TESTIMONY OF

JOE BISHOP-HENCHMAN

EXECUTIVE VICE PRESIDENT

NATIONAL TAXPAYERS UNION FOUNDATION

HEARING ON

PROVIDING SMALL BUSINESS RELIEF FROM REMOTE SALES TAX COLLECTION

BEFORE THE

U.S. SENATE COMMITTEE ON FINANCE,

SUBCOMMITTEE ON FISCAL RESPONSIBILITY AND ECONOMIC GROWTH

SEPTEMBER 25, 2024

Senator Hassan, Senator Grassley, and members of the Subcommittee,

My name is Joe Bishop-Henchman, and I am Executive Vice President of the National Taxpayers Union Foundation (NTUF), where we work for a simple and fair tax system that enables prosperity for all and respects taxpayers’ rights.

I’m pleased to testify today on the important issue of finding solutions for remote sales tax burdens for small businesses engaged in interstate activity. NTUF’s Interstate Commerce Initiative and my colleague Andrew Wilford have authored numerous research reports on this issue, both before the 2018 South Dakota v. Wayfair U.S. Supreme Court decision and since. We submitted written testimony for the Committee’s 2022 hearing where you heard from small businesses who want to comply with America’s 11,000 sales tax jurisdictions but struggle to do so given fragmented administrative apparatus, complexity, and the system’s vulnerability to even one state trying to take advantage of all the others.[1] This is also an issue I have worked on for nearly two decades, including assisting past legislative efforts, involvement with multistate organizations, litigation at the state level, and authoring an amicus brief in Wayfair in support of neither party that was cited twice by the Court majority.[2]

The Problem: Many States Do Sales Tax Collection Right, But Some Are Not

In 2018, the U.S. Supreme Court overruled its prior Quill decision and upheld South Dakota’s law requiring sales tax collection by remote sellers. The Court cited three features of South Dakota’s law as laudable: (1) a safe harbor protecting those who transact limited business in the state; (2) a ban on retroactive collection; and (3) membership in the Streamlined Sales and Use Tax Agreement to reduce administrative and compliance costs while preserving state tax sovereignty, through measures such as “a single, state level tax administration, uniform definitions of products and services, simplified tax rate structures,…access to sales tax administration software paid for by the State [and s]ellers who choose to use such software are immune from audit liability.[3] The Court majority of five justices invited Congress to legislate further, particularly with respect to the impacts on small business.[4] The four other justices declined to join the majority because they thought only Congress should act in this area.[5]

In the six years since, Congress has not acted. In that time, we have seen lots of good news, but also several points of bad news, and some ugly portents of things to come. I am not asking to go back to pre-Wayfair, but rather to ensure small businesses who sell across state lines will not be crushed by compliance burdens from a fragmented and disuniform tax administration.

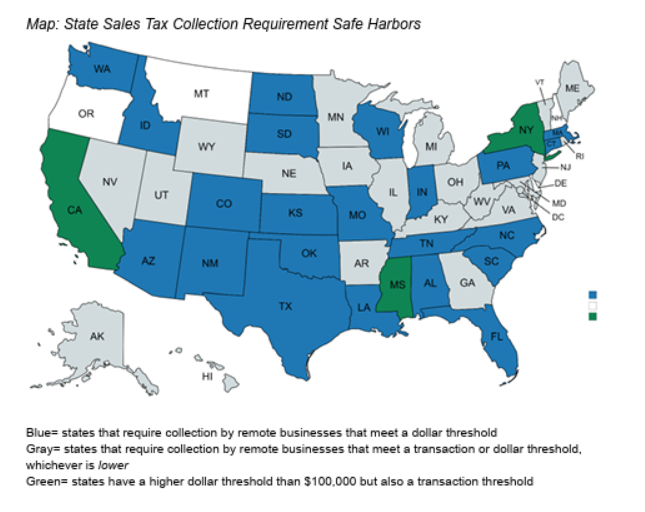

First, the good news: most states have a safe harbor protecting small businesses, and 22 states now have the gold standard of protecting high-volume, low-dollar remote sellers.

- All 46 states with a sales tax have adopted a safe harbor of some kind.[6]

- 21 states have adopted a safe harbor identical to South Dakota’s at the time of the Wayfair decision ($100,000 or 200 transactions): Alaska, Arkansas, Georgia, Hawaii, Illinois, Iowa, Kentucky, Maine, Maryland, Michigan, Minnesota, Nebraska, Nevada, New Jersey, Ohio, Rhode Island, Utah, Vermont, Virginia, West Virginia, Wyoming and District of Columbia.

- 22 states (including South Dakota itself) have dropped the transaction threshold or changed the “or” to an “and,” protecting small businesses that engage in high-volume but low-dollar transactions: Alabama, Arizona, Colorado, Connecticut ($100,000 and 200 transactions), Florida, Idaho, Indiana, Kansas[1] , Louisiana, Massachusetts, Missouri, New Mexico, North Carolina, North Dakota, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Washington, and Wisconsin.

- 5 states have adopted a higher dollar threshold: Alabama ($250,000), California ($500,000), Mississippi ($250,000), New York ($500,000 and 100 sales), and Texas ($500,000).

Blue= states that require collection by remote businesses that meet a dollar threshold

Gray= states that require collection by remote businesses that meet a transaction or dollar threshold, whichever is lower

Green= states have a higher dollar threshold than $100,000 but also a transaction threshold

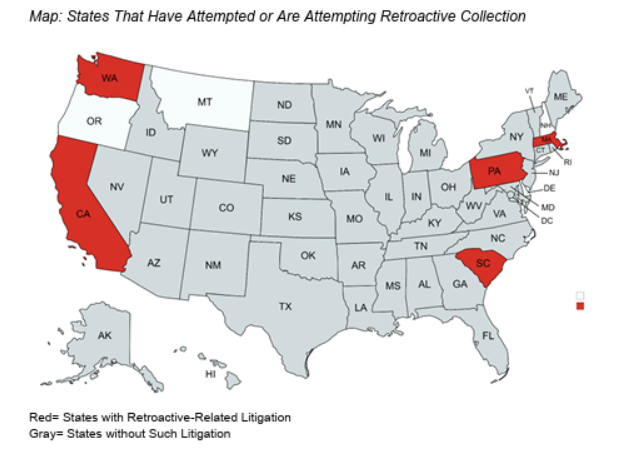

Second, some bad news: while all states have banned retroactive collection in principle, 6 states nevertheless have tried or are trying it. California, Massachusetts, Pennsylvania, South Carolina, and Washington have seen litigation after revenue departments attempted to enforce pre-Wayfair laws and regulations to achieve retroactive collection in practice.[7] Taxpayers generally have prevailed in this litigation, but some lawsuits such as the South Carolina one are ongoing.

Red= States with Retroactive-Related Litigation

Gray= States without Such Litigation

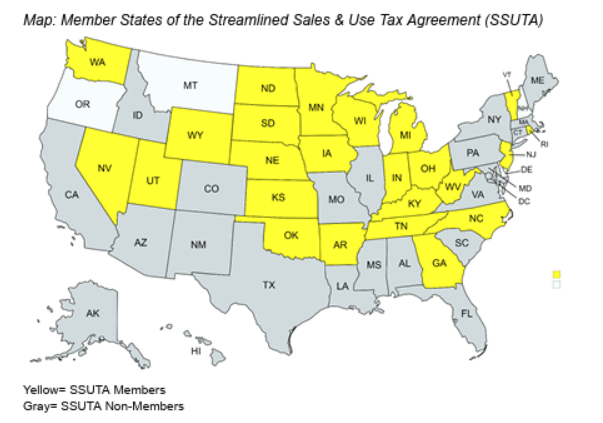

Third, the ugly news: only 24 states are full members of the Streamlined Sales and Use Tax Agreement, and no new states have joined since the Wayfair decision.[8] These are Arkansas, Georgia, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, West Virginia, Wisconsin and Wyoming.

In the other 22 states, remote sellers are required to collect sales tax but without many of the efforts at uniformity, simplification, and standardization remote sellers selling into South Dakota benefit from — efforts that the Supreme Court cited favorably when they upheld South Dakota’s law. Many of these states do not provide access to tax rate lookup software for businesses to use. Many of these states do not adhere to uniform definitions of products. Many of these states do not recognize other states’ exemption certificates. Many of these states do not offer centralized registration and filing for all the jurisdictions within the state, much less for all states.

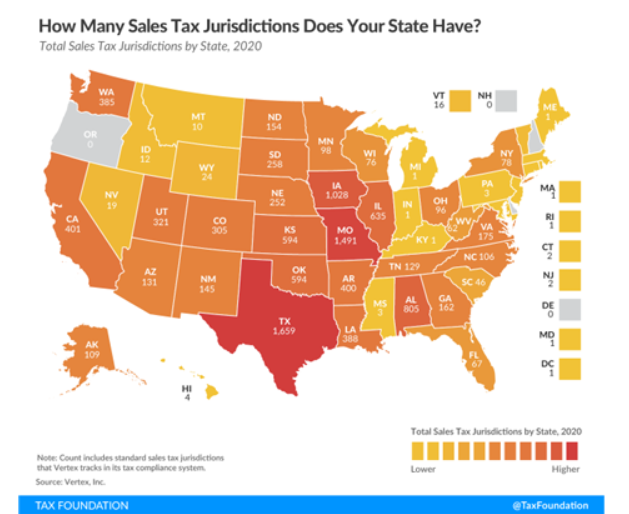

As these maps illustrate, this is not a red state or blue state issue. Every state doing these things differently, or in many cases the same way but with separate and duplicative procedures, is problematic. Sending the same information to 46 different states 46 different ways creates costs, which are magnified in the states (Colorado and Louisiana, especially) where local tax jurisdictions have not been required to align their sales tax administration with the state’s. It is a surmountable burden for those who only sell in one state or for large companies who can spread the cost of compliance over many transactions. But for a small business who wants to sell everywhere, the burden can be a lethal one.

Take Halstead Bead, whom we represented in litigation on this issue against local governments in Louisiana.[9] They sell beads and jewelry components: low-dollar but high-volume, and they want to sell everywhere in America. But for every $1 in state and local sales tax they collect, they spend $2.64 in compliance costs. Once they had 200 sales in Louisiana - even non-taxable wholesale sales - they were required to register with 64 different parishes and file up to 750 tax returns per year. Luckily, our lawsuit spurred Louisiana to reform its system, which is a good thing because Halstead Bead wants to create jobs and sell innovative products, not spend their time and money becoming tax compliance experts. We are preparing additional lawsuits, but it’s not practical to expect litigation by small businesses to fix this problem alone.

As this Committee learned in the 2022 hearing, and as has been noted by the GAO in a series of reports, there is a dark side to not acting on this problem.[10] Small businesses who want to sell into most states but who lack the internal tax compliance departments of large businesses face a choice among three unappealing options:

- Spend more money and time on state and local sales tax compliance and less on investment, job creation, and product development;

- Be bought out by a larger competitor, or sell via marketplaces that charge for the costs of compliance;

- Not comply and risk being caught.

In 2022, we conservatively estimated that nearly 50,000 businesses nationwide are choosing option 3, not complying and risking being caught, mainly from lack of awareness.[11] The GAO noted research that a majority of remote sellers are not complying.[12] The last six years since Wayfair have also been a period of flush state budgets, resulting from economic growth and significant COVID aid from the federal government to state and local governments. States have therefore had little motivation to crack down on non-compliance that may be happening. This may change in the next period of state revenue shortfalls, and then you may suddenly hear from lots of businesses when it may be too late to help them.

Source: https://taxfoundation.org/data/all/state/state-sales-tax-jurisdictions-in-the-us-2020/

The Solution: Federal Legislation Focused on Addressing the Worst Sales Tax Administration Practices that Burden Interstate Commerce for All Businesses

The GAO stated in 2022 that “[f]ederal legislation which puts nationwide parameters in place for state taxation of remote sales could help address the uncertainties and multistate complexities and improve the overall system.”[13] Last year, the GAO again noted the recommendation as one Congress has not acted upon but which could produce benefits for the nation, writing:

Congress should consider working with states to establish nationwide parameters for state taxation of remote sales. Such parameters should balance state interests with the need to address the multistate complexities discussed in this report. The parameters should improve the overall system's alignment with the criteria for a good tax system and help address existing uncertainties regarding what remote sales taxation is legally permissible by states and localities.[14]

I agree. I am pleased that the Streamlined Sales and Use Tax Agreement is represented at today’s hearing. SSUTA has received its share of criticism but works hard to create a framework for uniformity and standardization that eases compliance burdens while respecting state tax sovereignty. All states should join it.

Alternatively, states who do not wish to join SSUTA could demonstrate that they have taken steps to reduce compliance costs for their sales tax administration. For example, Texas is not an SSUTA member but has adopted an innovative law that allows sellers to collect either all of the over 1,600 local sales taxes or one single rate that is the average of all the local tax sales jurisdictions in the state. A seller need only register with the state, which receives the money and remits it to the local authorities. States embarking on this alternative could clarify their rules for uniform definitions, sourcing, exemption certificates, safe harbors for new or modified taxes, free compliance software, and audits.

Congressional legislation can also build on where most states are ending up, such as with dropping transaction thresholds from their safe harbors, prohibiting retroactive collection, and aligning local sales tax rules with state sales tax rules. The few states that have broken from the pack on these common-sense measures can inflict enormous damage on the national economy by imposing outsized compliance costs.

Congress could also change federal laws that restrict the ability of taxpayers to challenge state tax laws for violating the Constitution.[15]

As my colleagues Andrew Wilford and Tyler Martinez wrote in 2022:

The Founders designed the Constitution to protect interstate commerce, and Congress has the lead role in that defense. Keeping trade within the country free of barriers was a central purpose of the Constitutional Convention, and achieving this goal was the intended purpose of the Constitution empowering Congress to regulate interstate commerce.[...]

Because remote sellers cannot vote in every state they do business in, and given the tendency of states to export tax burdens and import tax revenues, only federal protection can discourage unfair taxation and excessive regulation of their trade. It is otherwise tempting to outlay taxes on those who have no vote or invent regulations that affect industries in other states. In other words, when taxpayers face taxation and regulation in states that they lack representation in, their elected representatives in the federal government must act to protect them from excessive burdens.

Like any other business, remote sellers should pay what is due. Most are eager to do so, if the compliance burdens can be eased to make it feasible. Congress has a role in assuring in-state and out-of-state businesses are treated fairly. Doing so keeps America’s economy strong, as the Founders intended.[16]

The pre-Wayfair legal and policy situation was not fair to brick-and-mortar businesses and to states. But we should make sure the pendulum doesn’t swing so far the other way that it rewards bad state sales tax administration policies that disrupt interstate commerce for all businesses. The goal should not be a leg up for remote sellers but a simpler, easier sales tax apparatus for all. NTUF stands ready to be a constructive voice in that effort.

Thank you for the opportunity to testify today.

[1] Joe Bishop-Henchman, Tyler Martinez, Andrew Wilford, & Andrew Lautz, “Reforms Congress Must Consider 4 Years After Wayfair Ruling,” Testimony to the U.S. Senate Finance Committee, Jun. 14, 2022, https://www.ntu.org/foundation/detail/reforms-congress-must-consider-4-years-after-wayfair-ruling.

[2] South Dakota v. Wayfair, Inc., 585 U.S. 162, 185-86 (2018) (citing brief of Tax Foundation). See also Joseph Bishop-Henchman, “The History of Internet Sales Taxes from 1789 to the Present Day: South Dakota v. Wayfair, 2018 Cato Supreme Court Review 269 (2018).

[3] Id. at 188-89.

[4] Id. at 186-87 (“Respondents argue that ‘the physical presence rule has permitted start-ups and small businesses to use the Internet as a means to grow their companies and access a national market, without exposing them to the daunting complexity and business-development obstacles of nationwide sales tax collection.’ These burdens may pose legitimate concerns in some instances, particularly for small businesses that make a small volume of sales to customers in many States. [...]And in all events, Congress may legislate to address these problems if it deems it necessary and fit to do so.”) (citations omitted).

[5] See, e.g., id. at 191 (Robetts, C.J., dissenting) (“Any alteration to those rules with the potential to disrupt the development of such a critical segment of the economy should be undertaken by Congress.”).

[6] Delaware, Montana, New Hampshire, and Oregon have no sales tax. Alaska has no statewide sales tax but many localities impose a sales tax, so it is included with other states here.

[7] See, e.g., Andrew Wilford, “Backdoor Retroactivity: How California Finds Itself in Court Over a Dubious Tax Grab,” NTUF Issue Brief, Oct. 6, 2020, https://www.ntu.org/foundation/detail/backdoor-retroactivity-how-california-finds-itself-in-court-over-a-dubious-tax-grab; Gail Cole, “Sales tax disputes continue as Wayfair ruling turns 6,” Avalara, Jun. 20, 2024, https://www.avalara.com/blog/en/north-america/2024/06/sales-tax-disputes-continue-six-years-after-wayfair.html; Grant Thornton, “South Carolina: Pre-Wayfair sales taxes must be collected,” Feb. 16, 2024, https://www.grantthornton.com/insights/alerts/tax/2024/salt/p-t/south-carolina-pre-wayfair-sales-taxes-must-be-collected-02-16; PWC, “Massachusetts Supreme Court rejects retroactive Wayfair application,” Jan. 2023, https://www.pwc.com/us/en/services/tax/library/massachusetts-s-ct-rejects-retroactive-wayfair-application.html.

[8] Tennessee was an associate member of SSUTA prior to Wayfair, and became a full member after.

[9] See NTUF, “Halstead Bead v. Lewis and NTUF’s Work Simplifying Louisiana’s Sales Tax System,” https://www.ntu.org/publications/page/halstead-bead-v-lewis.

[10] See Government Accountability Office, “Sales Taxes: States Could Gain Revenue from Expanded Authority, but Businesses Are Likely to Experience Compliance Costs,” GAO-18-114, Nov. 16, 2017, https://www.gao.gov/products/gao-18-114; Government Accountability Office, “Remote Sales Tax: Initial Observations on Effects of States' Expanded Authority,” GAO-22-106016, Jun. 14, 2022, https://www.gao.gov/products/gao-22-106016; Government Accountability Office, “Remote Sales Tax:

Federal Legislation Could Resolve Some Uncertainties and Improve Overall System,” GAO-23-105359, Nov. 14, 2022, https://www.gao.gov/products/gao-23-105359.

[11] Andrew Wilford, “Nearly 50,000 Remote Businesses Out of Compliance With Wayfair,” NTUF Issue Brief, Nov. 16, 2022, https://www.ntu.org/foundation/detail/nearly-50000-remote-businesses-out-of-compliance-with-wayfair.

[12] Government Accountability Office, “Remote Sales Tax:

Federal Legislation Could Resolve Some Uncertainties and Improve Overall System,” at 20, GAO-23-105359, Nov. 14, 2022, https://www.gao.gov/products/gao-23-105359.

[13] Id. at Highlights page.

[14] Government Accountability Office, “Open Matters for Congressional Consideration: Action Can Produce Billions of Dollars in Financial and Other Benefits for the Nation” at 62, GAO-23-106837, Jul. 25, 2023, https://www.gao.gov/products/gao-23-106837.

[15] See Tyler Martinez, “Give Taxpayers Access to Federal Courts,” Aug. 7, 2023, https://www.ntu.org/foundation/detail/give-taxpayers-access-to-federal-courts (describing amendments to the Anti-Injunction Act, Declaratory Judgment Act, and Tax Injunction Act to prohibit only temporary or preliminary injunctions); Samuel D. Brunson, “Watching the Watchers: Preventing I.R.S. Abuse of the Tax System,” 14 Fla. Tax Rev. 223, 268 (2013) (advocating that Congress allow taxpayer standing by “groups, across the political spectrum, that are interested in the proper administration of the tax law…, with knowledge of and interest in the tax law….”).

[16] Andrew Wilford & Tyler Martinez, “Federalism Concerns Should Be No Bar to Relief For Small Online Sellers,” NTUF Issue Brief, Sep. 16, 2022, https://www.ntu.org/foundation/detail/federalism-concerns-should-be-no-bar-to-relief-for-small-online-sellers.