Part 2: Tax Gap

Part 3: Modernization

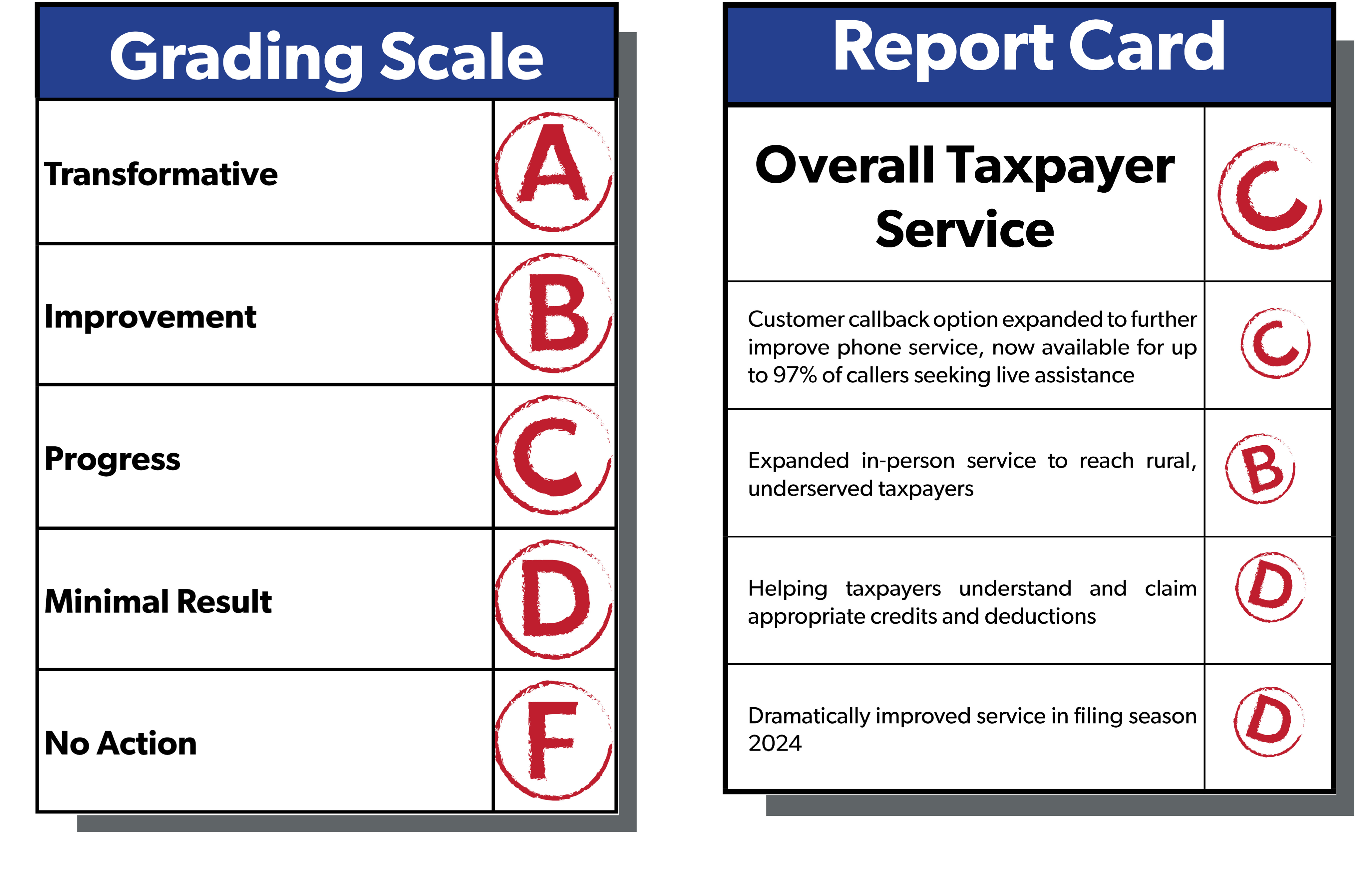

Two years after the Inflation Reduction Act (IRA) was signed into law, the Internal Revenue Service (IRS) wants you to know that it believes it is putting its funding boost to good use. The IRS has released its second “report card” for its IRA initiatives, giving itself a glowing review. However, absent from the IRS’s self-evaluation are the elements found on most report cards across American schools—actual grades based upon performance. So, NTUF has provided that missing grade scale.

Comparing the successes from this report card to the goals and objectives laid out in the IRS’s 2023 IRA Strategic Operating Plan shows that the IRS deserves a poor grade for some of its most important work.

Here are the supposed successes from the report card along with the facts behind its statements that justify NTUF’s grades.

Part 1: Taxpayer Service

Overall Grade: C

Law-abiding taxpayers often face a daunting task when calculating their tax liability in the face of increasingly complex tax laws. Sometimes taxpayers need assistance, feedback, or communication from the IRS to make sense of the tax process.

Taxpayers have a right to receive quality service from the IRS, and the voluntary nature of our tax system depends upon taxpayers having trust in the system. While the IRS has long faced challenges providing quality service in many key areas, the IRA funding presents an opportunity to improve communications with taxpayers and craft an entirely new taxpayer experience. The IRA allocated $3.2 billion to taxpayer services, and the IRS has already spent nearly half of that amount.

Reviewing the taxpayer service achievements of which the IRS is most proud shows that progress is being made to improve taxpayer service in some areas, while other areas lag behind what was accomplished without the influx of funding.

“Customer callback option expanded to further improve phone service, now available for up to 97% of callers seeking live assistance”

Grade: C

Improving taxpayer service was the main focus of the Strategic Operating Plan’s first objective and is a focus of several of the IRS’s IRA initiatives. While it is great to see that the IRS has reached its goal for taxpayer callback options, this isn’t necessarily a new accomplishment.

The Strategic Operating Plan, published in April 2023, noted that the IRS had been providing a customer callback option to 75 percent of calls to IRS live assistance toll-free telephone lines “with plans to expand coverage to 95 percent of taxpayers calling for toll-free live assistance by the end of July 2023.” In its first IRA report card released in August 2023, the IRS touted that the callback option was available to 95 percent of callers. Thus, while the final push to 97 percent is a step forward, it builds on progress already made last year.

The IRS should be focusing more of its efforts on ensuring that taxpayers’ questions are fully answered when they call a representative, or even without having to call the IRS, in addition to offering a callback option. The Strategic Operating Plan includes several customer service milestones for Fiscal Year (FY) 2024 that the IRS seems to have missed according to the Strategic Operating Plan update, including:

- Customer service standards created, implemented, and measured IRS-wide

- Increased service availability and services are offered in TACs and on phones to meet taxpayer demand

- Payment capabilities over the phone and through employees launched

- Data and analytics capabilities are used to predict taxpayer demand and staffing needs for customer service and to project estimated processing time for certain returns and other forms

In addition, taxpayers face several other longstanding challenges when attempting to reach the IRS, such as incorrect phone numbers listed online and unreturned calls. The IRS also fails to account for whether a taxpayer has had their question answered in its Level of Service (LOS) measurement. We previously recommended that the IRS adopt metrics that focus on outcomes instead of simply counting outputs to better understand whether taxpayer needs are being met.

There are also broad areas of the tax code that are “out of scope” for telephone assistance. This means that IRS agents cannot answer questions about these specified areas of the tax laws. Similarly, IRS tax preparation assistance programs like the Volunteer Income Tax Assistance and Tax Counseling for the Elderly cannot provide assistance on certain topics and can only provide limited assistance on others. Better training would help boost customer service and better services would ultimately increase tax compliance by helping taxpayers understand the tax laws.

Addressing these issues and adding clear customer service standards, as promised by the Strategic Operating Plan, would be a significant step forward in improving the overall taxpayer experience.

“Expanded in-person service to reach rural, underserved taxpayers”

Grade: B

The report card highlights additional hours at about two-thirds of Taxpayer Assistance Center (TAC) locations in 2024, including Saturday hours at TACs in 70 locations, and an increase in face-to-face contacts at TACs as IRS improvements in expanding reach. To assess how effective this effort was at reaching rural or underserved taxpayers, it would be helpful to have a full accounting of which communities benefited from increased service. In addition, as of August 2023, there were a total of 363 TACs, meaning that the increased hours were only available at about 20 percent of all locations. There were 359 TAC locations prior to the pandemic.

The report card also notes that Volunteer Income Tax Assistance (VITA) centers offered free assistance for taxpayers who participate in the gig economy. This is important to note, as these taxpayers may be confused about their responsibilities due to burdensome changes in 1099-K reporting laws and the IRS’s continued delay in enforcing the law.

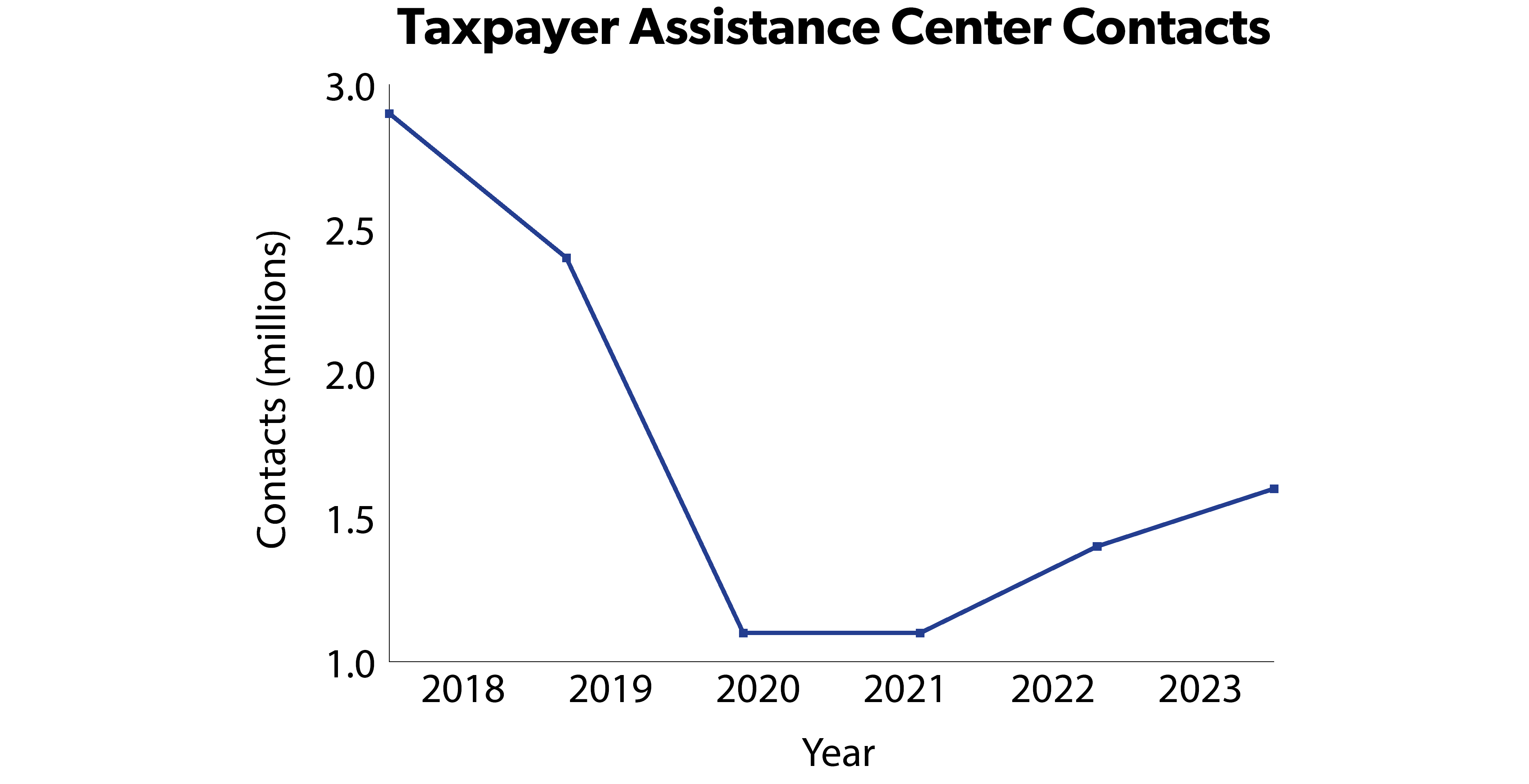

While the report card notes that assistance at TACs increased by 37 percent with nearly 1.3 million contacts for this calendar year, looking at the IRS data book shows a more modest improvement. The data book reports TAC contacts per fiscal year in Table 9, and shows that there were 1.6 million TAC contacts in FY 2023, which is a decline from pre-pandemic levels.

It is unclear what taxpayers should take away from this data. On one hand, an increase in TAC contacts may be a signal of more taxpayers being unable to reach IRS representatives on the phone or having more complex tax circumstances. On the other hand, it could be due to an increased availability of TAC assistance. The IRS must improve data collection and be more transparent in its reporting so the public can better understand who benefits from TACs and why.

In addition to understanding how many taxpayers are receiving services from TACs, it is also important for the public to know how effective TAC services are. For example, while we know that some areas are out of scope for TAC representatives to assist with, we do not know how many taxpayers visit a TAC and are subsequently denied full service due to an out of scope request.

“Helping taxpayers understand and claim appropriate credits and deductions”

Grade: D

The IRS report card boasts sending over 1.8 million reminder letters to taxpayers who did not file a 2021 return and could be eligible for some of the expanded Child Tax Credit (CTC). The IRS also launched a new education initiative aimed at tax professionals regarding the eligibility requirements for refundable credits to help clear up confusion. The report card also states that the IRS is now estimating credit gaps for the CTC and the Premium Tax, whereas it previously only estimated the gap for the Earned Income Tax Credit (EITC).

Compared to what the IRS has done in the past and what is possible with the $60 billion in IRA funding, this is a minor achievement at best. In 2020, prior to receiving the IRA funding, the IRS sent reminder letters to 9 million families who didn’t file a 2021 return, but possibly qualified for the CTC, Recovery Rebate Credit, or EITC. In 2021, also prior to IRA funding, the IRS sent letters to 36 million families who possibly qualified for advanced CTCs.

Simply sending letters also fails to address other serious concerns. First, on one of the occasions that the IRS sent similar letters, it later admitted to having sent some of them erroneously. Second, while it is important for taxpayers to understand what credits they are eligible for, the IRS should also be doing more to reduce improper payments that could cost taxpayers up to $22 billion annually for the EITC alone. Finally, these credits are incredibly complex to claim, which could prevent taxpayers from claiming them even if they believe they are eligible. It is clear that more should be done to help taxpayers understand their credits and deductions.

“Dramatically improved service in filing season 2024”

Grade: D

The IRS’s claim that it dramatically improved services for taxpayers this year needs additional context. First, the IRS touts that its main phone line reached an 88 percent level of service in the 2024 filing season. Yet the National Taxpayer Advocate cautions that the Level of Service (LOS) calculation is “far more optimistic than the reality taxpayers face when calling the IRS.” For example, despite having an 85 percent LOS through April 2023, the IRS only answered 35 percent of calls with a live agent. In FY 2023, a 51 percent LOS translated to only 29 percent of total calls being answered by a live agent. The rest of the calls were either transferred to automated assistance or were terminated by the taxpayer out of frustration.

As NTUF wrote back in July:

The IRS’s flawed LOS statistic raises several questions: Did taxpayers receive the information they needed? Did they have additional questions necessitating a callback? Did they intend to speak to a live agent in the first place? To answer these questions, the IRS should adopt metrics to measure outcomes. One improvement could be adding a question about the quality of service provided at the end of a taxpayer’s call to the IRS.

The IRS also claims to have answered over 1 million more calls in 2024 compared to 2023, but does not report on changes in the amount of calls made to the IRS and why so many taxpayers needed to call. This claim also does not take into account the fact that the amount of calls answered is below the amount for each year from 2017 to 2021.

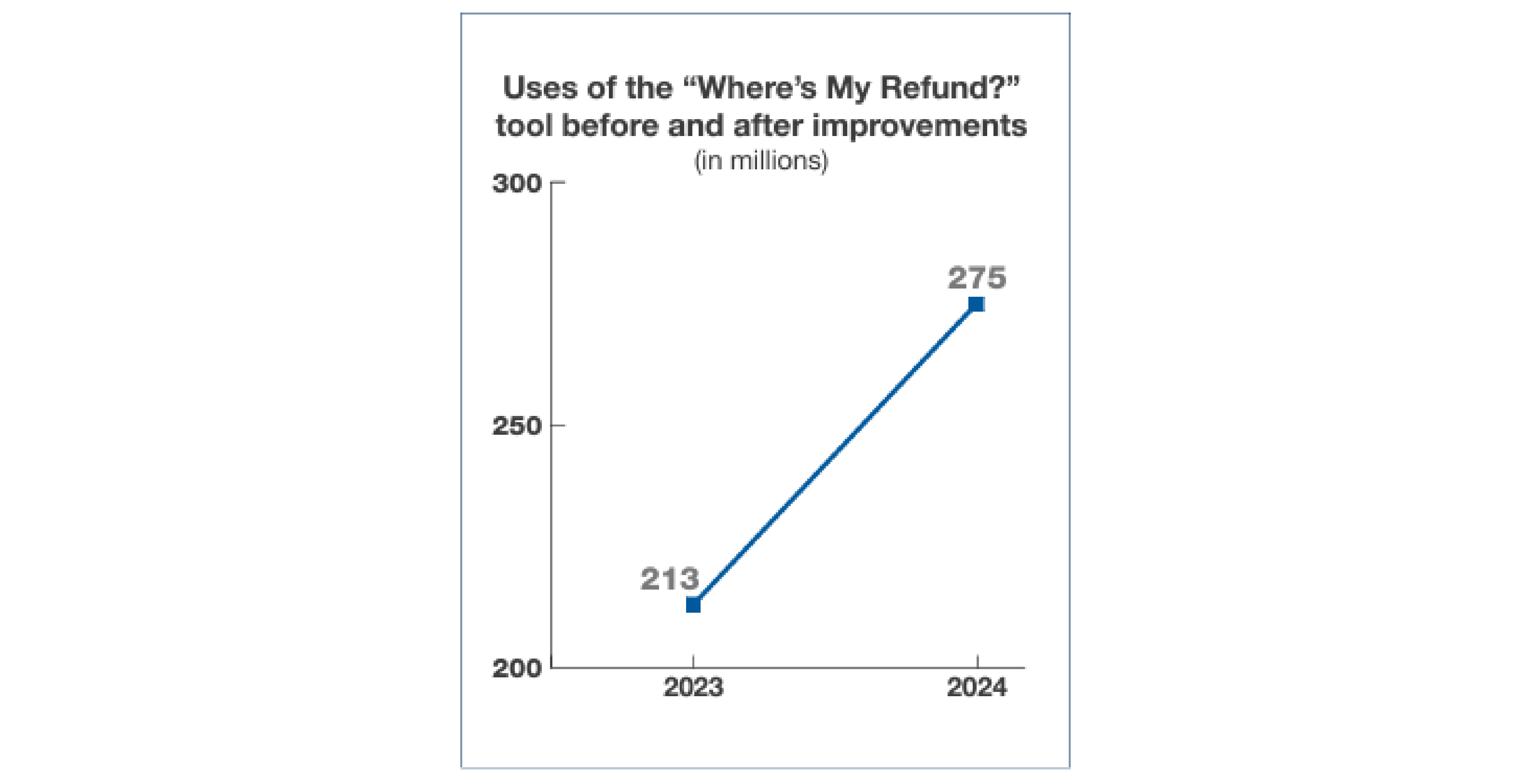

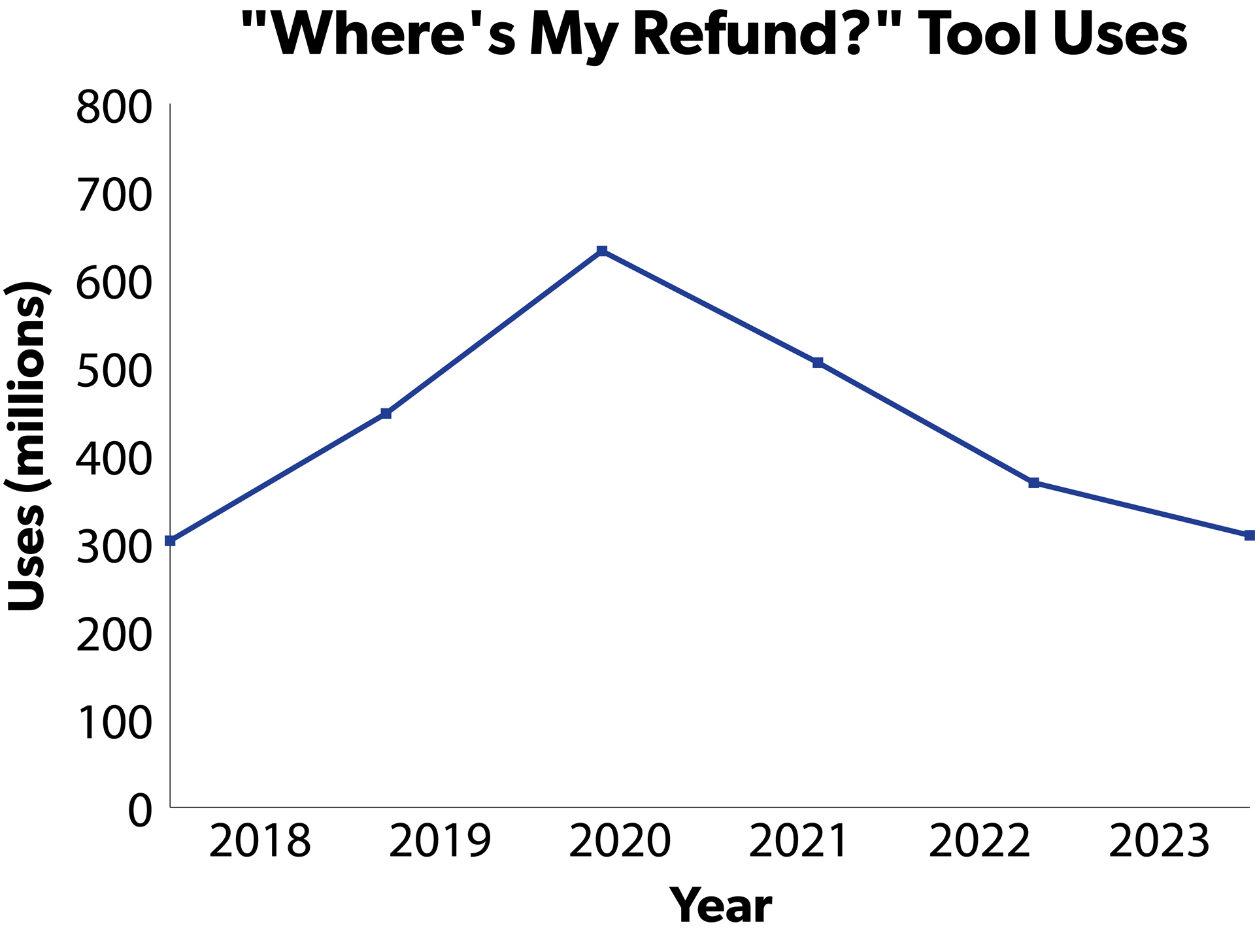

The report card also claims that there were 75 million more visits to IRS.gov this year, and gives credit to the redesigned “Where’s My Refund” tool. While taxpayers should be glad to receive detailed information in plain language on the “Where’s My Refund” tool, its usage has not necessarily increased. The following graphic from the IRS’s April 2024 Strategic Operating Plan update seems to indicate an increase in use from 213 million in 2023 to 275 million in 2024:

The IRS Data Book, published annually, shows a different trend:

The figures in the chart from the Strategic Operating Plan update appear to be for the filing season, whereas the Data Book numbers are per fiscal year. The Data Book shows 303 million uses of “Where’s My Refund?” in fiscal year 2023, whereas the Strategic Operating Plan update records only 213 million for the 2023 filing season and 275 million for the 2024 filing season.

Charts like these demonstrate why context is necessary to understand the IRS’s taxpayer service performance. Although the use of the refund tool is declining, the number of times it is used is not a meaningful measure of success. For example, if refunds were being distributed quicker, fewer taxpayers would need to use the tool. Usage is also affected by how many taxpayers are expecting a refund in a given year.

Fundamental transformation of taxpayer services requires a deep dive into these underlying performance metrics and a significant expansion of information and data that is tracked. For example, we recommended that the IRS collect paradata, such as how long taxpayers spend on the “Where’s My Refund?” page or how long it took them to find the page. Especially when it comes to the complexity of taxpayer interactions with the IRS, far more information is needed to determine true success.