Introduction

Taxpayers are on the hook for billions in hidden costs, thanks to federal credit programs that mask risks behind inadequate accounting methods. In its August 2024 report, the Congressional Budget Office (CBO) shows that federal credit programs continue to burden taxpayers with tens of billions of dollars worth of inefficient and distortionary subsidies. In FY 2025, total federal credit assistance is projected to amount to $1.9 trillion in new direct loans and loan guarantees from 129 different federal programs. The vast majority of this flows through mortgage guarantee programs and student loans.

When borrowers default and fail to repay these loans or loan guarantees, taxpayers are left to foot the bill. Using the Federal Credit Reform Act (FCRA) approach to measuring costs, the standard accounting method used by the federal government, CBO comes up with a subsidy cost estimate of $2.4 billion. However, under the more realistic fair-value method, which accounts for market risk, the true cost of these programs is closer to $65.2 billion.

The Advantages of Fair-Value Accounting

The FCRA greatly understates the actual costs of federal credit programs by ignoring the market risk arising from shifting macroeconomic conditions. By using interest rates on Treasury securities, the FCRA methodology is based on the faulty assumption that federal credit activities are as low-risk as government bonds, which is a flawed comparison. Treasury rates are low-risk because they’re backed by the government, but federal credit programs depend on people and businesses actually paying back their loans. Using Treasury rates to estimate these costs does not account for the likely outcome that some borrowers won’t repay their loans, which leads to an inaccurate picture of what these programs really cost.

When market risk is taken into account, the cost of these programs skyrockets, as there is a substantial $62.7 billion discrepancy between the two cost estimates. The fair-value method accounts for market risk by incorporating a premium that reflects the additional compensation an investor would require to bear the risk. Housing and real estate loans appear to be the biggest driver of the cost disparity between estimates. If federal credit programs were held to the same standards as private loans in a competitive market, many would hardly be considered worthwhile investments.

CBO’s Review of Credit Programs

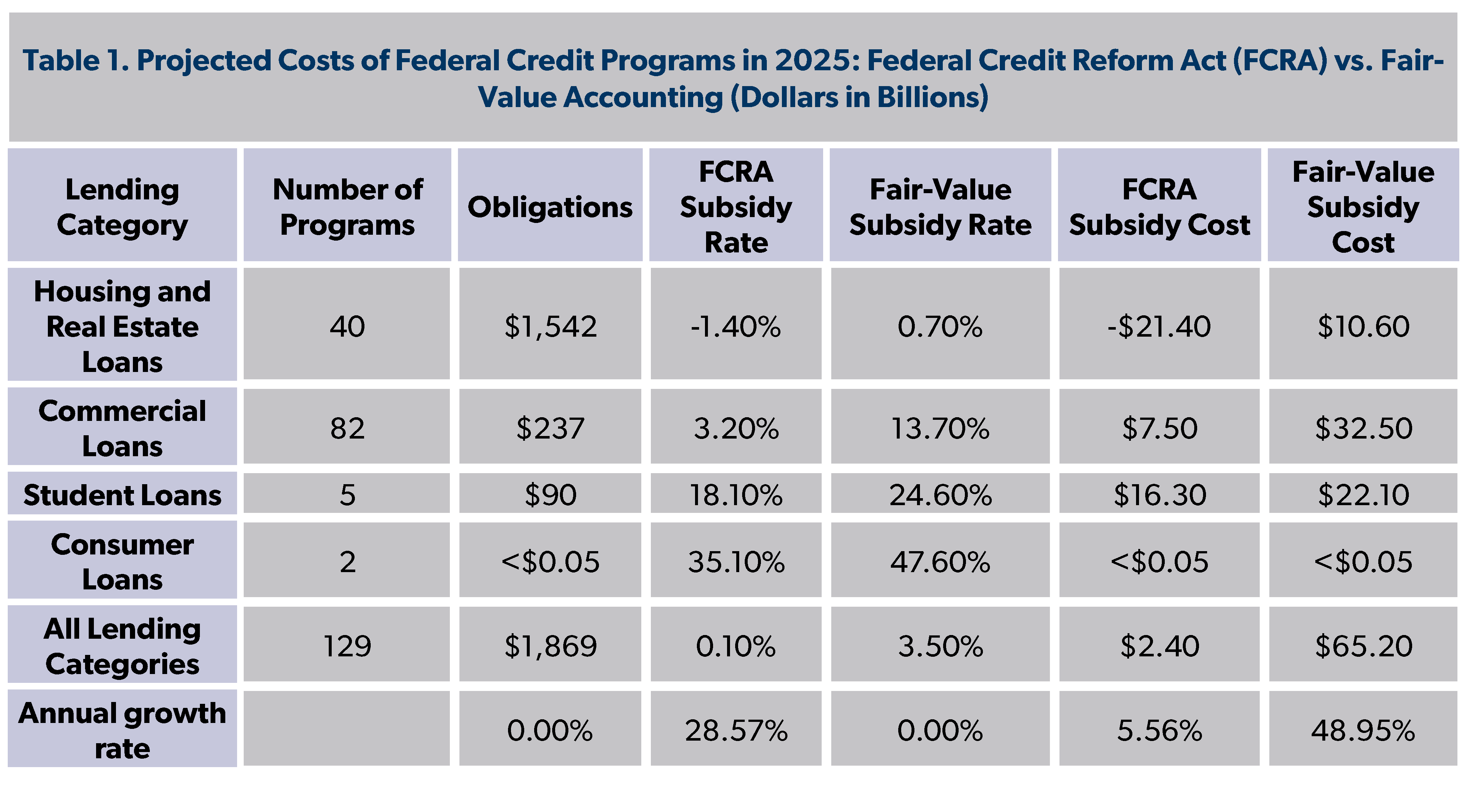

Table 1 shows the number of credit programs by lending category, the total amount of credit obligations projected for 2025, and the subsidy rates and costs under the two accounting methods. The subsidy rate indicates the cost as a percentage of the amount of credit disbursed. The fair-value method shows that subsidy rates for all programs are 3.4 percent higher than estimated by the FCRA. This difference is quite substantial, as exemplified by the cost disparity for housing and real estate programs. While initially estimated to generate $21.4 billion in savings, the more comprehensive fair-value method reveals they actually cost taxpayers $10.6 billion—a $32 billion swing.

Inflation is clearly affecting the costs of these programs. The CBO projects that costs for smaller credit programs grow at the rate of inflation. Thus, it is likely that the higher inflation in the past few years has contributed to the higher costs. In addition to inflation, higher interest rates may affect the costs of the federal government’s array of housing programs, including Fannie Mae and Freddie Mac. Not only are these programs impacted by inflation, but they also have the potential to contribute to it by artificially increasing demand in their respective sectors. For example, expanded federal housing and student loans will increase housing prices and tuition as providers raise prices to keep up with rising demand. Subsequent actions by the government to “forgive” these loans add yet another inflationary layer, reinforcing price hikes while shifting the financial burden directly onto taxpayers.

Trends in Federal Credit Programs

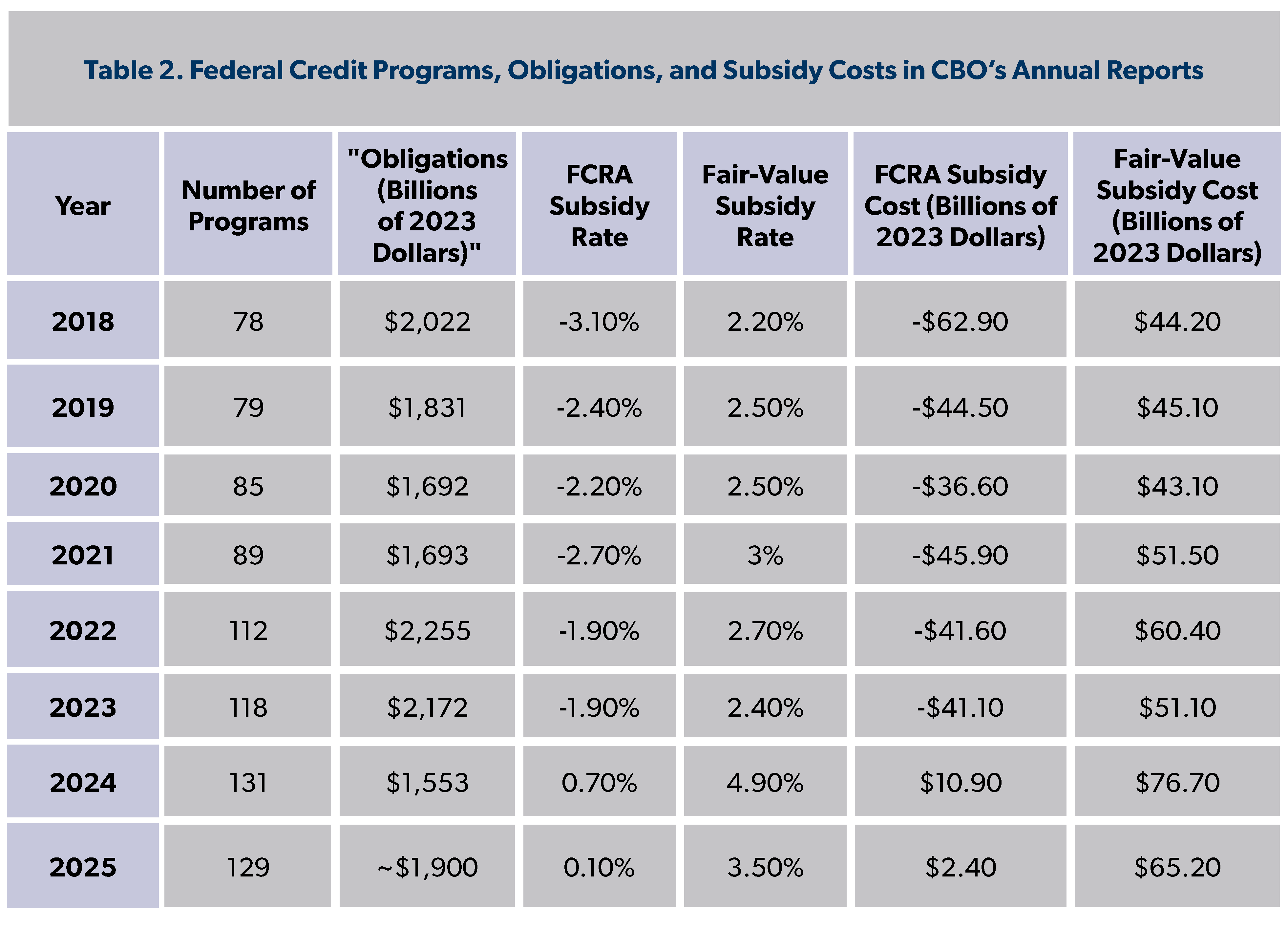

The costs of federal credit programs have not been continually increasing year over year. Table 2 below illustrates that they had declined from last year’s report when the CBO estimated the 2024 cost of credit activities to be $76.7 billion. Nevertheless, the current cost estimate is still substantial and higher than all of the (inflation-adjusted) CBO estimates for 2018 through 2023. CBO counted 129 programs in this year’s report, up from 78 in 2018. Even though projected credit obligations for 2025 are lower than the 2018 level, subsidy costs are significantly higher under both accounting methods.

Provisions of the so-called Inflation Reduction Act have piled on to these costs. For instance, the Act expanded the Department of Energy’s Section 1706 direct loan program, increasing its cost by $1.7 billion due to an increase in proposed credit obligations from $5 billion in 2024 to $29 billion in 2025. Loans made by the Department of Agriculture under the Act are expected to cost $1.1 billion.

Reforms to Protect Taxpayers

Using the fair-value approach to estimate the costs of federal credit programs provides more accurate budgetary data for lawmakers since it accounts for the actual market risks associated with these loans, such as interest rate changes and potential defaults. This transparency is essential for policymakers as they consider legislation, allowing them to make more informed decisions regarding the fiscal impacts of these programs. By better understanding the risks that taxpayers are exposed to, policymakers can ensure the government is using credit wisely and sparingly, reserving it as a last resort when the private sector is unable or unwilling to lend at a favorable rate.

The Fair-Value Accounting and Budget Act (H.R. 5571), introduced by Representatives Ralph Norman (R-SC) and Glenn Grothman (R-WI), aims to require the federal government to use fair-value accounting for its credit programs. This method would ensure a more accurate representation of the costs associated with loans and loan guarantees by adequately accounting for market risks. By mandating this method of accounting, this bill would ensure that policymakers and taxpayers have a clear understanding of the long-term fiscal consequences of these programs, promoting transparency and accountability, as well as better protecting taxpayers from hidden costs.

Conclusion

CBO’s latest report highlights the need for greater accuracy and transparency in accounting for the true costs of federal credit programs. By adopting fair-value accounting standards, lawmakers can better evaluate the fiscal risks associated with these programs. This may help ensure taxpayers are not forced to bear as much of a burden from risky ventures funded by federal loans. Policies like H.R. 5571 and working to ensure the government only remains a lender of last resort would help protect taxpayers from unnecessary liabilities.