Between 2020 and 2023, St. Louis required nonresident taxpayers to pay the city’s 1 percent earnings tax on income earned while working for St. Louis-based employers, despite lacking the legal basis to do so. Pursuant to a settlement agreement, taxpayers have three months, between July 1, 2024, and September 30, 2024, to claim a refund on earnings taxes paid to St. Louis if their work was performed outside of the city.

After the first week of eligibility for refund claims, the Collector of Revenue’s office claimed that just 113 refund applications have been submitted, in addition to 2,100 refund applications received by the city prior to the settlement agreement. Analysis by the state of Missouri’s legislative research arm suggests that well over 100,000 taxpayers are eligible.

Taxpayers are eligible if:

- One or more working days was spent working entirely outside of St. Louis city limits between the years 2020 and 2023

- The work was done for a St. Louis-based employer

- St. Louis earnings tax was paid to the city of St. Louis

Filing a return is quick and easy. Any eligible taxpayers should file, as they are entitled to up to four years’ worth of earnings taxes, as well as interest.

The Process of Filing a Refund Claim

To file a refund claim, download the E-1R form on the Collector of Revenue’s website. This form can be filled out with Adobe Reader or printed and filled out by hand. One form must be filed for each year you are claiming a refund. That means that if you are filing refund claims for 2020 through 2023, you should fill out and submit four separate E-1R forms. Fortunately, Form E1-R is easy to fill out quickly.

Remember that refund claims for the years 2020-2022 must be submitted by September 30, 2024 to be valid under the terms of the settlement agreement! Refund claims for 2023 can be submitted by April 15, 2024.

(View a sample E-1R-Form - Partial Year Nonresident)

(View a sample E-1R-Form - Full Year Nonresident)

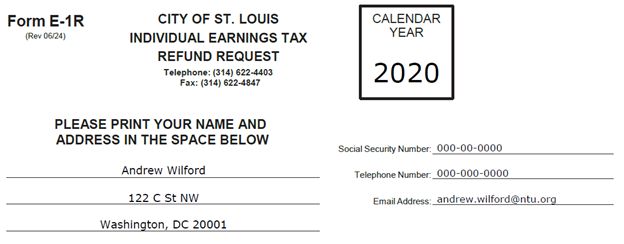

First, fill out the sections including your name, mailing address, social security number, telephone number, and email address. The calendar year at the top should represent the year you are filing for, not the current year. For instance:

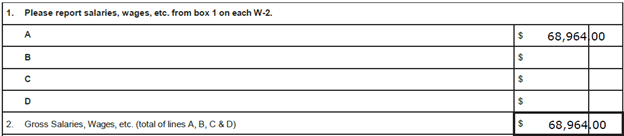

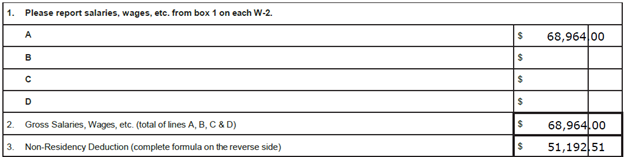

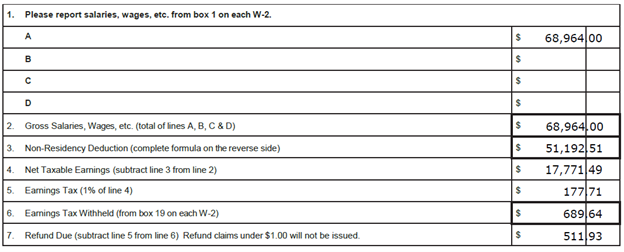

To fill out a Form E1-R, you must first have a copy of your W-2 form for the year in question. In Box 1A of Form E-1R, write the wages or other compensation reported on Box 1 of the W-2 form. Boxes 1B-1D should only be filled out if you received separate W-2 forms from different employers for the same year. In Box 2, add up Boxes 1A-1D (Box 2 will be identical to Box 1A if you only received one W-2 form that year).

(Note that the sample figures used throughout this explainer represent the estimated median household income in St. Louis County for the corresponding year, not real income figures).

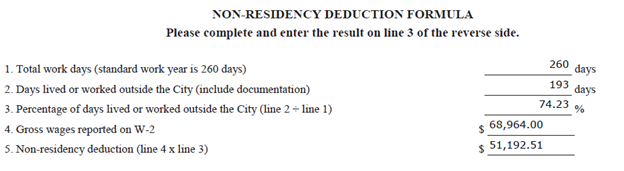

To complete Box 3, turn to the bottom of the next page to calculate your Non-Residency Deduction. If you worked outside of St. Louis for the entire year, this is simple to complete: your non-residency deduction will be the same as Box 2. Otherwise, you will have to figure out the number of days you worked outside of St. Louis and then divide that by the total number of work days for that year. Include holidays, sick days, vacation leave, and other types of days off.

Our 2020 sample form assumes a taxpayer commuted into St. Louis until being ordered to do otherwise by the statewide stay-at-home order issued by Governor Parsons beginning Monday, April 6, 2020.

The figure calculated here is then inserted in Box 3.

From here, calculate the remaining boxes as directed.

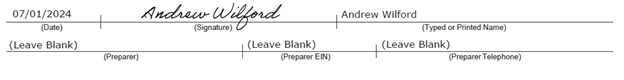

Fill out and sign the final lines on page 1. If you are preparing this form yourself, leave blank the sections referring to preparer information.

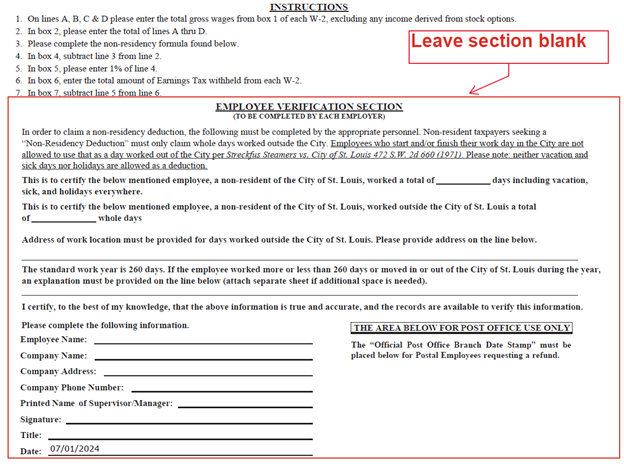

Leave blank the rest of page 2. This will need to be sent along to your employer to fill out. Your employer should have every incentive to help you out, as they can also claim a payroll tax refund for payroll taxes paid to St. Louis for work done outside the city.

Submitting Your Refund Claim

Once your employer has filled out their portion of each Form E1-R you intend to submit, gather together these forms, your corresponding W-2 forms, and proof of residence during the time period in question (either a lease agreement or mortgage deed). Submit these forms by mail to the following address:

Collector of RevenueEarnings Tax Remote Work Refund1200 Market St., Room 410St. Louis, MO 63103

If you have any questions, contact the St. Louis Collector of Revenue’s Remote Work Refund section by email at CORRemoteWork@stlouis-mo.gov or by phone at 314-622-3291.

*This is not legal advice. Consult a tax professional with any questions.*