(pdf)

The policy challenges facing the country are immense. Economic growth hasn’t reached its full potential, individuals and businesses pay too much for health care, and red tape holds back innovation and entrepreneurship, among many other concerns. But presidential candidate Senator Elizabeth Warren (D-MA) has a plan for all of them: Raise taxes.

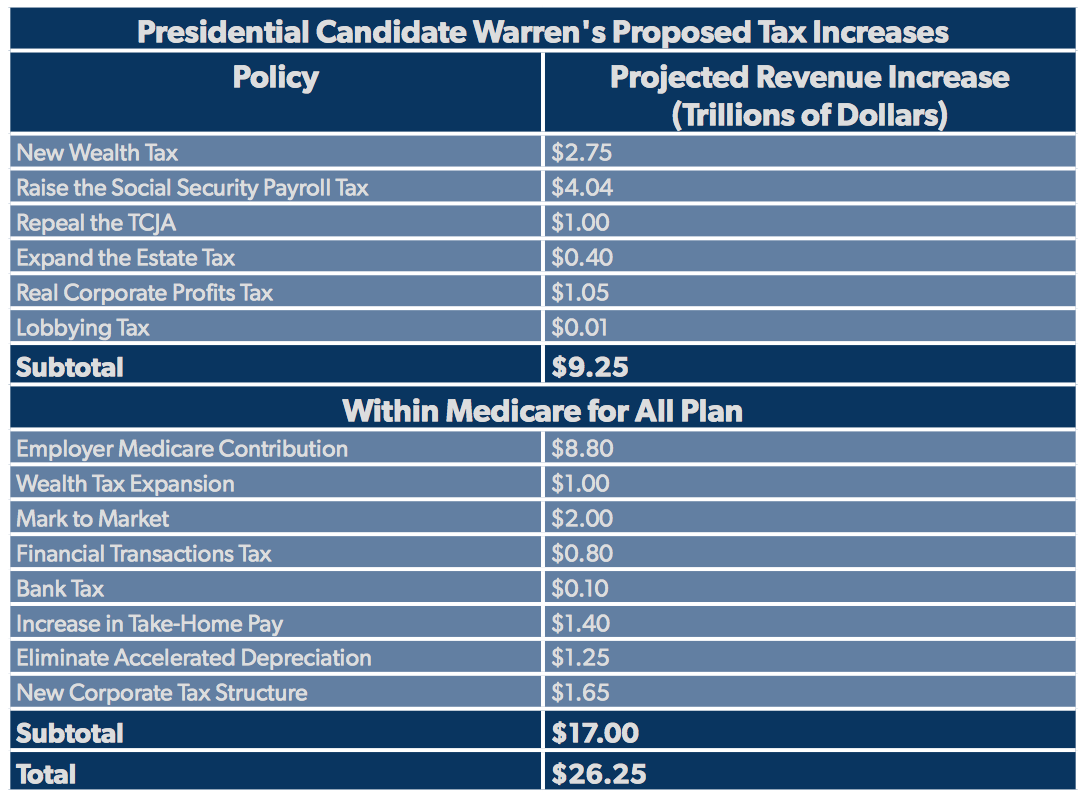

In total, Senator Warren is proposing raising federal taxes by $26.3 trillion over a decade to finance enormous expansions of federal benefits, such as Medicare for All, student loan forgiveness, and universal child care.[1]

She also projects she could raise an additional $2.3 trillion in new revenue from greater tax enforcement from the Internal Revenue Service, bringing the total new federal revenue projections to $28.6 trillion over a decade.

These tax increases would dramatically expand the size of the federal government, growing federal revenues by 63 percent over a decade. Her tax hikes would be larger than the federal government’s entire projected individual income tax collections, and just shy of total expected collections for both individual and corporate income taxes combined.

Senator Warren’s Proposed Tax Increases

Senator Warren’s policy proposals include a wide variety of tax increases. These tax hikes hit families, businesses, and estates. Contrary to her claims, many of these plans would, in fact, raise taxes on the middle-class.

- Create a New Wealth Tax:One of Senator Warren’s signature tax proposals is her support for creating a new wealth tax in the United States. It would assess a tax on net assets above $50 million at a rate of 2 percent, with the rate increasing to 3 percent for those with more than $1 billion in wealth. Estimated revenue according to the Warren campaign: $2.75 trillion over a decade.

- Raise the Social Security Payroll Tax: Senator Warren proposes a dramatic expansion of the Social Security payroll tax. Currently, the levy only applies to the first $132,900 of an individual’s wage income at a rate of 12.4 percent. She would assess a 14.8 percent tax on all wages and net investment income above $250,000 for single filers and $400,000 for married couples.[2]Estimated revenue according to the Warren campaign:$4.04 trillion over a decade.[3]

- Repeal the Tax Cuts and Jobs Act: (TCJA) If elected, Senator Warren says that she would repeal an unspecified portion of the 2017 TCJA that benefited the “wealthiest individuals and giant corporations.” Estimated revenue according to the Warren campaign: $1 trillion over a decade.[4]

- Expand the Estate Tax: Senator Warren proposes lowering the current estate tax exemption from $22 million for a married couple to $7 million.[5]She also proposes raising the tax rate from 40 percent to a progressive schedule with rates ranging between 55 and 70 percent. Estimated revenue according to the Warren campaign: $400 billion over a decade.[6]

- Real Corporate Profits Tax: This new tax would assess a 7 percent surtax on corporations with more than $100 million in global net profits, based on their book income. Estimated revenue according to the Warren campaign: $1 trillion over a decade.[7]

- Lobbying Tax: Senator Warren, if elected, proposes to create a new tax on companies that spend more than $500,000 a year on lobbying, with a maximum tax rate of 75 percent. Estimated revenue according to the Warren campaign: $10 billion over a decade.[8]

Senator Warren’s Medicare for All plan included a number of additional tax increases, which are discussed below.

- Employer Medicare Contribution: Senator Warren would convert current employer health insurance contributions into a quasi-payroll tax, charging companies a flat amount based on the number of employees they have and the amount they spent on previous employee health insurance contributions. Estimated revenue according to the Warren campaign: $8.8 trillion over a decade.[9]

- Wealth Tax Expansion:Within several short months, Senator Warren is already proposing expanding her wealth tax proposal. To help fund Medicare for All, she would raise the wealth tax on billionaires from 3 percent to 6 percent annually. Estimated revenue according to the Warren campaign: $1 trillion over a decade.

- Mark-to-Market:Currently, the United States taxes capital gains when the asset is sold and the gain is realized. Under her Medicare for All proposal, Senator Warren would require individuals to pay taxes annually as the asset appreciates, a so-called “mark-to-market” tax system. Estimated revenue according to the Warren campaign: $2 trillion over a decade.[10]

- Financial Transactions Tax:Senator Warren’s campaign says that she would assess a 0.1 percent tax on each sale of stocks, bonds, and derivatives in the United States. Estimated revenue according to the Warren campaign: $800 billion over a decade.[11]

- Bank Tax:Her financing plan includes a new tax on banks “that encourages them to take on fewer liabilities and reduce the risk they pose to the financial system.”[12]Estimated revenue according to the Warren campaign:$100 billion over a decade.[13]

- Increase in Take-Home Pay:Because employees would no longer need to contribute to their health insurance premiums, their pre-tax deductions from their paycheck will shrink. This would lead to more of their wages being subject to taxation, raising federal revenues. Estimated revenue according to the Warren campaign: $1.4 trillion over a decade.[14]

- Eliminate Accelerated Depreciation:This change would modify how businesses deduct their capital investments from their tax returns, increasing the cost of buying new machines and equipment. Estimated revenue according to the Warren campaign: $1.25 trillion over a decade.[15]

- New Corporate Tax Structure:Senator Warren would raise the corporate income tax rate from 21 percent to 35 percent and dramatically expand taxation of a company’s foreign profits. Estimated revenue according to the Warren campaign: $1.65 trillion over a decade.[16]

All told, these tax increases would raise $26.3 trillion in new revenue for the federal government over a decade. This puts Warren’s tax plan decidedly to the left of fellow presidential candidate and Senator Bernie Sanders (I-VT), whose proposals would hike taxes by “only” $23 trillion.[17]

For comparison, the Congressional Budget Office estimates the federal government is set to collect $23.2 trillion in revenue from the individual income tax from 2020 to 2029, and individual and corporate income tax collections combined are estimated to reach $26.8 trillion. In other words, the total revenue effects of Warren’s proposals would be similar to a plan in which every individual and corporate tax bill was doubled outright. The federal government’s total projected revenue is $45.6 trillion over the same time period. If enacted, these tax increases would expand total federal revenues by 63 percent over a decade—a tax hike so massive that it’s difficult to overstate the negative impacts it would have on the American economy.

Senator Warren also claims that she can increase tax enforcement by the Internal Revenue Service to raise an additional $2.3 trillion in revenue over the next decade, raising the total in new federal revenue to $28.6.

Finally, Senator Warren has made other vague tax increase proposals, such as supporting the elimination of “federal oil and gas subsidies, and closing corporate tax loopholes that promote moving good jobs overseas.”[18]These have not been included as they are too vague to determine the exact policy proposed.

Uncertainty in Revenue Projections

There are reasons to believe that Senator Warren’s tax increases will result in less revenue than she claims. In essence, her proposed tax hikes suffer from overzealous assumptions and sloppy math which doesn’t account for interactions among her own ideas.

Several of the revenue estimates produced for the campaign have been subject to scrutiny questioning her assumptions. For example, her initial wealth tax proposal was estimated to raise $2.75 trillion over a decade by economists Emmanuel Saez and Gabriel Zucman. However, the estimate is likely far too high. Larry Summers and Natasha Sarin estimate it could be as little as 40 percent of Saez and Zucman’s estimate.[19][20]In another instance, an outside estimate of Warren’s Real Corporate Profits Tax said it would raise $872 billion, compared to the $1 trillion projected by her campaign.[21]

Additionally, Warren’s proposals, particularly within her Medicare for All plan, do not account for interactions among the different policies themselves. Strictly adding the conventional scores of each tax increase will overestimate the amount of revenue generated. For example, a new wealth tax would interact with mark-to-market taxation. Over time, the mark-to-market tax would reduce the amount of wealth held by the ultrarich, reducing the amount of revenue collected from the wealth tax. Failing to account for such interactions will create massive budget risks.

In some ways, this is good news for taxpayers. The new tax revenue collected under Senator Warren’s proposals would be less than advertised. While her proposed tax hikes are still unthinkably large, it wouldn’t quite be a full 63 percent increase in the federal revenue baseline. But it means that her spending plans are not even close to fully-funded, putting huge upward pressure on already-high federal deficits.

While the practical results of Warren’s total tax hikes is unknown at this time (one shudders at the thought of a dynamic score that would model their economic impact), $26.3 trillion is the sum of tax increases her campaign has released to the public and thus is worthy of scrutiny on its own terms.

Conclusion

Senator Warren’s solution to virtually every problem is raising taxes on Americans and businesses. Her campaign advertises more than $26 trillion in new taxes over the decade, growing federal revenue collections by 63 percent.

[1]These totals only include policy proposals released by Senator Warren’s presidential campaign, and do not include tax proposals from her Senate career.

[2]Elizabeth Warren, “Expanding Social Security,” September 12, 2019, https://medium.com/@teamwarren/expanding-social-security-4db2f3617ca9.

[3]Mark Zandi, “Evaluating Senator Warren’s Social Security Reform Plan,” Moody’s Analytics, September 2019, https://www.moodysanalytics.com/-/media/article/2019/Warren-Social-Security-Reform.pdf.

[4]Elizabeth Warren, “100% Clean Energy for America,” September 3, 2019, https://medium.com/@teamwarren/100-clean-energy-for-america-de75ee39887d.

[5]Elizabeth Warren, “My Housing Plan for America,” March 16, 2019, https://medium.com/@teamwarren/my-housing-plan-for-america-20038e19dc26.

[6]Mark Zandi, “Addressing the Affordable Housing Crisis,” Moody’s Analytics, September 2018, https://www.economy.com/getlocal?q=867546e8-545c-4f78-b1c5-7fd90908dc6d&app=eccafile.

[7]Emmanuel Saez and Gabriel Zucman, Letter to Senator Warren, April 8, 2019, https://elizabethwarren.com/wp-content/uploads/2019/04/Saez-and-Zucman-Letter-on-Real-Corporate-Profits-Tax-4.10.19-2.pdf.

[8]Elizabeth Warren, “Excessive Lobbying Tax,” October 2, 2019, https://medium.com/@teamwarren/excessive-lobbying-tax-fca7cc86a7e5.

[9]Simon Johnson, Betsey Stevenson, Mark Zandi, Letter to Senator Warren, October 31, 2019. Retrieved from: https://assets.ctfassets.net/4ubxbgy9463z/27ao9rfB6MbQgGmaXK4eGc/d06d5a224665324432c6155199afe0bf/Medicare_for_All_Revenue_Letter___Appendix.pdf.

[10]Simon Johnson, Betsey Stevenson, Mark Zandi, Letter to Senator Warren.

[11]Ibid.

[12]Elizabeth Warren, “Ending the Stranglehold of Health Care Costs on American Families,” November 1, 2019, https://medium.com/@teamwarren/ending-the-stranglehold-of-health-care-costs-on-american-families-bf8286b13086.

[13]Simon Johnson, Betsey Stevenson, Mark Zandi, Letter to Senator Warren.

[14]Ibid.

[15]Ibid.

[16]Ibid.

[17]Brian Riedl, “The Unaffordable Candidate,” October 15, 2019, City Journal, https://www.city-journal.org/bernie-sanders-expensive-spending-proposals

[18]Elizabeth Warren, “My Green Manufacturing Plan for America,” June 4, 2019, https://medium.com/@teamwarren/my-green-manufacturing-plan-for-america-fc0ad53ab614.

[19]Lawrence H. Summers and Natasha Sarin, “A Wealth Tax Presents a Revenue Estimation Puzzle,” The Washington Post, April 4, 2019.

[20]Lawrence H. Summers and Natasha Sarin, “Be Very Skeptical about How Much Revenue Elizabeth Warren’s Wealth Tax Could Generate,” The Washington Post, June 28, 2019.

[21]Kyle Pomerleau, “An Analysis of Senator Warren’s ‘Real Corporate Profits Tax,’” Tax Foundation, April 18, 2019, https://taxfoundation.org/elizabeth-warren-corporate-tax-plan/.