Introduction

President Biden’s budget proposal for FY 2025 includes massive increases in federal taxes and spending totaling $7.3 trillion. But that figure is misleadingly low. The actual projected spending level exceeds $8 trillion — $740 billion more than what is reported as the top-line spending level.

The difference, which shows up regularly in annual budget requests, is attributable to offsetting receipts and user fees for certain government programs. This “hidden spending” is often left out of discussions and media reports about the budget, but greater transparency of the gross spending level is needed to help taxpayers understand the true size and scope of the federal government.

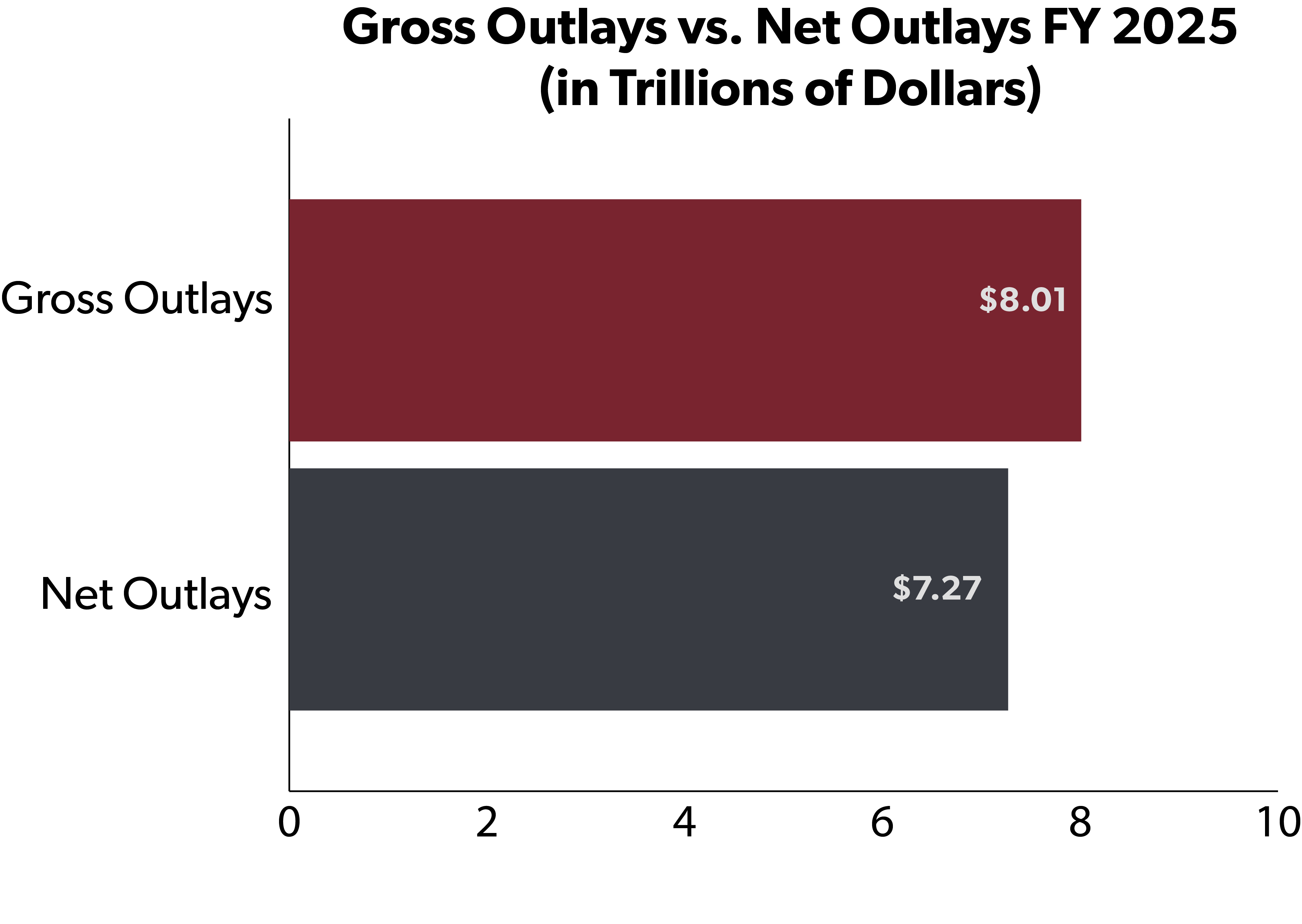

Gross Outlays vs. Net Outlays

Gross outlays refer to total levels of government spending before accounting for any offsetting receipts. These receipts can come from various sources, such as Medicare premiums, admission fees for national parks, payments by the public in exchange for goods or services, Public-Private Partnerships (PPPs), and royalty earnings. These receipts directly offset a portion of total outlays each year. Unlike the payment of taxes, these receipts and collections result from more business-like transactions such as payments for products or services.

Net outlays represent gross outlays minus the aforementioned offsetting receipts, financed entirely by taxes or new debt. The gross outlay totals provide a clearer picture of the true cost of government programs and services, as they reflect the federal government’s full fiscal footprint.

The chart above shows that gross outlays ($8.01 trillion) exceed net outlays ($7.27 trillion) by $740 billion. While this additional spending is theoretically offset, it nevertheless represents government activity that is not represented by the “net outlays” figure that is generally mentioned when discussing the federal budget.

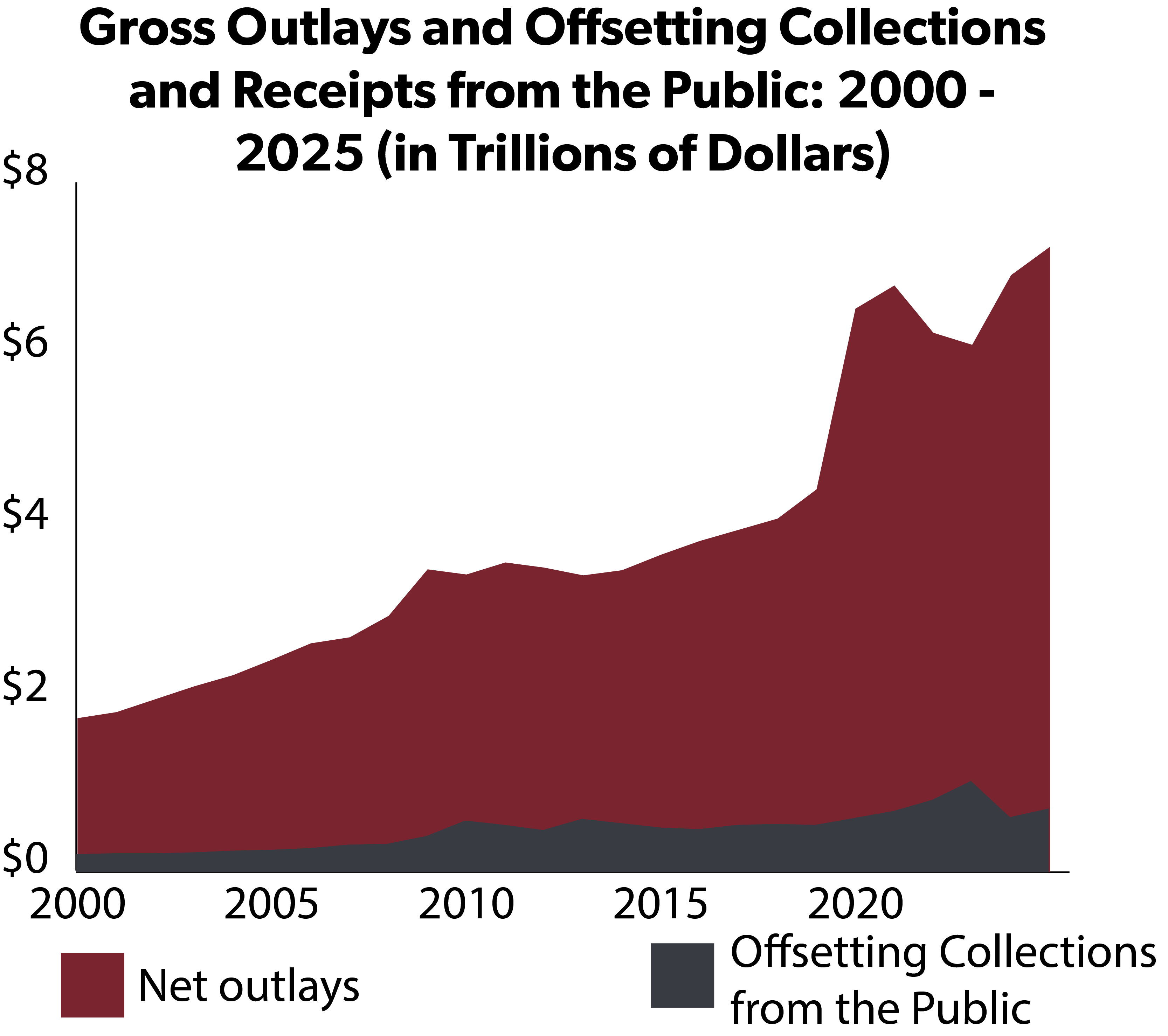

Historical Data

The chart above illustrates the gross level of spending each year since 2000 and the amount offset with collections from the public.The substantial increase in net outlays from $1.79 trillion in 2000 to $6.13 trillion in FY2023 reflects a significant expansion of government spending patterns and fiscal policy over the past two decades. While gross domestic product (GDP) has also increased, growth in government spending has outpaced economic growth — net outlays increased by 242 percent in this time period, whereas GDP only increased by 168 percent.

On average, gross outlays increased by around 6 percent per year between FY 2000 and FY 2023. Comparing the first two complete decades from 2000-2009 to 2010-2019, the average level of gross spending surged by 59 percent, escalating from $2.7 trillion to $4.32 trillion annually. In total, from 2000 through 2023, offsetting collections have masked 12 percent of annual spending.

Looking ahead, the projected totals for FY 2024 and FY 2025 reveal little willingness on the part of Congress to address rampant overspending, with net outlays expected to reach $6.9 trillion and $7.3 trillion respectively. While ultimately spending restraint will have to come from legislators themselves, transparent reporting of government expenditures would help to ensure a comprehensive understanding of how the federal government spends money.

Enhancing Transparency and Accessibility in Budget Reporting

While offsetting collections and receipts are often left out of snapshots of federal spending, these are important in understanding the government's fiscal footprint. The gross spending levels are included within the annual budget release from the White House, but they are not featured in the main volume where the administration states its policy objectives. Instead, they are included deep within the Analytical Perspectives volume which reports on economic and accounting assumptions, and other technical analysis that underlie the budget projections.

Making this data more available and accessible to taxpayers, including detailed account-level reporting of offsetting collections and receipts, can facilitate better budget management practices and promote accountability. Improved transparency in budget reporting is essential for providing lawmakers and taxpayers with accurate information about federal spending. Productive conversations about what an appropriate and sustainable level of federal spending should be must first start with an accurate understanding of what the federal government currently spends.