Introduction

While serving in office, presidents are paid a salary of $400,000 per year. After office, former presidents historically have possessed significant personal wealth and have had numerous options available to earn additional income. Nevertheless, former presidents upon leaving the White House are provided generous taxpayer-funded benefits, including a pension, office space, staff, and supplies. Since 2000, these benefits and perks for former presidents—whose ranks now include millionaires and one billionaire—have cost taxpayers $125 million. Reforms are needed to protect taxpayers from overly subsidizing these wealthy individuals.

Perks for Former Presidents

Retirement benefits and office assistance for former presidents are established in the Former Presidents Act of 1958 (FPA), a law enacted because of public concern about Harry Truman’s financial position upon leaving the White House five years earlier.[1]

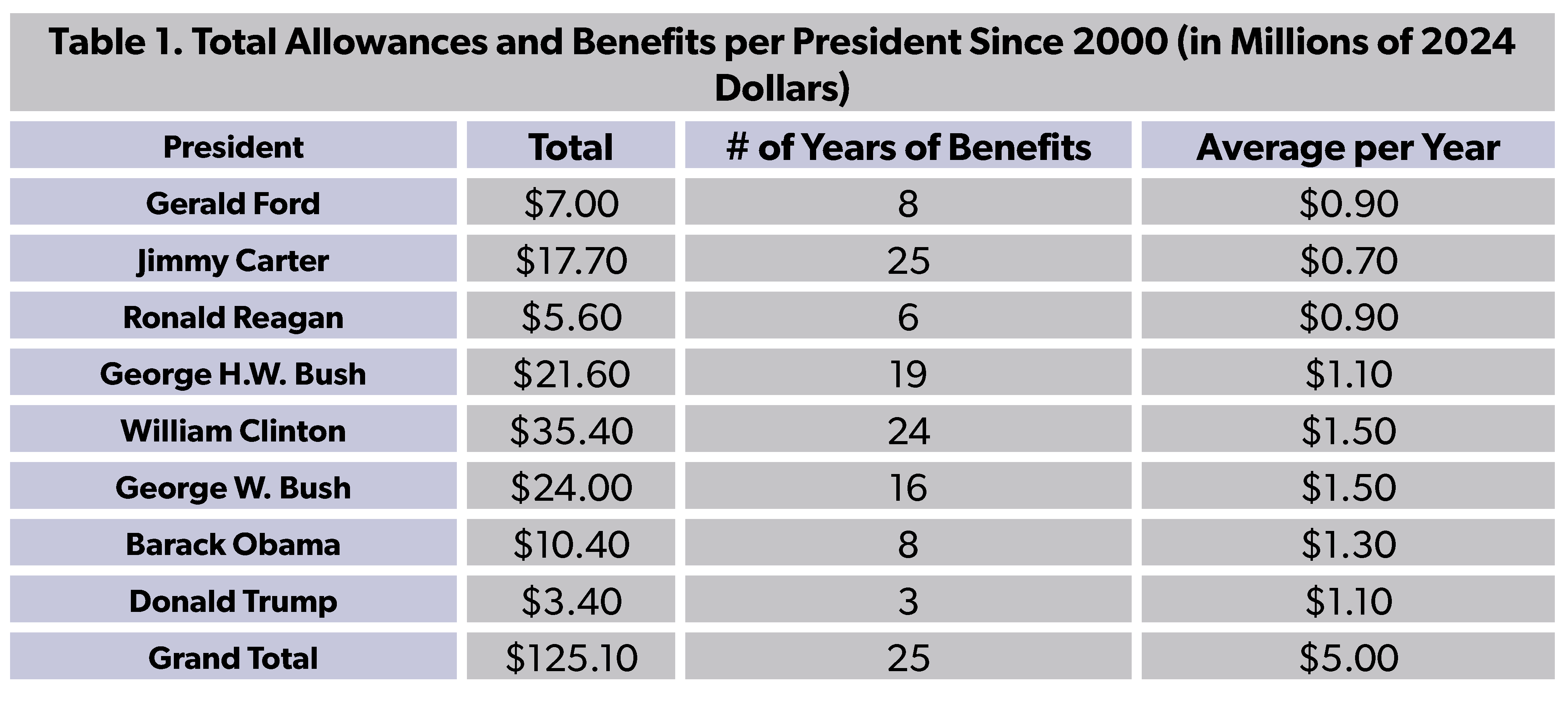

Below is a table of the total allotments for pensions and benefits to former Presidents since 2000. In 2016, the Congressional Research Service published a detailed report on the net outlays provided to former presidents from 2000 through 2015. NTU Foundation supplemented this with annual budget data from the General Services Administration (GSA), which administers the FPA. GSA’s data also shows the annual allotment to each president for the various benefits and services. These figures were converted to 2024 dollars.

Pension

The top personal benefit provided to former presidents is a pension. The FPA provides a pension equal to the yearly salary of the head of an executive department of the federal government. The Ethics Reform Act of 1989 provides that this salary level is adjusted each year based on the percent of change in the private sector wages and salaries portion of the Employment Cost Index, but minus 0.5 percent to incorporate modest reductions. The salary level is reported at the end of each calendar year by the Office of Personnel Management and was set at $246,424.

Depending on how long they have served in the White House, combined with other salaried federal positions, some former presidents also qualify for coverage in the Federal Employees Health Benefits program. GSA includes these expenses with the pension expenses in its budget reports. CRS notes that George H.W. Bush was eligible for health benefits but declined them.

Office Space and Staffing Allowances

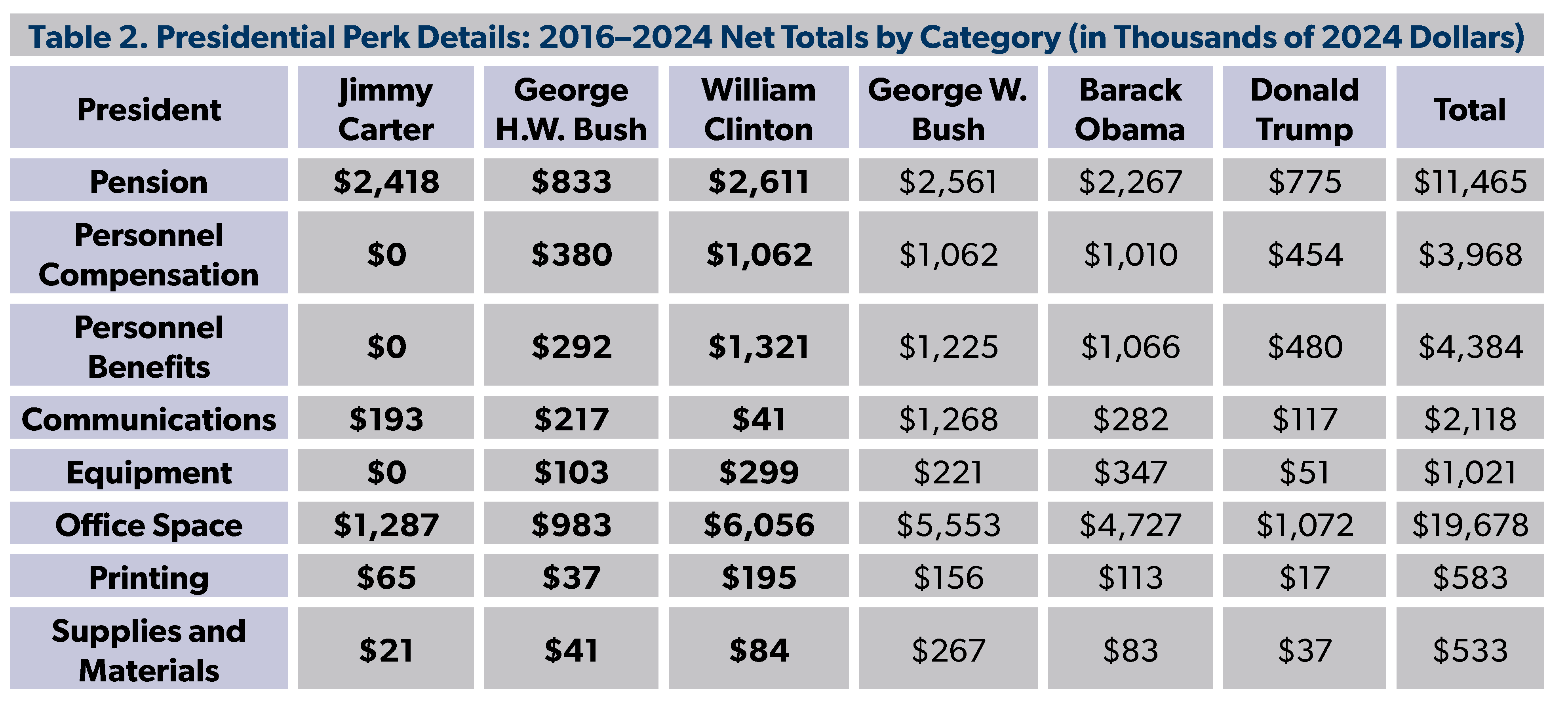

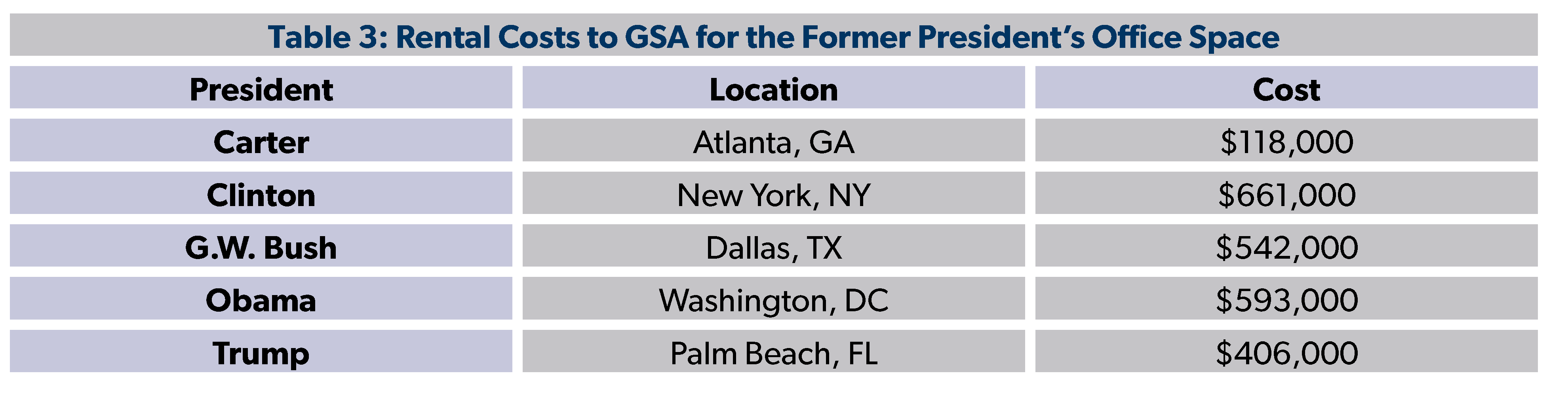

Starting six months after a President leaves office, the GSA provides funding to establish, furnish, and staff an official office anywhere in the U.S. The program was established to assist the former president with lingering official duties. Per CRS’s summary, this benefit is to “help them respond to post-presidency mail and speaking requests, among other informal public duties often required of a former President and his spouse.” There is no limit on the office space or total rent supported by taxpayers. President Bill Clinton has the most expensive office, followed by Barack Obama.

There is no restriction on where the office can be located. For example, Jimmy Carter’s office has been located at the Carter Center, a foundation he established in 1982, with relatively minimal rental costs of $118,000 (Carter’s staff are contractors and these expenses are accounted for in the Other Services funding category, see below). Bill Clinton’s office shares the same street address as the Clinton Foundation, which he founded in 2001. Rents along with staff salary and benefits have cost taxpayers over $8 million since 2016.

In 2001, the Government Accountability Office (GAO) outlined concerns about offices located at former presidents’ foundations:

To varying degrees, foundations associated with the former presidents or their spouses are involved with the use of former president’s office space and staff. In addition to staff compensation discussed above, former presidents' foundations share office in the former presidents’ offices and provide office equipment and furnishings. GSA officials informed us that there is no legal prohibition against the practices of sharing office space and providing furniture and equipment that have developed between former presidents and their foundations. We are unaware of any legal prohibitions that would preclude this.

Co-location of these offices raises concerns that taxpayers are not just subsidizing the presidential offices, which ostensibly support activities related to presidents’ official duties and responsibilities as former heads of state, but are also subsidizing the administration of their personal, charitable endeavors.

Communications

Former presidents also get support for communications, which, according to CRS, can include “cable, phone, and UPS/Fedex charges.” In this category, President George W. Bush has charged taxpayers the most since 2016, with $1.3 million in communication costs.

Equipment

According to CRS, this category includes “furniture or information technology hardware or software and the related installation.” Carter has had no charges in this category since 2016. It is unclear whether the annual charges from the other former presidents for equipment averaging $32,000 per year means that equipment is being leased.

Printing

A total of $583,000 has been provided to former presidents for printing since 2016, including an annual average of $7,000 for Carter, $22,000 for Clinton, $16,000 for Obama, $17,000 for Bush, and $6,000 for Trump.

Supplies & Materials

Taxpayers have subsidized 533,000 ($21,000 per year) since 2016 for “Supplies and Materials” which, according to CRS, is a category that includes “office supplies and subscriptions.” President Bush has charged taxpayers the most for supplies and subscriptions, $267,000 ($30,000 per year), and Carter has charged taxpayers the least with $2,000 per year.

Travel Expenses

Former presidents and up to two staff members are reimbursed for up to $1 million in security and travel-related costs annually. Former First Ladies also are eligible for $500,000 per year for official travel. Perhaps surprisingly, this has been the least costly perk provided by taxpayers. George H.W. Bush’s travels cost $288,000 since 2016, accounting for 73 percent of the total ($397,000). Clinton. Carter, and Trump have not charged taxpayers for any travel over the period since 2016. Taxpayers supported $74,000 for Bush’s travels and $35,000 for Obama.

Other Services

According to CRS, this category includes funding for security payments to the Department for Homeland Security for lease location, license and support hours for contracting of services, postage for franked mail, furniture moves, and disposal costs. The GSA’s annual budget documents also note that Personnel Compensation and Benefits for former President Carter are provided by contract support categorized under Other Services.

Secret Service Protection

Presidents are eligible for lifetime security protection, though they have the option to decline it. This protection is also offered to their spouses and minors under the age of 16. The status of the provision of security and the costs are classified. According to the GAO, the Secret Service maintains space close to the presidential offices and pays rent to the GSA.

Funeral

Presidents are guaranteed a ceremony with full honors and the option to be buried at Arlington National Cemetery. After a proclamation by the current President announcing the death of a former president, the U.S. Army’s Military District of Washington is responsible for the state funeral arrangements. The ceremonies can be held over several days in multiple locations, depending on the wishes of the president’s family. The proclamation also declares a National Day of Mourning on which federal agencies are closed and most federal employees get the day off with pay.

Impact of Impeachment and Removal from Office

Presidents who are removed from office through the impeachment process are no longer eligible for the pension and benefits provided in the Former Presidents Act. Lifetime Secret Service protections are provided under a separate law, so this benefit would not be impacted by removal from office.

FY 2025 Budget Request

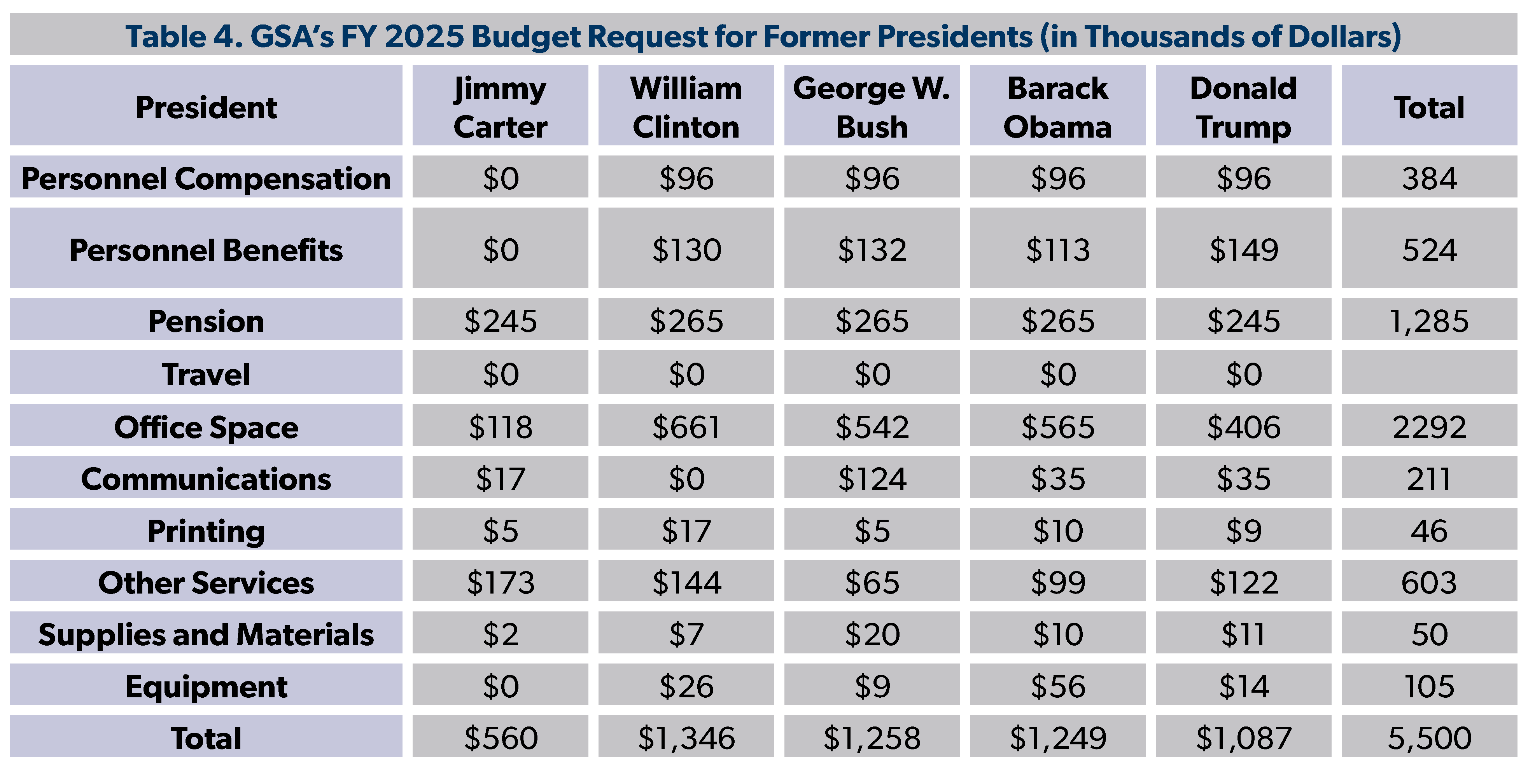

Below is the GSA’s request of $5.5 million for former presidents for FY 2025. In future years, GSA budget data available from the Office of Management and Budget foresees costs growing to $7 million per year.

Next year, Joe Biden will become eligible for the FPA pension and allowances. NTUF has found that he will also be eligible for a $166,374 congressional pension for his time in the Senate and as Vice President. This is a separate benefit, and nothing precludes eligibility for both. Combined, he stands to collect a combined pension of $413,000, topping the presidential salary.

If Donald Trump is reelected to the presidency, his pension benefits would be stopped upon inauguration and funding for his Office of the Former President would be wound down as its functions are shifted to the White House.

Reforming Perks for Former President

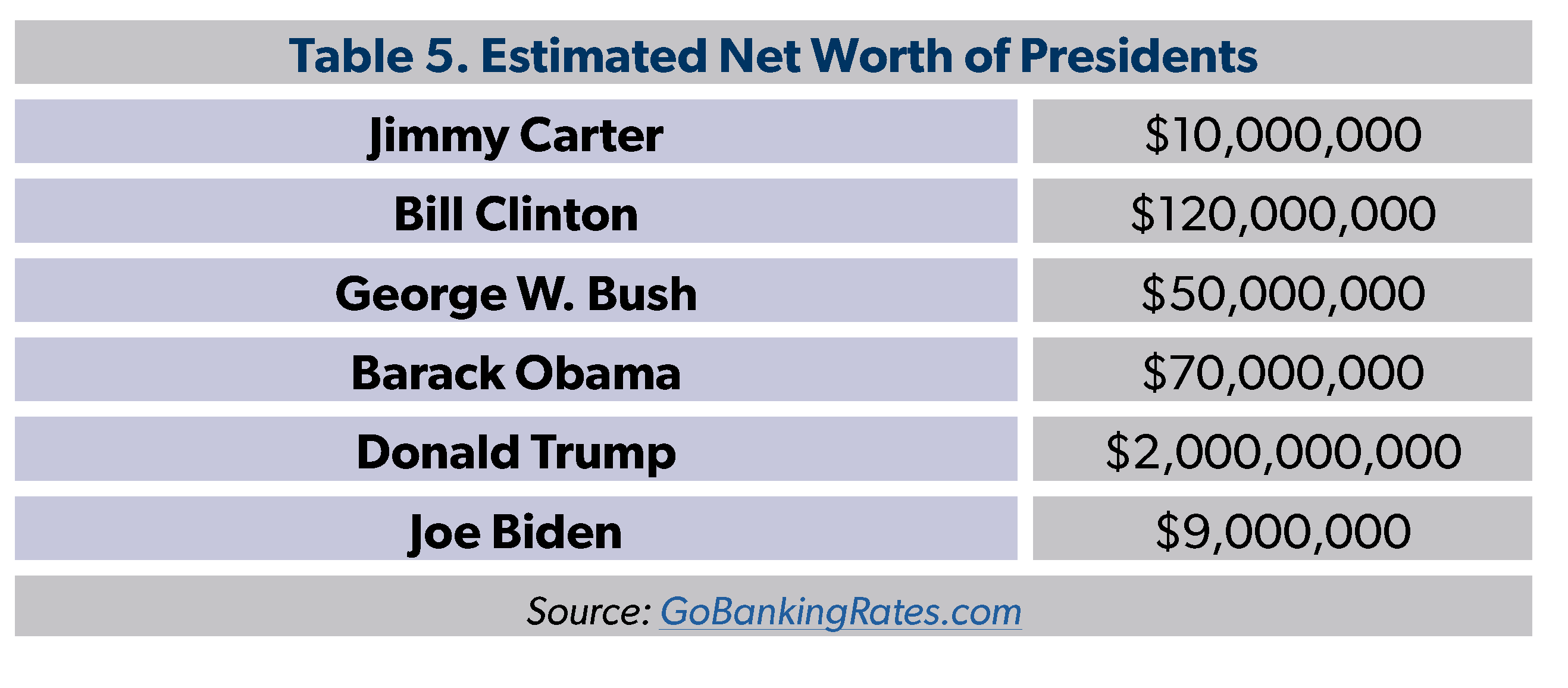

As the table above shows, the current batch of ex-presidents are very well off. To reduce costs to taxpayers for former presidents, Sen. Joni Ernst (R-IA) introduced the Presidential Allowance Modernization Act of 2023 (S. 501). This reform would limit the pension a president could receive to $200,000 annually, with the amount being indexed to inflation. It would also limit the cost to taxpayers for expenses such as office space and leases, furniture, and supplies, as well as staff salaries to a lump monetary sum of $200,000 per year. The allowance would be reduced dollar for dollar by the amount that a president’s adjusted gross income exceeds $400,000. The proposal would leave intact current healthcare benefits and Secret Service protection.

A previous version of the Presidential Allowance Modernization Act was passed by Congress in 2016, but was vetoed by President Obama just six months before he was set to leave office.

Conclusion

The Former Presidents Act was enacted because Harry Truman proclaimed that he was down on his luck after leaving the presidency, stating:

You know, the United States Government turns its Chief Executives out to grass. They’re just allowed to starve . . . If I hadn’t inherited some property that finally paid things through, I’d be on relief right now.

We now know that Truman was in much better financial condition than he let on, with one analysis estimating his net worth was $72 million in 2021 dollars. This casts doubt on the main reason initially put forth in support of establishing the package of benefits that now cost over $5 million per year and are expected to continue to rise. The vast personal wealth of current former presidents and the $35 trillion mountain of federal debt cast even more doubt on the wisdom of continuing to provide this expensive package of perks for life without regard to income level.

As the nation faces mounting debt, it’s time to ensure that the wealthy few at the top no longer receive undue taxpayer support. Reforming these benefits is not just a matter of fairness; it’s a matter of fiscal responsibility.

[1] Documents recently made publicly available from his wife Bess Truman’s personal files indicate that he was in much better financial condition than he let on, with wealth of $72 million in 2021 dollars.