(pdf)

I. Introduction

The burden of the tax code is much more than simply the amount that taxpayers owe to the Internal Revenue Service (IRS). Complying with the complicated tax system imposes an enormous time burden. There are also expenses incurred as an increasing number of filers use paid preparation services to help make sense of the tax forms in order to avoid triggering an audit. Last year, there were additional burdens on taxpayers seeking assistance as IRS tax clinics were closed during the pandemic, and telephone service and correspondence response suffered due to office closures and remote work.

Using official data sources, these burdens can be tallied in order to estimate the total cost, in terms of both time and dollars, of complying with the U.S. tax code. The National Taxpayers Union Foundation’s annual review of the complexity and cost of the federal tax code finds that for the third consecutive year after passage of the Tax Cuts and Jobs Act of 2017, Americans have spent less time complying with tax laws. However, most of the difference this year is due to technical changes made by the IRS in its calculation of time burdens and expenses.

Greater accountability and transparency from the IRS is needed so that taxpayers and policymakers can better understand the problem areas of complexity in the code that need to be addressed.

II. The Tax Code’s Compliance Burden

A. Calculating the Costs of the Tax System

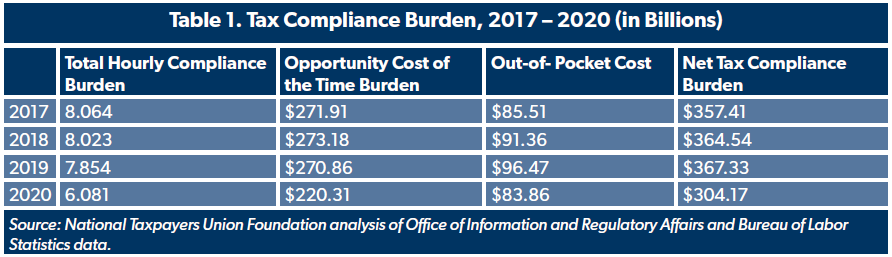

According to our analysis of data and supporting documentation that the Internal Revenue Service (IRS) files with the Office of Information and Regulatory Affairs (OIRA), altogether, complying with the tax code in 2020 consumed 6.081 billion hours for recordkeeping, learning about the law, filling out the required forms and schedules, and submitting information to the IRS.[1]

We can calculate an estimate of the value of this time burden using private sector labor costs. According to the Bureau of Labor Statistics (BLS), U.S. non-federal civilian employers spent an average of $36.23 per hour worked by their employees in December 2020. This includes all wages, salaries and benefits provided.[2]

The opportunity cost of the billions of hours spent on taxes is equivalent to $220 billion in labor – valuable time that could have been devoted to either more productive or more leisurely pursuits but was instead lost to tax code compliance. Add to that the $84 billion in estimated out-of-pocket costs taxpayers spent on software, professional preparation services, or other filing expenses, and the total economic value of the compliance burden imposed by the tax code can be calculated at $304 billion.

B. Comparison to Recent Years

The good news for taxpayers is that the total number of hours spent complying with the code has now fallen in each year since 2017 when it reached its high of nearly 8.1 billion hours. The implementation of the Tax Cuts and Jobs Act (TCJA) simplified the compliance burdens for many filers. The changes ushered in by the TCJA reduced the number of people who would need to file taxes and simplified and shortened the 1040 Form (see below), saving time for people who do not file electronically. The IRS previously estimated that 26 million fewer filers would use Schedule A because of the TCJA’s increased standard deduction, meaning much less time lost to paperwork on itemized deductions. The TCJA also eliminated the Affordable Care Act’s individual mandate effective in 2019. The IRS estimated that this reduced the compliance burden by 10 million hours.

This year saw a stunning drop in the compliance burden, freeing up 1.8 billion hours and $63 billion in costs compared to last year. This drop, however, is largely a result of technical changes, as discussed later in this paper.

C. Paperwork Burden Transparency

Taxpayers have access to this compliance data thanks to the Paperwork Reduction Act (PRA) of 1980, which required federal agencies to track the paperwork burden imposed on citizens and businesses through forms and recordkeeping requirements. The Paperwork Reduction Act of 1995 strengthened the law and required that agencies get approval from the Office of Management and Budget for each of their compliance burdens, also known as information collections. Pursuant to this, agencies seek public feedback through the Federal Register and provide largely standardized supporting documents to OIRA when they establish new paperwork collections or make changes to burden estimates, which are subject to periodic review.

Under the law, a collection can only be approved for up to three years at a time. However, the major information collections in the Internal Revenue Code are generally submitted on an annual basis rather than the three-year PRA cycle.

While last year’s drop in tax complexity resulted from the reforms in the TCJA that eased filing challenges for many, the large drop this year is due primarily to methodological changes made by the IRS in its estimates of paperwork burdens. The IRS regularly conducts surveys of taxpayers to get feedback on how much time was spent on tax-filing activities such as understanding the forms or recordkeeping, and to estimate related out-of-pocket expenses. The IRS then uses this information to update the model it uses to estimate the paperwork burden.

In its Supporting Statement filed this year with OIRA, the IRS noted a revision to its estimate of burdens under business income taxes, which dropped sharply from 3.3 billion hours to 1.1 billion hours. Despite the size of the revision, this is all that the IRS reported about it:

Changes in estimated aggregate compliance burden are due entirely to adjustments in agency estimates. IRS has conducted a re-baselining of the burden estimates for business entity filers based on new survey data, which indicate that the previous burden was significantly over-estimated.

The IRS also made technical revisions in its estimate of the individual income tax compliance burden. Here, the IRS provided some additional information explaining the change in its Supporting Statement:

The [Tax Year 2018] survey results indicate that out-of-pocket costs appear to have increased on the margin. Reported time amounts also increased but to a lesser extent. The increased time and money burden for these taxpayers are primarily responsible for the increase in burden. It is still unclear whether this increase is temporary or permanent. Anecdotal evidence suggests that this may be a temporary increase since many taxpayers may have collected and entered the same information compared to the prior year even though it was no longer optimal for their situation. Specifically, filers who previously itemized may have been more likely to collect and enter their itemization activity even though they ultimately claimed the standard deduction. Survey data for TY19 will be available at the end of FY21 and should insight [sic] into the permanence of these changes.

NTUF reached out to the Internal Revenue Service requesting more information on these changes but did not receive a response before publication of this paper. In the event that the agency provides more detailed explanation of its methodological reforms, this paper will be updated to reflect the new information.

The IRS should shed more light on its taxpayer burden model and calculations. The scale of the changes on the business tax side and the counterintuitive findings on the individual side merit more detailed discussion than was provided in the Supporting Documents to OIRA. Most recent academic commentaries on tax compliance burdens tend to agree that filing and form completion burdens are overestimated, while recordkeeping and the somewhat nebulous "learning about the law" are underestimated (the latter especially when activities such as consulting financial advisors or publications and engaging in tax savings planning get accounted for).

Transparency of the data and model would allow for assessment and feedback to improve the calculations. The IRS should work to provide more accountability of the massive compliance burdens imposed on taxpayers through the tax code so that lawmakers can address areas of concern. This effort could also help fill in the gaps in missing cost estimate burdens across major sections of the tax system (see below).

The IRS would do well to learn some lessons from the Congressional Budget Office (CBO). For many years, NTUF has encouraged CBO to boost transparency of its models and processes so that taxpayers can better understand and assess its cost estimates of legislative proposals. The agency has made strong improvements in transparency of its methods by providing detailed reports on its models for policy areas, providing more supplemental data underlying its reports and cost estimates, and by highlighting areas of uncertainty in its analyses.

D. Understanding the Massive Costs of the Compliance Burden

Even with the IRS’s technical adjustments that significantly reduced its overall compliance burden estimate, 6 billion hours is nevertheless a massive time sink that may be difficult to comprehend. $304 billion:

- is equivalent to 1.4 percent of last year’s GDP ($21 trillion);

- exceeds CBO’s estimate of net interest payments on the federal debt for this fiscal year ($303 billion); and

- is nearly equal to the cost of the combined FY 2020 regular budgets of the Departments of Education, Homeland Security, and Transportation ($306 billion).

Fortune publishes a yearly list of the Global 500, the largest companies in the world by revenue. Only three businesses on the list sell more than the value of the compliance burden of the U.S. tax code: Walmart (with revenues of $524 billion), Royal Dutch Shell ($352 billion), and Saudi Aramco (a state-owned enterprise, at $330 billion).[3] The amount of money lost to tax compliance is greater than the revenues of Amazon and is twice the revenues of Costco.

To further contextualize this immense cost, not only does the amount of time spent on taxes waste entire companies-worth of productivity, but also entire countries-worth: The U.S. federal income tax compliance burden would rank 41st out of the 212 nations listed in the World Bank’s latest global GDP calculations, close behind Denmark and just ahead of Egypt and Bangladesh.[4]

It is also difficult to fathom just how much time is consumed by the paperwork burden of federal taxes. 6.081 billion hours is equal to almost 694,000 years. In that time, the top ten longest-running scripted U.S. television shows (from The Simpsons to CSI: Crime Scene Investigation) plus every Meet the Press and every Sesame Street, could be binge-watched more than 525,000 times.[5]

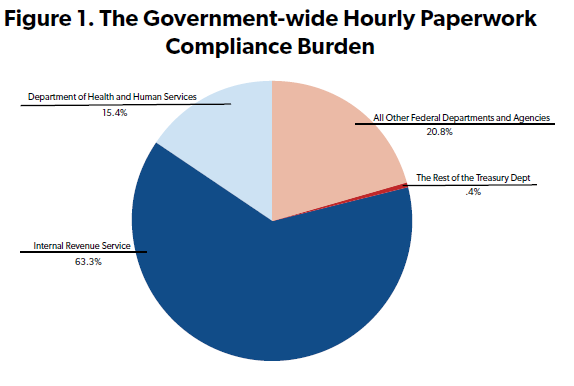

E. The IRS Represents the Vast Majority of the Government-wide Paper Burden Imposed on Citizens

With its vast reach, it is unsurprising that the IRS’s 6.081 billion hours represents nearly two-thirds of the total government-wide paperwork burden of 9.62 billion hours in compliance time. The next closest is the Department of Health and Human Services, imposing 1.5 billion paperwork compliance hours.[6]

* The IRS is within the Treasury Department.

F. The Complexity Burden of Sections of the Tax Code

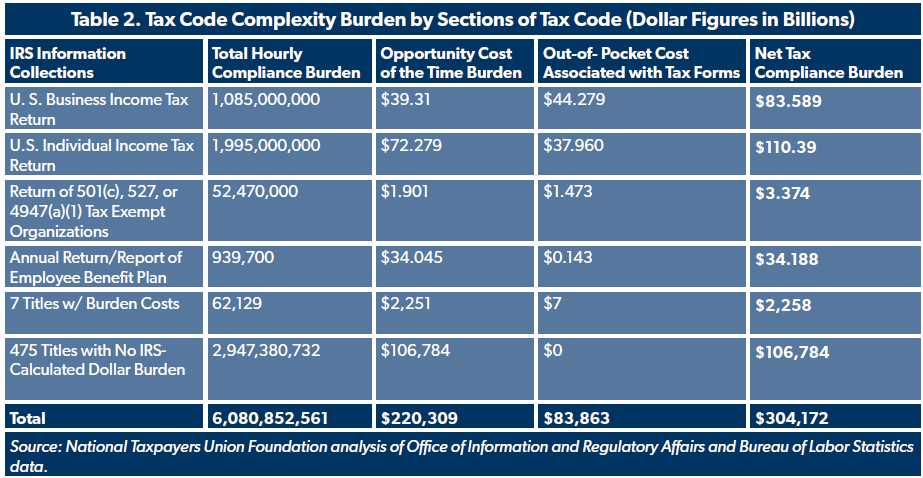

Table 2, below, breaks out the latest compliance burden and costs associated with the IRS’s various information collections, ranked by the IRS reported out-of-pocket costs.

The individual and business tax income sections are discussed below. Tax exempt organizations are required to file forms with the IRS to provide transparency regarding financial information and for purposes of IRS enforcement and regulation of certain activities. The IRS reports collection of 1.6 million annual responses. The fourth collection on the list is a joint effort of the IRS and the Department of Labor pursuant to a law requiring administrators of employee pension and benefit plans to file annual returns or reports to the federal government. The IRS reports this collection receives over 939,000 responses a year. In addition, there are seven additional collections with combined estimated out-of-pocket expenses totaling $7 million.

There are currently 475 IRS paperwork collections with a listed $0 cost. In some cases, the Supporting Statements (SS) that were submitted to OMB for review of the specific collections clarify that the IRS does not expect that there are any costs. For example, “There are no capital/start-up or ongoing operation/maintenance costs” associated with Form 4562 regarding Depreciation and Amortization (imposing 448 million compliance hours).[7] It is, of course, implausible that a form that imposes a time cost of nearly 450 million hours has no out-of-pocket costs associated with it, suggesting that compliance burdens could remain significantly underreported in some ways.

There are other cases where the IRS has failed to account for the estimated cost burden of a form. For example, Form 1099-B requires brokerage firms to report taxpayers’ gains or losses for stocks, bonds, and other securities. Copies are shared with the IRS and the taxpayer. The IRS estimates that the form imposes 674 million in burden hours -- the third highest time burden across the Internal Revenue Code. Tax preparers have labeled it the worst tax form because of filing delays it causes.[8] The form requires information including a description of the item sold, along with the date and value of the item when it was acquired and sold. There are often revisions that brokers need to make. Although no dollar cost is currently associated with Form 1099-B, its 2017 Supporting Statement noted that more research would be required to determine the expenses required:

As suggested by OMB, our Federal Register notice dated June 19, 2013, we requested public comments on estimates of cost burden that are not captured in the estimates of burden hours, i.e., estimates of capital or start-up costs and costs of operation, maintenance, and purchase of services to provide information. However, we did not receive any response from taxpayers on this subject. As a result, estimates of the cost burdens are not available at this time.[9]

The IRS may be finally making some progress here. The most recent Supporting Statement, posted in 2020, notes that the IRS “is in the process of revising the methodology it uses to estimate burden and costs. Once this methodology is complete, IRS will update this information collection to reflect a more precise estimate of burden and costs.”[10]

However, nine of the top ten information collections listed with $0 costs have the same vague language. Among these, the Supporting Statement of a collection regarding Form 1099-INT, regarding returns with payment of interest, additionally notes that the IRS requested public comment in 2019 but did not receive any feedback. The only collection among the top ten that specified there were zero costs involved was for forms under the W-2 and W-3 series, which generally take a minute or less to fill out.

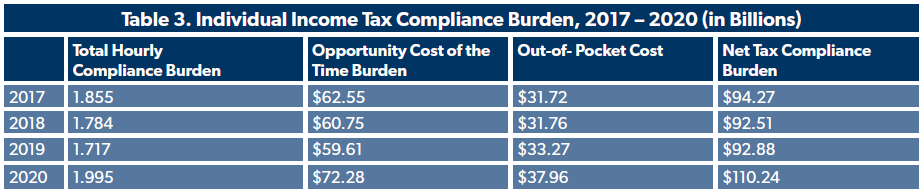

III. Individual Income Tax

A. The Overall Individual Income Tax Compliance Burden

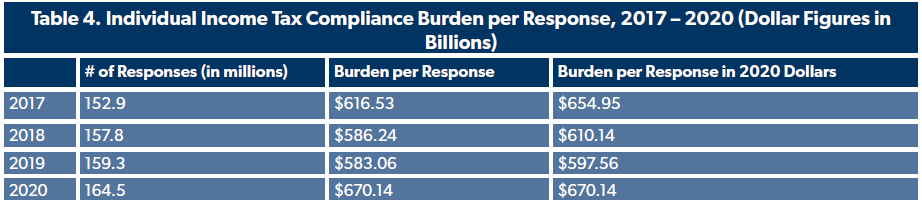

The compliance burden for the entire individual income tax (IIT) collection has increased by 278 million hours compared to last year, resulting from a rise in the estimate of the number of taxpayers and the technical change made by the IRS discussed above. Because of rising out-of-pocket costs and private-sector labor costs, the net compliance burden rose from last year by $17 billion, reaching $110 billion.

As noted above, the IRS made technical changes to its estimate of time and cost burdens incurred from complying with individual income tax laws. This revision has now put the total time burden higher than it was before passage of the TCJA, which had made significant strides in simplifying tax burdens. In recent years, the IRS projected that fewer people would need to itemize because of the tax reform. The agency estimated that 26 million fewer filers would use Schedule A, and that 25 percent of filers did not need to use any of the schedules associated with the 1040 form in 2018.[11] It turned out that the actual number was actually 29 million lower, according to the IRS report on the complete 2018 tax year published last fall.[12]

The TCJA also eliminated the Affordable Care Act’s individual mandate effective in 2019. The IRS estimates that this reduced the compliance burden by 10 million hours. The TCJA also significantly reduced the double-filing burden of the Alternative Minimum Tax (AMT). In 2013, the Taxpayer Advocate cited an IRS estimate from 2000 that taxpayers spent over 18 million hours complying with the AMT forms, over 12 hours per person who was liable for the tax that year.[13] The IRS has not provided details of the AMT compliance burden since then, but filers subject to this double-calculation of taxes declined from over 5 million in 2017 to 244,007 in 2018.[14]

But after reviewing survey results, the agency found that many taxpayers continue to gather receipts and spend time doing the extra calculations even though it is no longer optimal to do so after the TCJA nearly doubled the standard deduction. The IRS notes that this additional time burden is probably not permanent as taxpayers gain experience with the reformed tax code.

The IRS did not comment on whether its figures for recent years were similarly underestimated as it claims 2019 was. If the IRS’s revised estimates of the time burden and out-of-pocket costs were applied to its other data for 2019, the total time burden associated with the IIT would rise from 1.7 billion to 1.9 billion hours, and the total expenses calculation would increase from $33.3 billion to $36.8 billion ($37.8 billion in 2020 dollars).

It is also unclear what is driving the increase in the number of filers during a recession. The Supporting Statement notes that the number is based on trends in the filing forecast that the IRS published last fall, but the latest figures are much higher than in that report.[15] An increase in the number of filers eligible for refundable credits could add to the overall time burden due to the complexity and interaction of the credits, including the child tax credit, the additional child tax credit, and the earned income tax credit.

The totals in Tables 3 and 4 exclude a one-time change that was made to the IIT information collection during 2020 pursuant to the rebate checks enacted in the Coronavirus Aid, Relief and Economic Security (CARES) Act. Taxpayers who had filed in 2018 or 2019 or who received Social Security payments were able to receive the rebates automatically. The IRS estimated that there were an additional 22.8 million people who are eligible for the rebate but who do not receive Social Security (up from its preliminary estimate a year ago of 14 million). The agency produced an online form to allow nonfilers to submit their information, qualifying them for the rebates. They estimate that this resulted in a temporary 4.2 million-hour increase in the compliance burden.[16]

That burden might have been much heavier, were it not for the fact that the IRS created a method for nonfilers to claim CARES Act payments using off-the-shelf technology. By adapting the Free File portal developed by the private sector to assist taxpayers with filing their returns online at no charge, nonfilers had a quick and easy way to access rebates.[17]

The IRS also noted a reform in 2020 that decreased filing burdens. In May 2020, while much of the agency was shut down due to the pandemic and social distancing restrictions, the IRS finally allowed taxpayers to file amended returns electronically. Form 1040-X, which is used by taxpayers to correct mistakes in previously filed tax forms, was one of the last major individual tax forms that could only be filed with a paper form. The IRS estimates that 1.5 million taxpayers will save a total of 150,000 hours and $4 million in out-of-pocket expenses. Private sector tax preparation software had long allowed users to complete such forms electronically, but the government took years to catch up with the times.

B. 1040 Forms

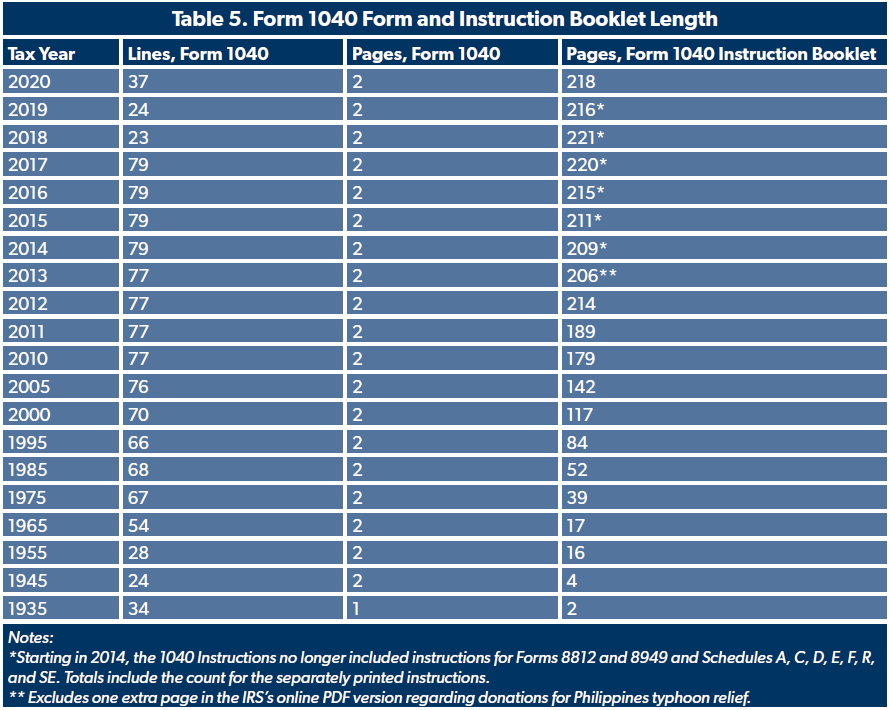

There are a total of 136 forms and schedules associated with the Individual Income Tax but the basic form used by most taxpayers to file their federal income taxes is the 1040. As Table 5 shows, the changes under the TCJA cut the number of lines on the 1040 from 79 in 2017 down to 23 in 2018. However, the number of lines crept up this year to 37.

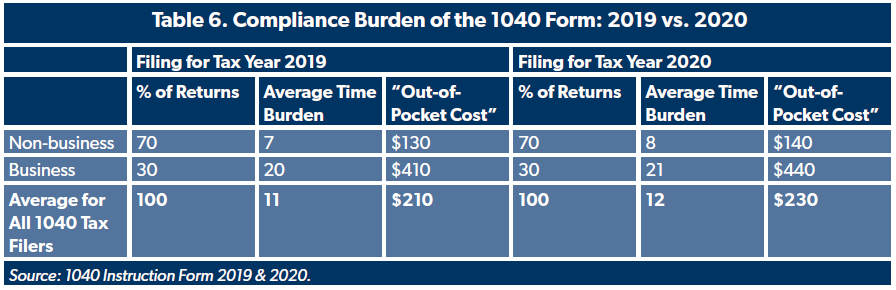

Breaking out the statistics of filers using the 1040 shows that average time and expense burden can vary significantly. Business filers who use the 1040 form must also use one or more of either Schedule C, C–EZ, E, F, Form 2106, or 2106–EZ. The time burden for business filers is nearly 3 times higher than non-business filers.

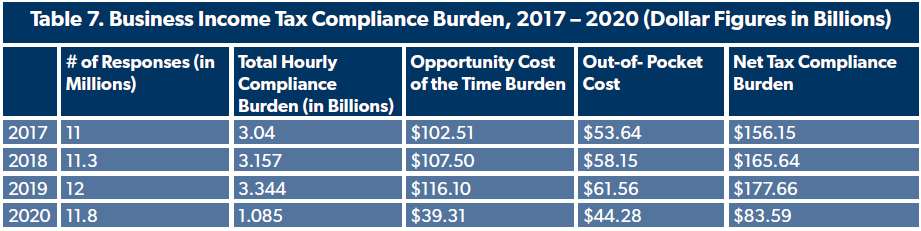

IV. Business Income Tax Compliance Burden

Partnerships, corporations, and pass-through businesses file taxes using Business Income Tax returns. There are currently 242 forms and schedules associated with this collection. As noted above, the IRS made a drastic revision to its compliance burden estimate but provided no substantive information reporting why the newest taxpayer survey results “indicate that the previous burden was significantly over-estimated.” NTUF reached out to IRS and Treasury officials for more information, but did not receive a response prior to publication.

Unless the IRS reassesses its previous burden estimates in light of these changes, or shares its data for public review, it is impossible to determine trends in the compliance costs for the business taxes that would indicate problem areas for the IRS and Congress to address.

The TCJA reduced compliance costs in some areas of the business code. Prior to the TCJA, the U.S. had the highest combined federal, state, and local statutory corporate tax rate in the industrialized world. The TCJA dropped the federal rate from 35 percent to 21 percent. The law also eliminated the Corporate Alternative Minimum Tax, the domestic production credit, and several other general business credits, which saved filers 100,000 hours and $4 million in out-of-pocket expenses. The temporarily full expensing provisions also achieved compliance savings by eliminating some of the need for complicated depreciation schedules. Unfortunately, the IRS has not yet updated the compliance estimate from 2017, which showed a time burden of over 448,000,000 hours.

However, the TCJA also increased complexity through international provisions that act essentially as a complicated alternative minimum tax, including the Global Intangible Low-Taxed Income tax, the Foreign-Derived Intangible Income deduction, and the Base Erosion and Anti-Abuse Tax.

In 2017, the IRS reported an average time burden of 276 hours for each business income tax return. This has now been revised down to 92 hours, again due to technical changes made by the IRS. It is also important to note that there is a wide range in time burdens underlying the national average. Larger, more complex businesses will spend a lot more time calculating and reporting their taxes. For example, small corporations are estimated to spend an average of 80 hours on taxes (compared to 280 in the IRS’s previous model). In comparison, corporations with assets greater than $10 million take an average of 325 hours (compared to 1,255 hours in the IRS’s previous model).

V. Components of Complexity

Tax laws are codified in U.S. Code Title 26, also known as the Internal Revenue Code (IRC). The 1913 law that established the income tax was 27 pages in length. A report published that year including the “text of income tax amendments to the Constitution and Income Tax Act of 1913, plus regulations, rulings, official opinions, judicial decisions and forms” expanded the count of tax provisions to 400 pages.[18] This relatively modest start steadily grew into a colossal, bewildering web of complexity over the next century but there are signs that the trend of an ever-growing Tax Code has recently been slowing.

The total number of pages if the tax code were to be printed can vary widely depending on the formatting of columns, page widths, font, or margins in the documents. For example, the current PDF of it published on the House of Representatives’ website runs 6,571 pages while the archived version of the Code from 2019 with a smaller font and two columns per page stands at 3,945 pages.

To help standardize year to year comparisons, NTUF has copied the texts of the Tax Code PDFs into Microsoft’s Word processor in order to use the program to generate a word count. The analysis found that over the 20-year period, the tax code had expanded by over 37,000 words per year, on average, reaching 3.97 million words in 2018. The version of the code available online in 2019 was slightly smaller, with 3.95 million words.[19] But the tax code is again expanding, reaching a new record length of 3,995,585 words.

If, for some reason, anyone would want to listen to the tax code read out loud, that could take nearly 430 continuous hours (nearly 18 days) at Audible’s reported average reading speed of 9,300 words per hour.[20]

In addition the Department of the Treasury interprets the tax law in the 22 volumes of Title 26 of the Code of Federal Regulations. The most recently available version of Title 26 comprises 15,480 pages, compared to 16,788 as published in 2018.[21]

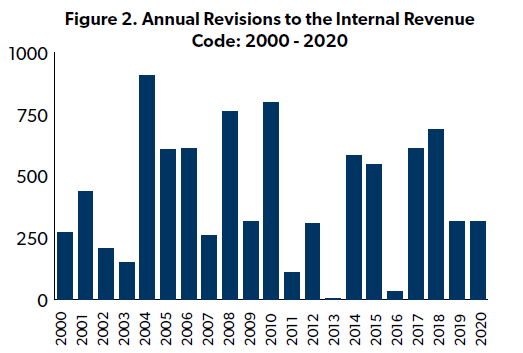

From 2000 through 2020, Congress enacted, on average, 420 changes to the tax code each year (see Figure 2), ranging from a low of three in 2013 up to 797 in 2010.[22] After two successive years that saw changes enacted higher than the annual average, 2020 included 314 tax changes. This number could rise this year: The American Recovery Plan Act made 96 changes to tax law and Congress is weighing plans to significantly modify the TCJA and raise tax rates.

Keeping up with these annual changes and navigating through the labyrinthine laws is only part of the challenge for anyone trying to make sense of the system. The IRS also issues tax guidance and legal interpretations through various types Rulings, Notices, Memoranda, or Announcements. The agency can also retroactively impose regulation.[23]

For taxpayers with complicated finances, that is a lot of information to keep track of to ensure a proper understanding of applicable tax laws, regulations, and rulings. The ongoing issues related to the pandemic continue to impose difficulties on taxpayers seeking assistance and information from the IRS as taxpayer clinics were shuttered and many agency staffers worked remotely, impeding their ability to provide telephone services. This year’s tax filing extension was to some degree driven by the massive correspondence backlog at the IRS built up during the shutdown.

Getting filing advice from the IRS was already problematic, as previous editions of our annual tax complexity study has warned that the agency considers vast areas of the tax code as “out of scope” for taxpayer telephone assistance. There are also areas that are out of scope through the IRS tax preparation assistance programs like the Volunteer Income Tax Assistance and Tax Counseling for the Elderly.[24]

VI. Tax Preparation Assistance Fees Continue to Fall

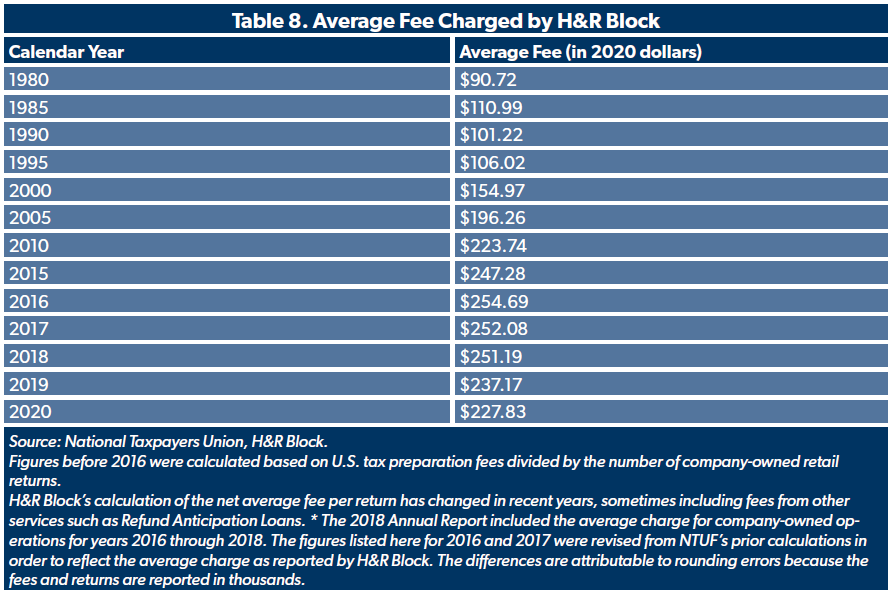

In part due to tax complexity, the demand for tax assistance has increased: The IRS has estimated that 90 percent of businesses and 95 percent of individual taxpayers use a paid preparer or tax software to complete their tax return.[25] For several years, National Taxpayers Union and National Taxpayers Union Foundation have tracked the average fee charged by H&R Block, one of the largest such preparation businesses in the country.[26] Perhaps not surprisingly, those fees have generally increased along with the system’s complexity. Table 8 below tracks the average fee since 1980, adjusted to 2020 dollars.

On the plus side, the cost of return preparation has dropped by over 10 percent from a high of $255 in 2016. However, at $228, the cost is still 250 percent higher than it was in 1980, suggesting that the growth in tax complexity is outpacing even the technological and administrative improvements that have been made to professional preparation firms in that time.

As more filers seek professional assistance either to save time or to avoid making an error and triggering an audit notice, the IRS has been attempting to increase its oversight and regulation of preparers. The new regulatory power would be duplicative of existing mandates and related safeguards that are already in place including use of unique filing IDs by preparers so that patterns of fraudulent or questionable filings could be detected. Preparers are also subject to costly penalties up to $100,000 and prison. Giving the IRS additional heavy-handed authority could force many independent preparers out of business, leaving taxpayers with fewer options for tax compliance.

VII. Conclusion

The IRS projections for the current filing season show that the overall time compliance burden associated with the Tax Code has fallen for the third straight year after the passage of the tax reform law in 2017. However, the costs imposed on individuals and businesses spent on tax preparation remain immense, chewing up valuable time and energy that could be directed to productive efforts.

The massive revision to the data the IRS made this year with very little explanation also raises concern about the way the agency calculates the burden. Greater accountability and transparency is needed so that lawmakers have better information about how taxpayers interact with the tax system and can identify trends in problem areas that need to be addressed.

The gains in simplicity achieved in 2017 could be headed for reversal as Members of the current Congress and the Biden administration seek to increase taxes and roll back parts of the TCJA. It should be noted that making significant changes to the tax law would complicate administration. Major revisions would require the IRS to issue new regulations, but at the same time, it will still have to continue to issue guidance, regulations, and rulings under the TCJA-era laws because of tax forms that will still be filed by taxpayers for those years. It will also further confuse the results of compliance burden models used by the IRS as taxpayer behavior will change in response to changes in the tax law.

The solution from many left-of-center politicians and advocacy organizations is to have the IRS fill out and pre-calculate tax forms for taxpayers to sign off on and pay. This misguided scheme is often called “return-free” or “ready-return” but it is riddled with major costly problems and is not ready for prime time. The countries that use this have far simpler tax systems than the one that has entrenched itself across the U.S. Implementation would also impose huge reporting mandates on employers (especially small businesses), but also any entity including financial institutions and government agencies that payout salaries or benefits. Advocates also fail to consider the IRS's perpetual technological problems, its history of repeated abuse of power, and the ongoing challenge of ensuring that IRS employees are adequately trained regarding taxpayer rights. It would also be highly ironic to have the IRS automatically fill out the forms for taxpayers, yet questions to the IRS regarding tax form and schedule preparation have been ruled as “out-of-scope.”

Taxpayers could be in for a rough path ahead with higher rates and greater complexity. There are also proposals to boost the IRS’s tax enforcement budget to increase examinations and audits. Despite all the griping that certain taxpayers and businesses are not paying their “fair share” of taxes, a recent report from the Treasury Inspector General of Tax Administration found that 55 percent of tax returns from large businesses that were systematically flagged for examination were closed with no net change in taxes owed.[27] This raises questions about the calculation of the tax gap, estimates of rates of return on enforcement budget increases, as well as methods used by the IRS. The agency is attempting to update its models in order to more effectively target examinations, but its models will not hold up well to a constantly shifting tax system.

Taxpayers would be better served by a simplified system and more responsiveness and transparency from the IRS.

[1] Office of Information and Regulatory Affairs. “Inventory of Currently Approved Information Collections.” Retrieved on April 7, 2021 from https://www.reginfo.gov/public/do/PRAMain.

[2] Bureau of Labor Statistics. “Employer Costs for Employee Compensation – December 2020.” March 18, 2021. Retrieved from https://www.bls.gov/news.release/pdf/ecec.pdf.

[3]Fortune. “Global 500.” Retrieved on April 8, 2021 from https://fortune.com/global500/. Fortune’s list also currently includes three Chinese state-owned companies whose revenues exceed the current U.S. tax compliance burden.

[4]World Bank. “National Accounts Data, GDP (current US$).” Retrieved on April 8, 2021 from https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?view=map&year_high_desc=trueAccessed.

[5] Wikipedia, “List of longest-running scripted American primetime television series.” Retrieved on April 10, 2021 from https://en.wikipedia.org/wiki/List_of_longest-running_scripted_American_primetime_television_series. The calculation of the time of each of the series is from Bingeclock.com, retrieved on April 10, 2021 from https://www.bingeclock.com/.

[6] Office of Information and Regulatory Affairs. “Inventory of Currently Approved Information Collections.” Retrieved on April 7, 2021 from https://www.reginfo.gov/public/do/PRAMain.

[7]Internal Revenue Service, “Supporting Statement: Form 4562 Depreciation and Amortization (Including Information on Listed Property),” May 1, 2017. Retrieved from https://www.reginfo.gov/public/do/PRAViewDocument?ref_nbr=201704-1545-011.

[8] Saunders, Laura. “The Worst Tax Form,” Wall Street Journal, February 19, 2016. Retrieved from https://www.wsj.com/articles/the-worst-tax-form-1455877800.

[9] Internal Revenue Service. “Supporting Statement: (Form 1099-B) Proceeds from Broker and Barter Exchange Transactions.” July 25, 2017. Retrieved from https://www.reginfo.gov/public/do/PRAViewDocument?ref_nbr=201705-1545-021.

[10] Internal Revenue Service. “Supporting Statement: (Form 1099-B) Proceeds From Broker and Barter Exchange Transactions.” November 16, 2020. Retrieved from https://www.reginfo.gov/public/do/PRAViewDocument?ref_nbr=202007-1545-008.

[11] Internal Revenue Service. “Supporting Statement: U.S. Individual Income Tax Return.” October 11, 2018. Retrieved from https://www.reginfo.gov/public/do/PRAViewDocument?ref_nbr=201808-1545-031.

[12] Internal Revenue Service. Individual Income Tax Returns Complete Report: 2018. SEptember, 2020. Retrieved from https://www.irs.gov/pub/irs-pdf/p1304.pdf.

[13] Brady, Demian. “The Alternative Minimum Tax and Tax Reform.” National Taxpayers Union Foundation. May 15, 2017. Retrieved from https://www.ntu.org/foundation/detail/the-alternative-minimum-tax-and-tax-reform.

[14] Internal Revenue Service. Individual Income Tax Returns Complete ReportL 2018. September, 2020. Retrieved from https://www.irs.gov/pub/irs-pdf/p1304.pdf.

[15] Internal Revenue Service. Publication 6292 Fiscal Year Return Projections for the United

States: 2020–2027. September, 2020. Retrieved from https://www.irs.gov/pub/irs-pdf/p6292.pdf.

[16] Internal Revenue Service. “Supporting Statement: U.S. Income Tax Return for Individual Taxpayers

OMB Control Number 1545-0074.” February 12, 2021. Retrieved from https://www.reginfo.gov/public/do/PRAViewDocument?ref_nbr=202012-1545-009.

[17] Sepp, Pete. “Treasury Payment Snafus – Umpteenth Reason to Avoid “Return-Free” Scheme.” National Taxpayers Union. January 7, 2021. Retrieved from https://www.ntu.org/publications/detail/treasury-payment-snafus-umpteenth-reason-to-avoid-return-free-scheme.

[18] Wolters Kluwer, CCH. “Fact Sheet: 100-Year Tax History: The Length and Legacy of Tax Law.” 2013. Retrieved from https://www.cch.com/wbot2013/factsheet.pdf.

[19] U.S. House of Representatives Office of the Law Revision Counsel, Annual Historical Archives. Retrieved on April 8, 2021 from https://uscode.house.gov/download/annualhistoricalarchives/pdf/1998/index.html. Additional available yearly archives since 1994 can be found by changing the year in the link. The version published on January 13, 2021 was retrieved on April 12, 2022 from https://uscode.house.gov/download/download.shtml.

[20]Commins, Karen. “Simple math about audiobook rates,” KarenCommins.com, June 13, 2011. Retrieved from https://www.karencommins.com/2011/06/some_simple_math_about_audiobo.html/.

[21] U.S. Government Publishing Office. Code of Federal Regulations (Annual Edition). Retrieved on April 8, 2021 from https://www.govinfo.gov/app/collection/cfr/.

[22]Office of the Law Revision Counsel. United States Code Classification Tables: 2020, U.S. House of Representatives. Retrieved from https://uscode.house.gov/classification/tables.shtml.

[23] Internal Revenue Service. Understanding IRS Guidance – A Brief Primer. September 24, 2020. Retrieved from https://www.irs.gov/uac/understanding-irs-guidance-a-brief-primer.

[24] Internal Revenue Service. VITA/TCE Volunteer Resource Guide. January 2021. Retrieved from https://www.irs.gov/pub/irs-pdf/p4012.pdf.

[25]Internal Revenue Service. “Supporting Statement: U.S. Business Income Tax Return.” February 9, 2021. Retrieved from https://www.reginfo.gov/public/do/PRAViewDocument?ref_nbr=202012-1545-012. Internal Revenue “Supporting Statement: U.S. Individual Income Tax Return.” October 11, 2018. Retrieved from https://www.reginfo.gov/public/do/PRAViewDocument?ref_nbr=201808-1545-031.

[26] H&R Block, Annual Reports. Retrieved from https://investors.hrblock.com/financial-information/annual-reports.

[27] Treasury Inspector General for Tax Administration. The Large Case Examination Selection Method Consistently Results in High No-change Rates. June 22, 2020. Retrieved from https://www.treasury.gov/tigta/auditreports/2020reports/202030031_oa_highlights.html.