View PDF

Introduction

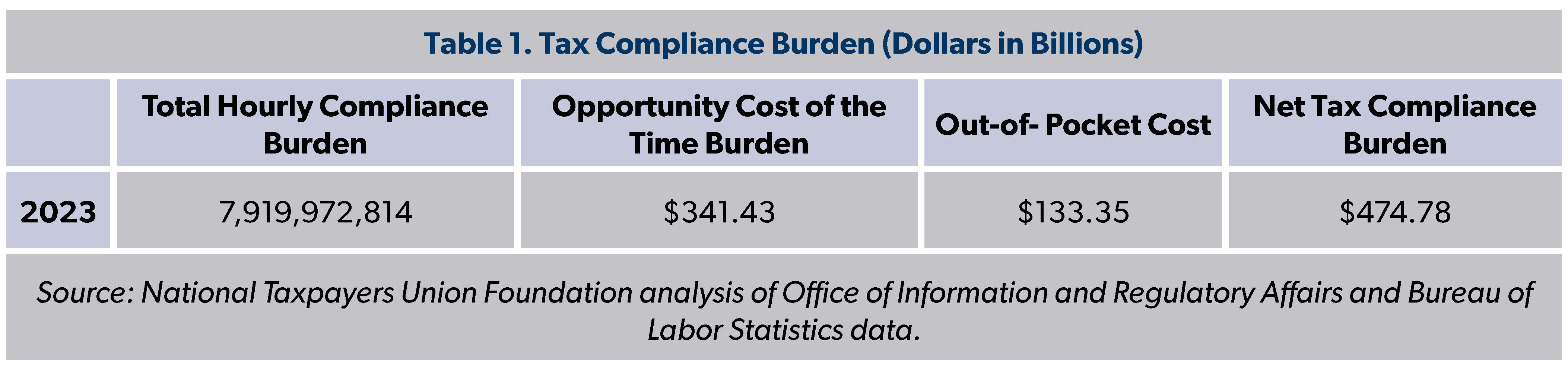

In advance of Tax Day earlier this year, NTUF reported that Americans collectively spent 6.5 billion hours laboring over their taxes—an opportunity cost of $280 billion based on private sector wages—and incurred out-of-pocket preparation and filing expenses of $133 billion.

However, we underreported the tax compliance burden: Americans actually spent over 7.9 billion hours. This higher figure emerged from a last-minute revision by the Internal Revenue Service (IRS) just before Tax Day, which came after we had already completed our report for the filing season.

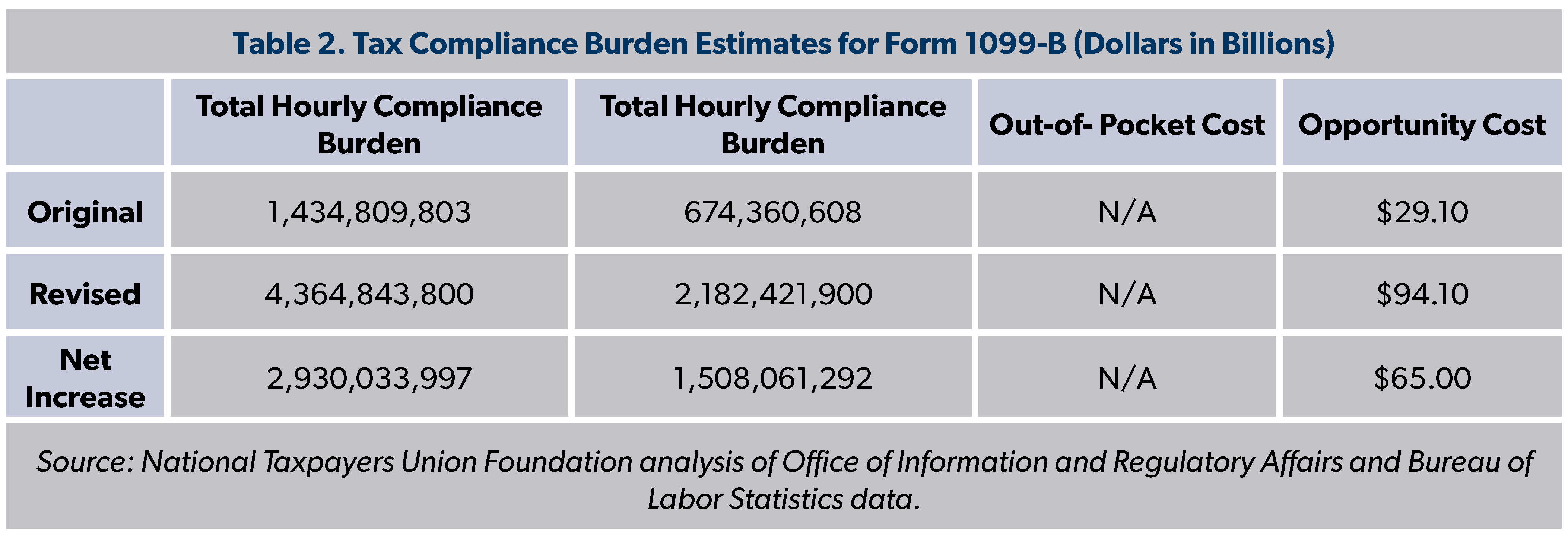

The revisions affected more than a dozen forms, with the update to the 1099-B Form accounting for the bulk of the change. The IRS now projects that it will receive 4.36 billion responses to this form, imposing a time burden of 2.18 billion hours—both figures being three times higher than previous estimates.

Tracking Paperwork Burdens

Under the Paperwork Reduction Act, all federal agencies are required to report the time and financial burden imposed on the public to comply with forms. This includes accounting for the time and expenses associated with activities such as reading and understanding the forms and instructions, gathering and retrieving the necessary information, seeking assistance, and completing, reviewing, and submitting the response. Agencies submit these calculations and supporting statements to the Office of Information and Regulatory Affairs (OIRA), which maintains a public database of all such filings.

With its extensive array of tax forms, the IRS typically accounts for nearly two-thirds of the government-wide 11.9-billion-hour paperwork burden imposed on the public. This represents valuable time that could have been spent on other activities. NTUF assesses the value of this time based on private sector labor costs. According to the Bureau of Labor Statistics (BLS), U.S. non-federal civilian employers spent an average of $43.11 per hour worked by their employees in 2023. Along with the out-of-pocket expenses, NTUF calculated the compliance burden of the 2024 tax filing season cost 6.5 billion hours and $413.66 billion. However, the actual burden turned out to be 1.4 billion hours and $61 billion higher.

What Led to the Higher Burden?

On April 11, the IRS reported revisions to OIRA for 16 different forms, with the most significant change being reported to the dreaded Form 1099-B: Proceeds from Broker and Barter Exchange Transactions. As NTUF noted in our tax complexity report, this form, which brokers use to report capital gains and losses, has long been listed as the worst tax form by tax preparers. As the Wall Street Journal reported in 2016, “Tax preparers say the 1099-B is worse than other vexing forms, such as those for partnership income and foreign income, because far more people have brokerage accounts.”

The IRS’s recent change projected an additional 2.9 billion responses to Form 1099-B, resulting in a time burden spike of 1.5 billion hours. This adjustment partly stemmed from a methodological change in how the IRS estimates filings, which increased the number of responses by 100 million. The majority of the change was driven by Section 80603 of the Infrastructure Investment and Jobs Act, which requires brokers to report digital assets. This section also expanded the definition of “broker” to include individuals or entities responsible for transfers of digital assets on behalf of another person.”

The IRS Still Fails to Properly Account for Missing Out-of-Pocket Estimates

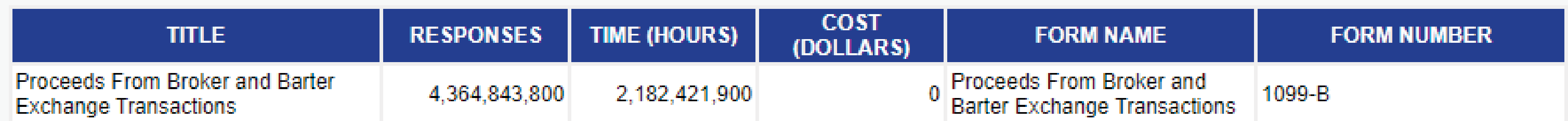

Despite its new methodology used, the IRS still fails to calculate the out-of-pocket costs associated with this burdensome form. OIRA’s database lists that the out-of-pocket cost for the 1099-B is $0, see the screenshot below, however this is misleading.

The IRS’s Supporting Statement for this Form notes, “This information collection will be included in the consolidated OMB submission for information returns currently being developed. IRS is working on the methodology for evaluating information return burden and cost; and will update the cost and burden estimates as part of the consolidation.”

Similar language is included in other Supporting Statements for many other forms that are missing a dollar burden estimate. For situations such as these, the public would be better served if the information on OIRA’s paperwork burden database specifies that a cost is indeterminate instead of listing it as $0.

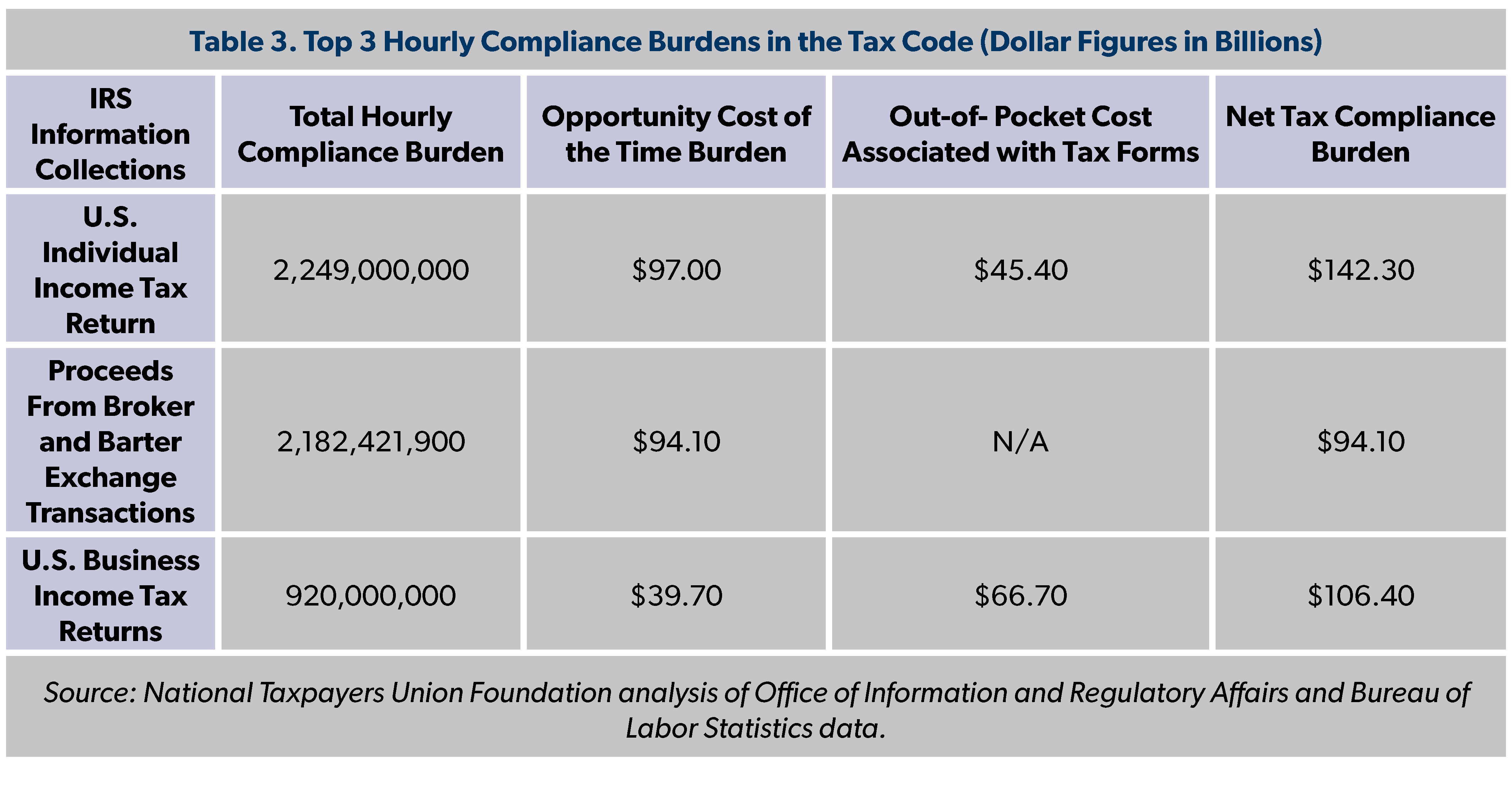

Form 1099-B Overtakes Second Place Among Tax Forms for Highest Time Burdens

Before the revision, Form 1099-B imposed the third highest hourly compliance burden, but it has now leapfrogged over the total time spent on Business Income Tax Returns and is in a close second place to the Individual Income Tax set of forms.

Compliance Burdens Could Get Worse with New Regulations and a New Form

The IRS has released a draft for a new Form 1099-DA for brokers dealing with digital assets. NTUF’s Taxpayer Defense Center (TDC) reports that form, rooted in outdated early 20th-century securities reporting requirements, presents numerous problems that could harm taxpayers and stifle the digital asset market. We filed a comment urging the IRS to reconsider the form and its approach to digital asset taxation.

As the IRS rolls out this new form for digital assets and cryptocurrency, the compliance burden could be as much as four times higher than the revised estimate for Form 1099-B. Last fall, the IRS director for digital assets said that the agency could collect up to 8 billion information returns pursuant to cryptocurrency taxation. As NTUF’s Lindsey Carpenter cautioned:

The IRS also grossly understates the time and money that will be required to comply with the proposed 1099-DA form’s reporting requirement. Aside from the fact the IRS tries to apply outdated rules to the digital asset sector, the cryptocurrency industry needs time to develop the infrastructure and professional expertise necessary to comply. Moreover, the IRS itself is not ready to handle this proposed taxation scheme.

The Tax Compliance Trend

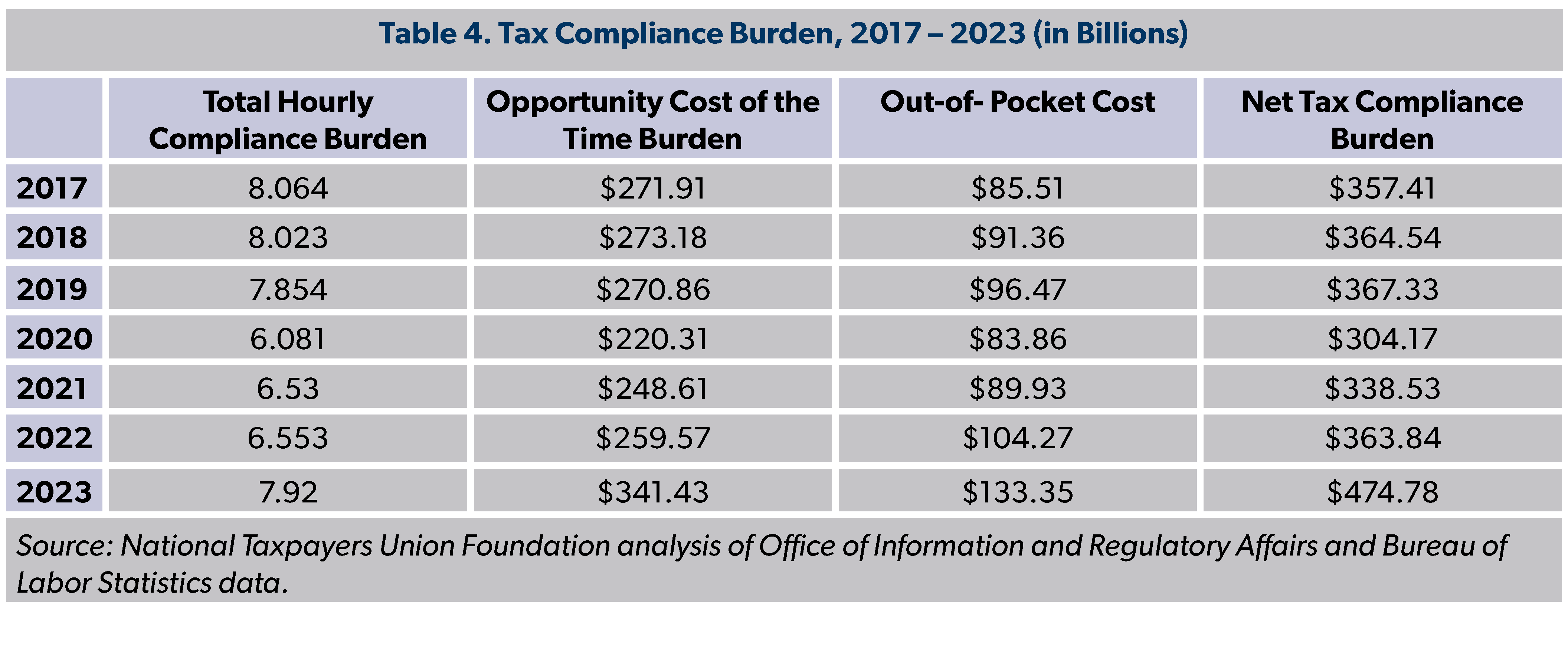

NTUF has tracked that, after 2017, the compliance burden decreased over a number of years. As we have written in our previous analyses, this was a result of changes implemented in the 2017 Tax Cuts and Jobs Act that simplified filing burdens for many (while at the same time increasing the progressivity of income taxes) and also methodological changes made by the IRS after it realized it was overestimating the time spent complying with the Business Income Tax.

The compliance burden began to creep back up starting in 2021. What had initially looked like a moderate increase for 2023 has now become a significant spike, reaching the highest hourly burden since 2018. The opportunity cost for the revised hours, along with the out-of-pocket costs, which are higher due to inflation, now peg the total compliance burden at $475 billion.

Conclusion

The rising complexity and burden of tax compliance in recent years highlight the urgent need for reform. While previous measures like the 2017 Tax Cuts and Jobs Act succeeded in reducing the burden on taxpayers, recent spikes indicate that more comprehensive solutions are necessary. The sharp increase in compliance costs, exacerbated by inflation and the growing complexity of tax forms like the 1099-B and the proposed 1099-DA, underscores the inefficiencies within the current system.

Simplifying tax compliance should remain a priority for policymakers, as the opportunity costs and financial burdens currently imposed on taxpayers divert valuable time and resources away from more productive endeavors.

Next year, Congress will have an opportunity to protect taxpayers from large tax hikes before the expiration of many provisions of the Tax Cuts and Jobs Act. Lawmakers will also have an opportunity to simplify the tax code through policies that make it easier to understand and comply with the tax laws while at the same time not imposing millions in costs on taxpayers through legally-dubious projects such as Direct File that have distracted the IRS from following through on so many top priorities. By seizing these opportunities, Congress can ensure a more transparent, efficient, and taxpayer-friendly system that truly serves the needs of all Americans.