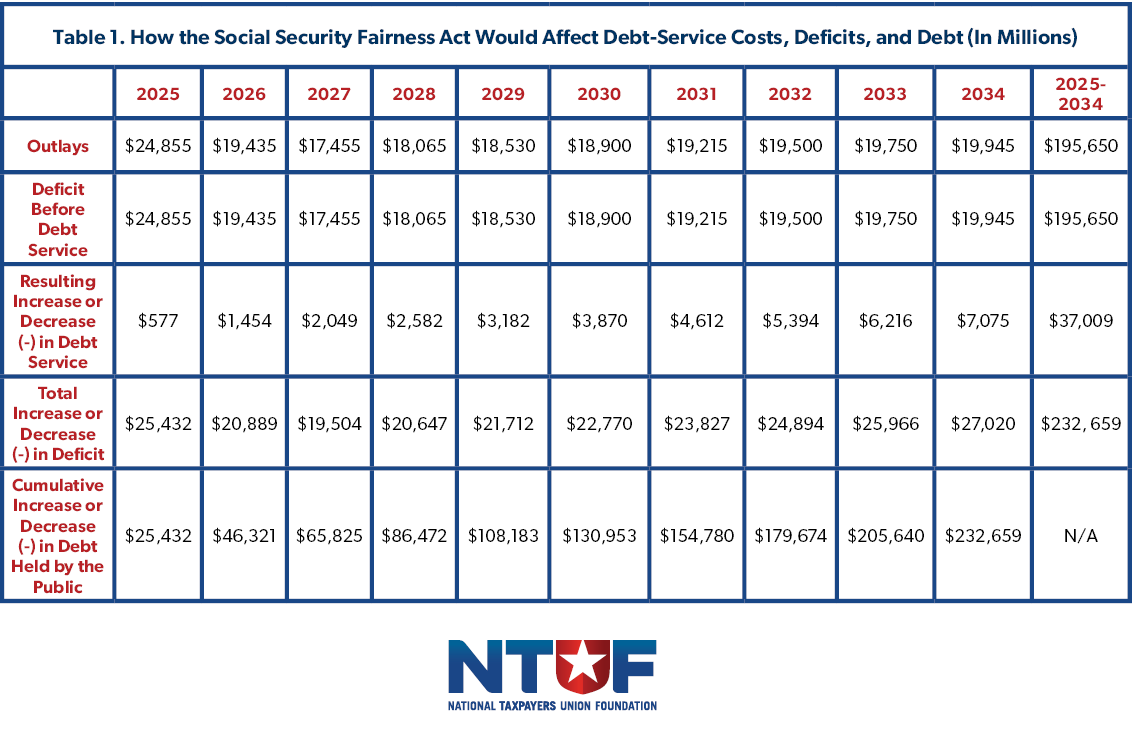

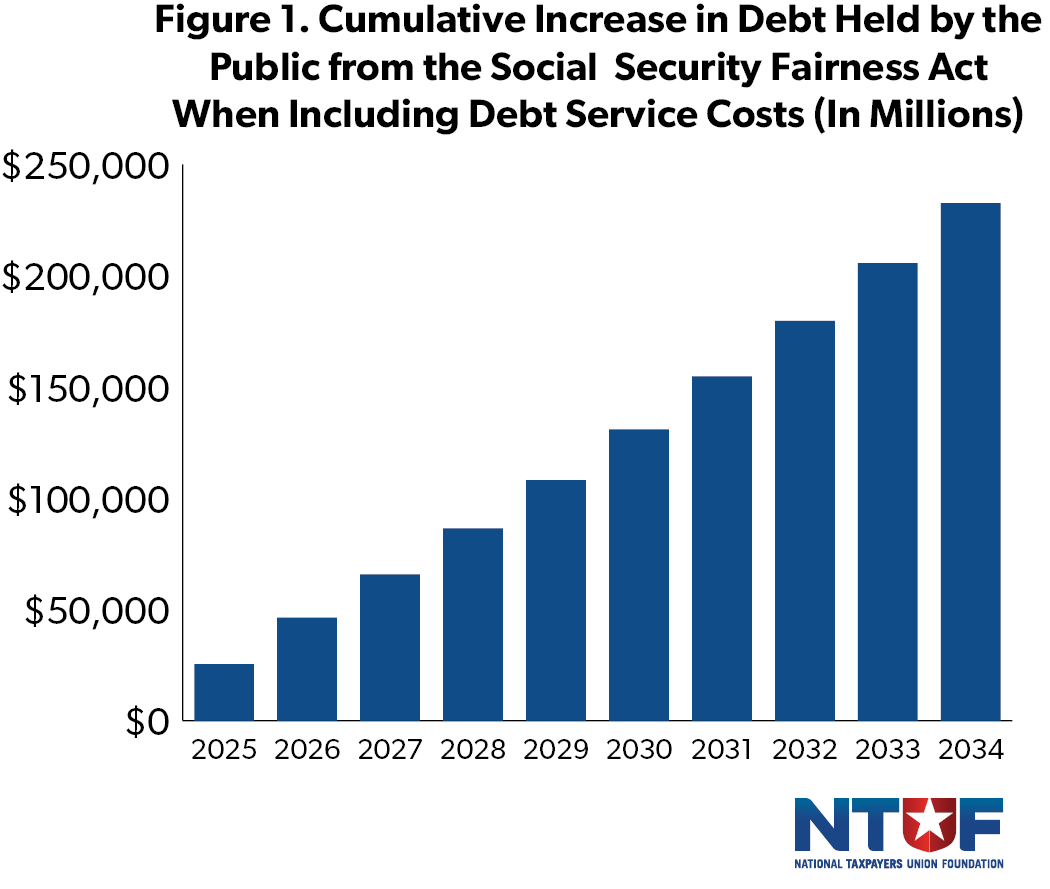

Eliminating these provisions would unfairly benefit certain public sector workers at a significant expense to taxpayers. The Congressional Budget Office (CBO) estimates that the bill would increase outlays by $196 billion through the year 2034. However, when accounting for impacts on financing the federal debt, the actual cost of the SSFA is $233 billion—19% higher than the official CBO score. Moreover, the SSFA would also accelerate Social Security’s impending insolvency by six months, reducing scheduled benefits for retirees.

WEP, GPO, and Social Security

The WEP and the GPO are safeguards designed to prevent individuals who worked in positions not covered by Social Security from receiving excessive or duplicative benefits. Enacted in 1983 and 1977, respectively, these two provisions reduce regular Social Security benefits for certain state and local government workers, including teachers, firefighters, and police officers, who receive pensions based on employment not subject to Social Security taxes.

The WEP modifies the benefit formula for about 3% of retirees who receive pensions from non-Social Security-covered jobs, ensuring that their benefits more accurately reflect contributions to the Social Security system. Without this adjustment, these individuals could receive higher benefits than workers with equivalent earnings entirely covered by Social Security. Similarly, the GPO reduces spousal and survivor benefits for individuals who receive their own pensions from non-Social Security-covered work, preventing an unfair double-dipping of benefits.

Before the WEP and the GPO were enacted, the Social Security benefit formula treated these former government workers as if they earned incomes significantly lower than what they actually did. This was because their employment was not subject to Social Security taxes, creating a misleading record of their earnings in the Social Security system. Thanks to the progressive benefit structure of Social Security, these individuals received disproportionately higher benefits compared to what they would have received if their entire income had been subject to Social Security taxes.

The WEP and the GPO were introduced to correct this disparity. However, when Congress enacted these safeguards, the Social Security Administration did not have access to sufficient data on beneficiaries’ non-covered wages. As a result, Congress relied on rough estimates of beneficiaries’ non-covered wages when designing those provisions. This approach led to imprecise benefit adjustments: some affected beneficiaries receive more benefits than they would if their benefits had been calculated with a more exact formula, while others receive fewer. Today, this data is available, enabling benefits to be properly indexed for these individuals based on their total career earnings.

Rather than leveraging this data to fix this issue, the SSFA would eliminate these provisions altogether. This would create an unfair loophole in the benefit structure, add billions of dollars to the national debt, and hasten Social Security’s insolvency.

The SSFA Would Add $233 Billion to the National Debt When Accounting for Interest

According to CBO’s analysis of the bill, the SSFA would add $196 billion to the national debt. $101 billion in added outlays would come from eliminating the WEP and a further $110 billion would come from eliminating the GPO. Because of some interactive effects resulting from individuals affected by both the WEP and the GPO, the total cost of repealing both provisions would be $13 billion less than the sum of the costs of repealing each provision separately. Additionally, CBO estimates that, because the SSFA would increase Social Security income for some individuals who receive Supplemental Nutrition Assistance Program (SNAP) benefits, the additional Social Security benefits would offset income applicable for SNAP, decreasing the total cost of the bill by $2 billion.

However, CBO’s analysis does not account for accrued interest from the additional spending. Fortunately, CBO provides an interactive tool that calculates debt-service costs (interest) to future outlays. When plugging in CBO’s own data to its interactive spreadsheet, we found that the SSFA would add $37 billion in interest, bringing the total cost to taxpayers to $233 billion.

H.R. 82 Would Expedite Social Security’s Insolvency by Six Months

By significantly increasing spending on benefits, the SSFA would also expedite the depletion of Social Security’s trust funds. In response to a request from Senator Chuck Grassley (R-IA) for information on how the bill would affect the finances of the Old-Age and Survivors Insurance (OASI) Trust Fund and the finances of that fund combined with the Disability Insurance (DI) Trust Fund, CBO reported that the additional outlays from this bill will cause the Old-Age, Survivors, and Disability (OASDI) trust fund to be exhausted roughly six months sooner than its current projected date of fiscal year 2034.

This expedited insolvency would have an adverse impact on Social Security’s scheduled benefits. If the SSFA were to pass, the typical Social Security recipient would see a benefit cut of about $2,500 in 2033. Furthermore, CBO estimates that the bill would cause scheduled benefits over the next 75 years to decrease from 78.3% to 77.8%, further eroding benefits for retirees.

This reduction of scheduled benefits would disproportionately affect workers that paid Social Security taxes for most of their career. Limited trust fund resources would be redirected to individuals with pensions from non-Social Security-covered positions, creating an unfair redistribution of Social Security benefits from taxpayers to former government employees.

An Alternative Approach

House Budget Committee Chairman Jodey Arrington (R-TX) has proposed an alternative to the SSFA that would address shortcomings in Social Security for certain workers. While the SSFA seeks to eliminate the WEP and GPO, this approach disregards the taxpayer protections that these provisions were designed to uphold and would impose significant budgetary costs.

Arrington’s Equal Treatment of Public Servants Act (H.R. 5342) offers a more pragmatic solution by replacing the WEP with a formula that accounts for a worker’s entire earnings history. This reform would ensure that benefits reflect actual contributions to Social Security while preventing costly windfalls. Unlike the SSFA, which would increase the national debt by $233 billion when accounting for interest, CBO estimates that Arrington’s alternative would cost “roughly $30 billion” over the decade.

To strengthen this approach further, lawmakers should seek to identify spending reductions or other offsets to ensure that any additional costs do not burden taxpayers or exacerbate the federal deficit.

Conclusion

By eliminating the WEP and the GPO from the Social Security Act, the Social Security Fairness Act would impose a heavy burden on taxpayers by adding $233 billion to the national debt, hastening Social Security insolvency, and reducing scheduled benefits for individuals who have been paying into Social Security for their entire careers. Rather than undermining the broader Social Security system, reforms should focus on addressing its long-term fiscal challenges.