Part 1: Taxpayer Service

Part 2: Tax Gap

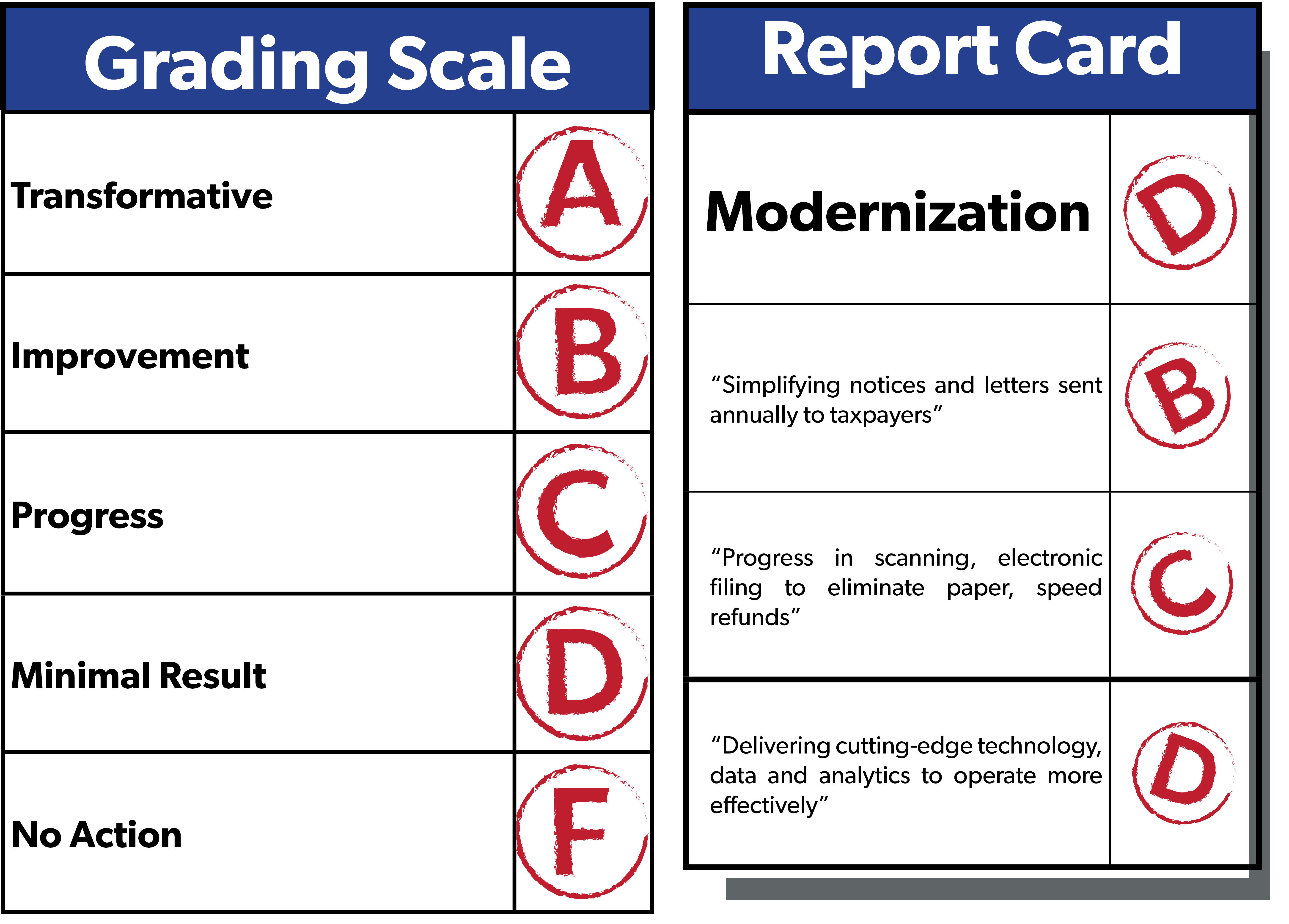

Part 3: Modernization

Overall Grade: D

Technological modernization is arguably the most important part of the IRS’s transformation agenda. Without modernized processing systems and emphasis on meeting the needs of modern taxpayers, the transformation will not succeed.

The IRS regularly ranks among the least favorable government bureaus for a variety of reasons. While some factors are out of its control, such as the complexity of the tax code, the mission of the IRS is to administer and enforce the tax law while helping taxpayers understand their responsibilities. Despite this, about a third of taxpayers do not trust the IRS to help them understand their tax obligations.

Given these challenges, IRS modernization must be holistic, including modern communication methods. Thus far, the IRS has updated some communications from their unacceptable prior state, yet has not met the needs of the 21st Century.

We believe that the IRS should be much further in its technological modernization now that it has spent nearly one-third of its Inflation Reduction Act business system modernization funding.

“Simplifying notices and letters sent annually to taxpayers”

Grade: B

Enhancing communications sent to taxpayers is an important step toward improving the IRS and easing compliance burdens on taxpayers. The IRS sends out around 170 million notices to taxpayers each year and has admitted that they are “often long and difficult for taxpayers to understand. And they do not always clearly and concisely communicate the next steps a taxpayer must take.”

In the report card, the IRS highlights its Simple Notice Initiative, which redesigned 31 notices for the 2024 tax season and hopes to redesign 200 notices by the 2025 filing season. It would be helpful for the IRS to make all of the redesigned notices publicly available on its website, as it has done with some forms, to prepare taxpayers and tax practitioners for what they may encounter next filing season.

The report also claims that the IRS has made over 170 different notice types available to be received or viewed digitally by individual taxpayers. At the time the Strategic Operating Plan update was published in May of this year, the IRS had not completed its milestone of adding more notices to Individual Online Accounts. The Strategic Operating Plan originally set a goal of 72 notices to be available to taxpayers via Individual Online Accounts, so the IRS has exceeded its goal here.

Based on the report card, it is not clear how many letters have been redesigned. Letters can be an important educational tool to let taxpayers know about credits or deductions they may be eligible for, whereas notices are typically sent in the instance of an error during filing.

Taxpayer education is incredibly valuable, and letters are just one way to transmit proactive communication. The Strategic Operating Plan includes language about educating taxpayers through innovative and cost-effective methods including media and partnerships with community-based organizations. While the IRS has outlined several outreach and education goals for FY 2025, it would be helpful to have more detailed information. The IRS should ultimately transform taxpayer experience rather than simply improving it.

“Progress in scanning, electronic filing to eliminate paper, speed refunds”

Grade: C

The IRS attributes its success in scanning and electronic filing to its Document Upload Tool that has accepted over a million taxpayer documents so far. In addition, the IRS has replaced scanning machines and made more forms available for electronic and mobile filing. These achievements in updating outdated systems will make it easier for taxpayers to get information to the IRS.

While these reforms are welcome, the IRS has still not made much progress on how it handles the taxpayer information that it receives. The Strategic Operating Plan update and supplemental document released in May of this year noted that none of the IRS’s technology priorities for 2024 had been met yet. Many of these unmet goals deal with how the IRS processes taxpayer information, including:

Initiate modern individual tax processing to be run in parallel with the legacy Individual Master File (IMF)

Continue to develop an enterprise data platform for use across taxpayer service and compliance functions with easily consumable services

Replace high-volume manual processes through the delivery of “bots” built using robotic process automation (RPA)

IMF handles all individual taxpayer data and is one of the most egregious examples of antiquated technology in the IRS, at over 60 years old. While the IRS has reported spending IRA funds on revamping the IMF, it should be clear about the progress it has made thus far. Completing the upgrade should be a top priority. Without progress on the backend, it is doubtful that getting taxpayer information to the IRS more quickly will actually result in faster refunds.

“Delivering cutting-edge technology, data and analytics to operate more effectively”

Grade: D

Of all of the IRS’s goals for its transformation with IRA funding, cutting-edge technology is arguably the most important. As the National Taxpayer Advocate Erin Collins said: “When I look back eight years from now on how the IRS spent its Inflation Reduction Act funding, the changes I consider ‘transformational’ will primarily involve the deployment of new technology and innovative thinking.”

Unfortunately, the IRS report card offers very little by way of details into the cutting-edge technology that it has delivered thus far. Instead, it says that “the IRS has enabled bulk filings of Forms 1099, replaced decades-old mail sorting machines, and scanned millions of paper forms.” These basic improvements to filing, sorting, and scanning only represent the beginning of the upgrades one might expect from a large-scale technological modernization effort and must be followed by significant backend improvements.

The Treasury Inspector General for Tax Administration (TIGTA) recently reported on the IRS’s progress modernizing its information technology (IT) and noted that the IRS has only completed seven out of 13 key modernization milestones that were due to be delivered in FY 2023. The milestones yet to be completed are typical for any modern IT strategy, such as use of cloud-based platforms, ensuring data security, preventing malicious activity, and defining ways to use advanced analytics.

The Strategic Operating Plan update released in April of this year lists 10 priority efforts for the IRS’s modernization objective that were due to be completed in FY 2024, yet none of them had been completed at that time. The milestones listed as past due include:

Implement a new operating model, with increased partnership between the IT team and the rest of the IRS organization, allowing the IRS to more quickly deliver better products, tools, and improvements

Enhance protection of IRS data through cybersecurity enhancements including multifactor authentication and data-at-rest encryption

Ensure critical data is available for responsible use of advanced analytics and innovation to improve enforcement, taxpayer services, and operations

Evaluate future access models for responsible use of 3rd party data and complete pilot integration of corporate registry data into IRS data platforms

While TIGTA notes that the IRS is making progress on its IT objectives that have fallen behind schedule, it also points out that the IRS does not have a detailed plan outlining how it will achieve its IT milestones. The IRS’s IRA Enterprise Roadmap is a plan that details key transformation efforts through the 2025 tax filing season. The Government Accountability Office (GAO) previously recommended that the IRS complete this roadmap and “ensure it addresses the strategic operating plan's technology objective.” TIGTA confirms that the roadmap was issued in May 2024, yet it does not include information about milestones for the IRS’s modernization objective.

The IRS is showing some progress on delivering cutting-edge technology, but has not done so at the pace it expected to, and so far the achievements listed in the report card look more like replacing old hardware than implementing new software and backend improvements. While the IRS still has IRA funding for another 8 years, it must begin to implement these changes now so that there can be adequate time for testing, monitoring, and evaluation.