Part 1: Taxpayer Service

Part 3: Modernization

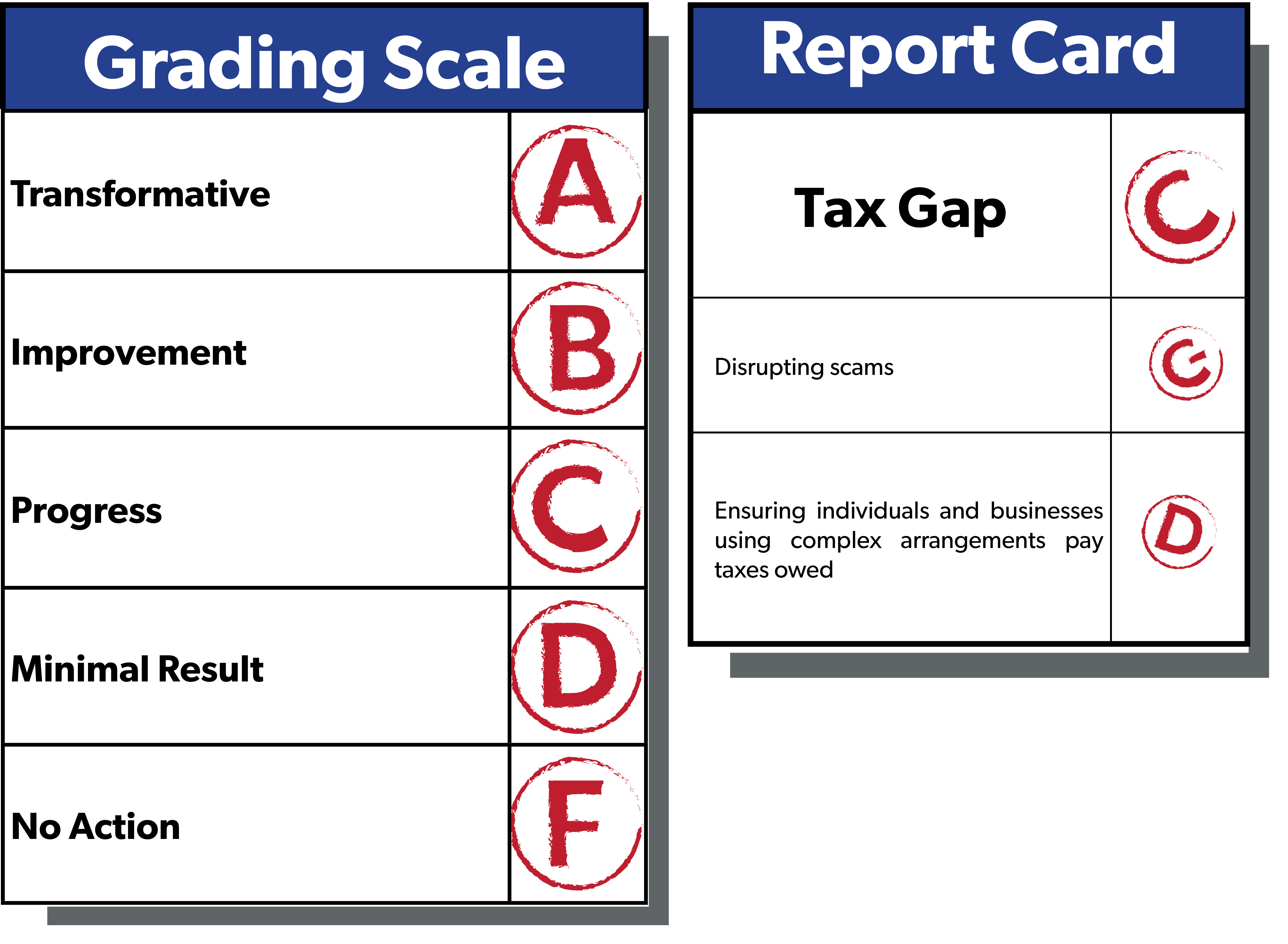

Part 2: Tax Gap

Overall Grade: C-

A good measure of the effectiveness of our tax system could be based in part on how many people actually pay the taxes they owe. While a variety of factors can influence taxpayer behavior, from ignorance to willful malfeasance, it is important for the government to collect all legally due taxes.

The IRA included a significant amount of funding for tax enforcement to close the tax gap, which is the difference between the amount owed and the amount paid. With these additional resources, NTUF has recommended that the IRS refine its calculation of the tax gap, set accountable goals for closing the tax gap, and increase compliance through communication with taxpayers.

Unfortunately, the efforts that the IRS has highlighted thus far fail to make meaningful improvements on assessing the tax gap and seemingly only chase the lowest-hanging fruit.

“Disrupting scams”

Grade: C

The IRS claims that its Employee Retention Credit (ERC) processing moratorium and other efforts prevented $1 billion in taxpayer funds from being lost to ERC scams. It also recently announced the formation of the Coalition Against Scam and Scheme Threats that will expand outreach about emerging scams. The IRS also boasts that it sent warning letters to 32 tax preparers suspected of scamming taxpayers.

While the IRS has made earnest efforts to stop ERC scams in absence of congressional action to halt the program, The Strategic Operating Plan update notes some missed 2024 objectives that would have gone further to help taxpayers in the face of scams. These include:

Improve victim assistance for those who fall victim to tax scams

Use advanced analytics to measure success and find areas of vulnerability

The Strategic Operating Plan update’s 2025 priorities to “disrupt scams” only include continuing to partner with the newly formed coalition and continuing to analyze IRS information to identify tax scams. The IRS deserves credit for deploying this coalition within the Strategic Operating Plan proposed timeline, and we hope to hear about the coalition’s progress throughout the next year.

Still, it is disappointing that the IRS has failed to use analytical tools to identify and measure other vulnerabilities, since ERC fraud only accounts for a subset of the entire universe of tax scams that taxpayers or the tax collector may encounter. Unfortunately, victims of identity theft often must wait 18 months to get their case resolved by the IRS. This long wait time is unacceptable, and the IRS should immediately shift additional resources toward reducing it.

“Ensuring individuals and businesses using complex arrangements pay taxes owed”

Grade: D

Part of the IRS’s efforts to improve tax collection with IRA funds involve closing the tax gap, which is an estimate of the difference between the tax revenues collected and the amount taxpayers actually owe. The IRS report card focuses on a push to collect taxes that were long overdue from high-income taxpayers, as well as some new initiatives to uncover tax evasion among targeted groups.

Closing the tax gap is important enough for the IRS that it is the focus of the third objective outlined in the Strategic Operating Plan. However, the plan’s update released in April of this year lists several key FY 2024 milestones for this objective that had not yet been completed, including:

Continue examinations of 76 of the largest partnerships in the U.S. that represent a cross section of industries including hedge funds, real estate investment partnerships, publicly-traded partnerships, large law firms, and other industries

Continue to explore alternative interventions including “soft” notices such as compliance alerts sent to large partnerships with balance sheet discrepancies

Establish a team and develop work plan to evaluate key enforcement programs for fairness

Develop data and research approach to inform and continuously refine compliance strategy needed to promote voluntary compliance

Establish at least one minimum viable product for advanced case selection of priority taxpayer segment such as high income—high wealth

Since then, the IRS has announced a new team dedicated to uncovering what it deems are “basis shifting” transactions by partnerships. It has also said that it is continuing to audit 76 of the nation’s largest partnerships. While it is good that the IRS is investigating potentially unlawful activity, the IRS should not assume wrongdoing merely based on the size of a business. The report card also highlights efforts to target specific groups that may be evading taxes, such as individuals using corporate jets for personal purposes. It is unclear how widespread this practice is, how much tax revenue this project will generate, and how much this will cost in IRA resources that could otherwise be dedicated to more systematic efforts to close the tax gap.

The report card highlights over $1 billion that has been collected from high-wealth taxpayers who are known to owe taxes or have failed to file returns in recent years. Since the IRS was already aware of the potential tax due in these instances, this seems to be low-hanging fruit. Unlike the taxes collected from these known high-wealth nonfilers, much of the tax gap is unknown and merely estimated through analyzing data from the past. Comprehensively refining its methodology for developing these estimates, as recommended by NTUF, would be a better approach to transform how the IRS addresses the tax gap.

Furthermore, $1 billion is well below what the IRS was projected to reclaim when the IRA was passed. The Congressional Budget Office (CBO) had estimated that the IRS would collect a total of $200 billion over ten years due to its increase in funding, with nearly $4 billion and $7 billion being collected in fiscal years 2023 and 2024 respectively. While some IRS enforcement funding was later rescinded, this change only took effect in late March of 2024, meaning that the IRS has no excuse for falling this far behind estimates. With a net tax gap estimate of $625 billion, the IRS should be much farther along in “closing the gap” after the completion of one-fifth of the ten-year IRA funding window.

Truly transformative efforts to close the tax gap will require better methods to estimate and identify the unknown element of the tax gap. In light of this, we have recommended that the IRS make critical improvements to its data collection, analysis, and transparency.