Introduction

Taxpayers often seek clarity from the Internal Revenue Service (IRS) on complex tax matters. These inquiries not only help individuals or businesses navigate their own filings, but also highlight for IRS officials the areas of the tax code that are particularly difficult to understand. However, over the past decade, the IRS has doubled the fees on requests for Private Letter Ruling (PLRs) which could be deterring taxpayers from seeking pre-filing tax guidance.

A recent Law360 article reported that the IRS Associate Chief Counsel reviews the PLR fees every two years and adjusts them based on a cost analysis. An IRS official noted that it seemed that there are fewer taxpayers requesting PLRs, but no formal analysis had been conducted.

NTUF’s own analysis of IRS data shows that, as these fees have risen, fewer requests for rulings are being filed, which suggests that higher costs are discouraging taxpayers from seeking the certainty that these rulings provide. This increases the likelihood that taxpayers end up in court to resolve tax disputes with the IRS over interpretations of tax laws and regulations.

Private Letter Rulings and Higher User Fees

A PLR is a written statement issued by the IRS that interprets and applies tax laws to a taxpayer’s specific set of facts regarding proposed or completed transactions. PLRs help clarify uncertain aspects of tax law and provide legally-binding assurance from the IRS for the taxpayer who requested the ruling, enhancing taxpayer compliance and minimizing potential disputes. PLRs are eventually made public after removing information that may identify the taxpayer who requested the information, and these are not to be cited as precedent by other taxpayers because they were drafted in response to the facts of a particular case.

A PLR is typically sought when a taxpayer wishes to confirm that a prospective transaction is unlikely to result in a tax violation. The request may be filed either before initiating the transaction, or before filing to seek guidance on the tax consequences. To obtain a PLR, the taxpayer must submit a written request to the IRS and pay a fee. However, the costs associated with this procedure and the user fees for obtaining a PLR have been increasing annually. Information on fees for PLRs is published on the IRS website under Rev. Proc. Appendix A: Schedule of User Fees in the Internal Revenue Bulletin.

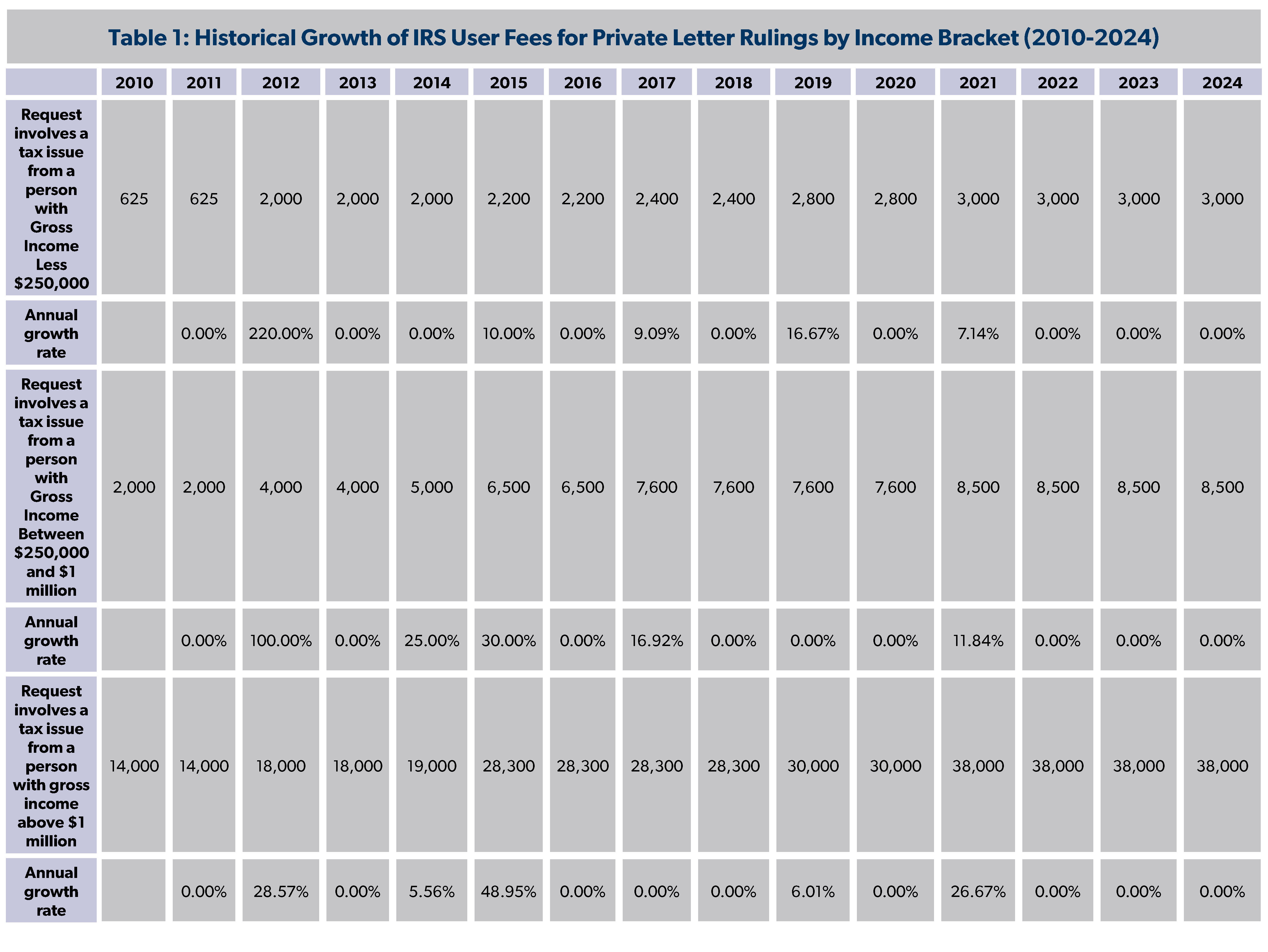

The IRS reevaluates the fees for PLRs approximately every two years to determine if adjustments are necessary. Table 1 illustrates the annual fees and fee growth rates for PLRs from 2010 to 2024. Over this 15-year period, there have been six instances of fee increases: in 2012, 2014, 2015, 2017, 2019, and 2021. Notably, from 2022 to 2024, the fees for PLRs have remained unchanged.

Requests for Private Letter Rulings are Trending Downward

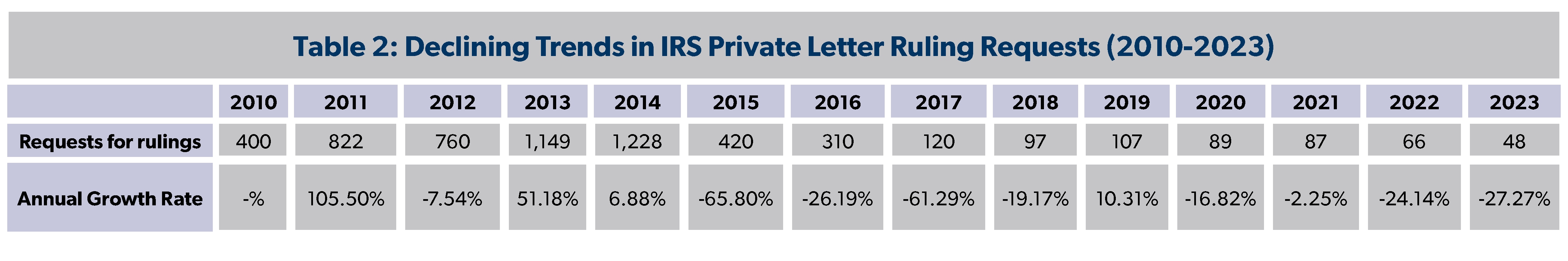

The IRS publishes an annual data book that details its activities for each fiscal year. Table 16 of this data book includes a chart representing the Technical Activities and Voluntary Compliance Closures for the IRS. The chart below compiles the total requests of private letter rulings from 2010 to 2023, taken directly from Table 16. The last row shows the growth rate each year for the request for rulings compared to the previous year. Notably, a closer examination of the requests for rulings reveals a decline in the total number over this period.

Between 2010 and 2014, requests for rulings increased at an annual average rate of 39 percent, peaking at 105.5 percent growth between 2010 and 2011. However, a decline began in 2015, with requests dropping by 65.8 percent compared to the previous year. From 2015 to 2023, there was an average annual decrease of 25.85 percent. Notably, there was a small uptick between 2018 and 2019, when requests rose from 97 to 107—a 10.31 percent increase amid an overall downward trend. The most significant decline occurred in 2015, when requests plummeted from 1,228 in 2014 to 420.

Exorbitant Fees May Be Deterring Requests for Guidance

This raises the question: Is there a correlation between the decline in taxpayer requests for private letter rulings and the increase in annual filing fees? The rising cost of filing may be disincentivizing taxpayers from utilizing these resources provided by the IRS.

In 2012, the fees for PLR filing increased for all income brackets, leading to a 7.54 percent decrease in requests for rulings. Three years later, after another fee increase for all income brackets, the requests for filings dropped significantly by 65.80 percent in 2015. Following a reevaluation by the IRS in 2017, fees were increased again across all income brackets, resulting in a 61.29 percent decrease in requests for rulings. Finally, in 2021, the continuation of this trend led to a 2.25 percent decrease in requests.

Unsurprisingly, every time the IRS increases fees for all income brackets, the requests for PLRs drop. Although the increase in fees doesn’t tell the full story of the drastic decline for PLR requests in the last 15 years, it does provide a piece of the puzzle. There appears to be a negative correlation between fee increases and the number of requests for rulings. In most years where fees increased, the number of requests for rulings decreased. This trend suggests that higher fees may be discouraging individuals and entities from seeking PLRs.

In a Law360 article, Stephen K. Cooper raises concerns that these higher fees make it harder for the less affluent to get tax justice, noting the disparate impact on small businesses as a result of these higher PLR fees. Certified Public Accountant Glenn Frost told Law360 that his clients seek clarity, but find the fees prohibitive. “There are less dollars in dispute so when cost and fees are raised, it certainly is detrimental to our client base.” He also noted that attorneys in his firm have seen PLRs requested in the areas of individual retirement accounts and retirement contributions, as well as other issues “where the law and the regulations aren’t entirely clear.”

The Taxpayer Advocate Service (TAS), which serves as an ombudsman for taxpayers within the IRS, has also been vocal about its concerns over higher PLR fees. In a blog post updated in February 2024, TAS warned of a violation of the Taxpayer Bill of Rights. A fee could undermine the entitlement to a just and equitable tax system, TAS noted. Some groups recommend that, for taxpayers with lower incomes, the IRS should adjust the fees for inflation. Another suggestion is to eliminate the fees for those whose income is below 250 percent of the poverty line. These suggestions and recommendations could help make PLRs more accessible and affordable for taxpayers.

In the current Congress, Senator Marsha Blackburn (R-TN) introduced legislation (S. 232) to cap IRS user fees, including PLR fees, at $1,900 for individual taxpayers earning less than $5 million annually. This proposal aims to alleviate the financial burden on taxpayers who may find current fees prohibitive and encourage more taxpayers to seek pre-filing guidance, which could improve voluntary compliance and reduce costly tax disputes.

Higher User Fees Hurt Taxpayers

It’s not just PLRs that are seeing higher user fees. Recently the IRS announced that, effective October 1, the fee it charges for the Income Verification Express Service (IVES) would double. IVES is widely used in a variety of financial contexts, especially for determining borrower qualifications for loans. As a recent post from the National Taxpayers Union noted, this charge is small (rising from $2 to $4), but it raises questions over other policies in the Biden Administration aimed at attacking so-called “junk fees”:

Before readers scoff at a $2 difference, this is precisely the methodology that CFPB [the Consumer Financial Protection Bureau] was using to describe what it apparently believed were alarming increases in certain private-sector fees associated with loan closing, among them charges for credit score reports. CFPB noted anecdotal accounts claiming that such reports had jumped in price by 25 to 400 percent, burying the fact that the actual difference in cost amounted to about $30 to $60.

Perhaps CFPB Director Chopra owes IRS Commissioner Werfel a call. Until more of that sort of communication occurs, the government’s diversion tactics will persist over what’s really behind so many of the fee burdens about which consumers are supposedly complaining.

In January, the IRS published an updated schedule of its 24 user fees effective starting February 2.1 The IRS increased the fees charged for 7 services, representing 30 percent of the total. Four services, including different kinds of advance pricing agreements, saw an average increase of 7 percent. The fee for requesting filing extensions for Form 3115, Application for Change in Accounting Method, was raised by 9 percent. More substantial hikes include a 40 percent increase in the fee for requesting competent authority assistance under tax treaties, bringing it to $51,900, and a 50 percent increase in the fee for a Foreign Insurance Excise Tax Waiver Agreement, which now costs $12,000.

In response to an inquiry from NTUF in 2016 about higher fees that the IRS was seeking to impose at the time, Taxpayer Advocate Nina Olson commented:

Some of the user fees will very likely deter taxpayers from becoming compliant, simply by sending the clear message that you can’t get relief unless you pay something. Most of them raise the question: What are the core functions of tax administration? If the IRS’s job is to help taxpayers voluntarily comply with the laws, it seems to me it shouldn’t be charging a fee when it’s doing its core job.

Conclusion

By providing taxpayers with guidance through Private Letter Rulings, the IRS gains insight into areas of the tax code that may need clarification, potentially leading to more streamlined regulations. Raising fees for PLRs could discourage taxpayers from seeking this crucial guidance, which would not only increase the likelihood of disputes ending up in court, but also burden both taxpayers and the IRS with unnecessary administrative and legal challenges. Reducing these fees could help prevent drawn-out court cases, saving time and resources for taxpayers as well as the IRS.

1 This count excludes the $0 fee listed for “information letter requests.”